Perth CBD office rents are poised for a period of strong rent growth over the coming years, with no new supply under construction, according to the latest research from Knight Frank.

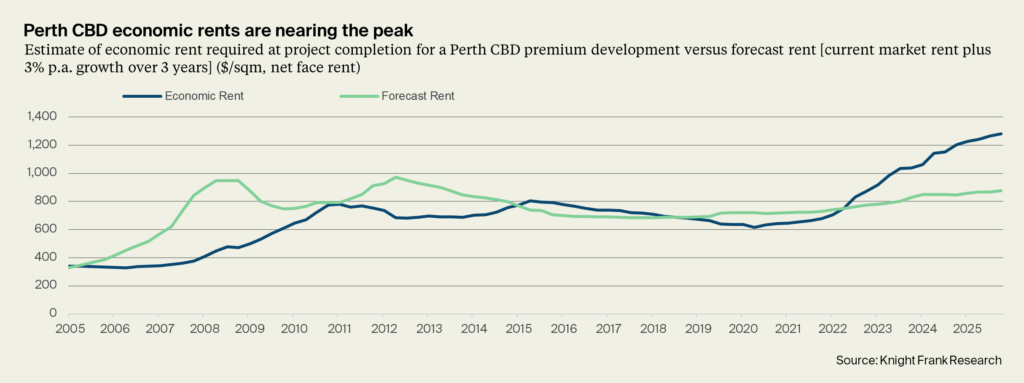

The lack of new supply is due to a sharp rise in economic rents – the level of rent at which the construction of a new development becomes feasible – in Perth since 2021, with a mix of rising costs and market pressures putting the brakes on new office development, according to Knight Frank’s ‘High economic rents drive Perth supply drought’ report.

“Economic rents have surged due to a significant rise in construction costs, interest rates and incentives, as well as a softening in yields – and the resulting fall in asset valuations,” said Knight Frank Senior Economist Alistair Read, who authored the report.

“Economic rents for premium office towers in the Perth CBD have doubled since Q1 2021 to now sit at $1,280 per square metre.

“That’s 46% higher than the $880 per square metre forecast level of rent upon development completion, assuming a building was to start being constructed now and completed in Q4 2028.

“While economic rents have doubled over the past five years, over the same period premium rents have risen by just 22%.

“This historically wide gap between economic and forecast rent underscores the challenge of achieving financial feasibility for new office developments in the current market environment.

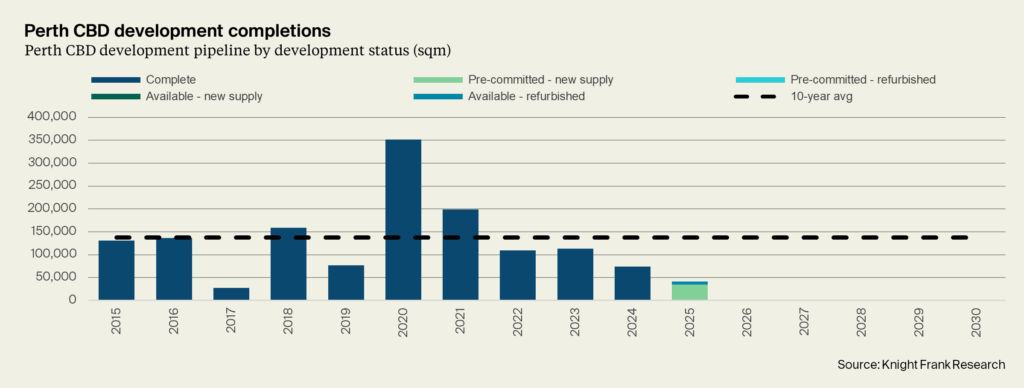

“As a result, the pipeline for new office supply in the CBD has diminished substantially, which will lead to a drought in new office supply over the coming years.

“While other cities around Australia will also face a lack of supply for premium CBD office stock, Perth stands out as a city with a particularly scarce supply pipeline. There is no new supply under construction that is expected to be completed beyond 2025, marking a record low.”

The Knight Frank research found Perth CBD premium office market rents are forecast to rise as supply tightens, with net effective rents to grow at an average rate of 9.1% per annum from Q4 2025 to Q4 2030, well above the 10-year average to Q4 2025 of 1.9% per annum.

“Premium net face rents are forecast to rise by 5.8% in 2026 and continue to accelerate until 2030 with no new supply, closing the gap to economic rents,” said Mr Read.

“Development is forecast to be once again viable around 2030, which means there may not be any new premium developments completed until 2033.”

Knight Frank Head of Tenant Representation WA Alyson Martinovich said: “We expect availability, particularly at the top end of the market, will tighten and rents across the board to rise, and as tenants will have fewer options available to consider at lease expiry. As such, we are recommending our clients bring forward their evaluations and decisions about their space requirements.

“This is particularly the case for large tenants searching for new, best-in-class, contiguous space that is available through new developments.

“With strong rent growth forecast for Perth CBD offices, tenants may also look to optimise their leased space to minimise costs.

“This could lead to tenants reducing their footprint as well as sustained or increased working from home to offset the rise in rents.

“Given new development seems unfeasible until the gap between economic and actual rents closes, we expect to see an increase competition for higher quality space from tenants, and a sustained rise in volume of lease renewals.

“Lease renewals allow occupiers to remain relatively cost neutral. They can avoid substantial capex investment and use rent abatement to support cash flow.

“Larger tenants who have a clear trigger to relocate may have a challenge, particularly if they delay decisions.”

Knight Frank Managing Director WA Jeremy Robotham said the current vacancy rate of 10.8% for premium stock in Perth’s CBD office market was expected to tighten relatively quickly as tenants bring forward their movements.

“With no new premium supply on the horizon, competition for high-quality space is likely to intensify, placing further upward pressure on rents.

“In the first instance, we are already seeing rents required on a pre-commitment basis for new towers rising significantly to make new development feasible. This, and the growing scarcity of new product, will then drive improvements in occupancy and rental growth for existing premium and A-grade assets. This has begun in the CBD and will gradually extend to non-CBD areas.

“A tighter leasing market sets the stage for a rebound in Perth’s capital markets. Stronger rent growth and rising returns should draw capital back into the city, with improving liquidity helping investors transact more easily and re-enter the market with greater confidence.”