Outlook for retail sector increasingly positive, with growth expected in 2025 as more buyers compete – Knight Frank research

15 April 2025

- Knight Frank’s latest Australian Retail Review – April 2025 found the outlook for the retail sector was increasingly positive, with two positive signs being improving retail sales (forecast to rise by 3.5% over 2025) and a return in asset value growth (of 0.8% in Q4 2024)

- Improving investor sentiment has led to greater investment, with volumes rebounding strongly in 2024 with $9.9b traded, up 39% from 2023. NSW led the way with $3.6b, followed by Victoria at $2.1b

- In Q1 2025, $2.9b has traded, with NSW seeing the most investment activity

- Investment volumes over 2025 are expected to be similar to or surpass 2024 levels, driven by NSW and QLD

- Private investors were the most active in retail in 2024, but this trend is changing in 2025 with REITs and institutions expected to return to the market

- The 3 key themes for retail property in 2025 are that major retailers are becoming more active, retail specialists will dominate transactions and there will be growth in mixed-use retail developments

The outlook for the retail sector is increasingly positive following a challenging period, with conditions in place for growth from 2025, according to Knight Frank’s latest research.

The firm’s Australian Retail Review – April 2025 found positive signs for the sector included improving retail sales and the return in asset value growth.

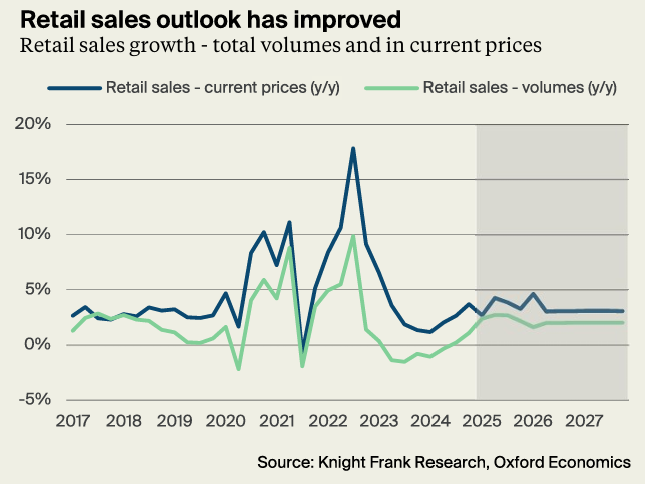

Knight Frank Senior Economist, Research and Consulting and report author Alistair Read said retail sales growth was gaining momentum, up by 3.6% over the year to February in nominal terms.

“Looking ahead, the outlook for retail sales is positive – with 3.5% forecast growth over 2025 – as some of the pressures on household budgets start to ease and in turn spending starts to improve,” he said.

“Over the past two years, a combination of pressures on the consumer have proven a challenging backdrop for retail spending, including high inflation outstripping growth in wages and resulting in declining real incomes, and rising interest rates cutting into household budgets even further.

“However, after a long wait, households are starting to see relief with falling inflation, a cut in interest rates, a tight labour market and real wage growth.

“These factors are forecast to drive a 2.2% annual increase in real personal disposable income in 2025, which, if realised, would be the strongest growth since 2021.”

The Knight Frank report found improving investor sentiment in the retail market in response to recent evidence of a resilient trading performance from the major centres and retailers had led to increased investment in retail property.

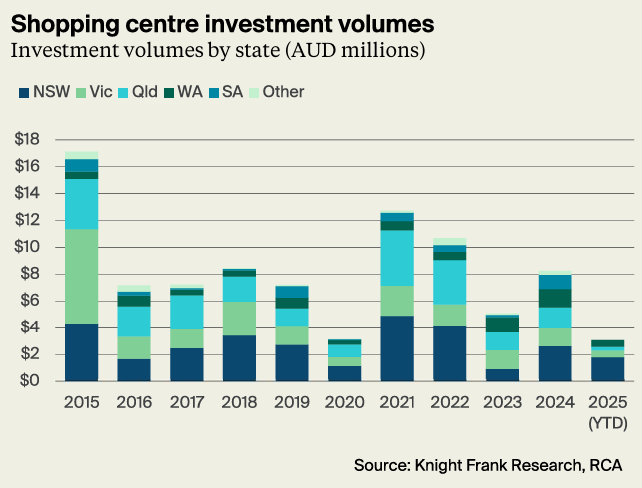

Total investment volumes in the retail sector rebounded strongly in 2024 with $9.9 billion traded, up 39% from 2023. New South Wales led the way with $3.6 billion traded, followed by Victoria ($2.1 billion). Retail yields stabilised at 5.7% as a markets became increasingly confident that interest rates have peaked.

Investment volumes have been strong over Q1 2025 with $2.9 billion of assets traded. NSW has accounted for most of the volume, reflecting the sale of Westpoint Shopping Centre in January, a transaction highlighting the growing optimism and fundamentals underpinning the Australian retail sector.

Investment volumes over 2025 are expected to be similar to or surpass 2024 levels, driven by NSW and QLD.

Knight Frank Head of Retail Investments Campbell Aitken said investors were responding to the prospect of an improving economic climate, with reduced uncertainty around the outlook for inflation and interest rates removing the brake on deal activity.

“Turnover and leasing spreads in the major centres are on an upward trajectory, which are both contributing to improved investor sentiment,” he said.

“As a result, the market for retail assets is proving to be more liquid than office markets, and the outlook for income growth is arguably the best among the major sectors.

“Capital returns across all types of retail assets experienced a second consecutive quarter of growth in Q4 last year, growing by 0.8%. This indicates the bottom of the cycle valuations cycle has likely passed, which is luring investors who are anticipating strong asset performance in years to come.

“Looking ahead, shopping centre returns will be supported by constrained supply, with a limited development pipeline, and strong population growth, which is driving a decline in per capita supply and underpinning high visitation levels and MAT growth in the major centres.”

The Knight Frank report found private investors have been the most active in the retail property market, accounting for 35% of total acquisitions made in 2024.

However, Mr Aitken said this was expected to change in 2025 as REITs and institutions return to the market.

“Continued positive leasing trends, resilience in non-discretionary retail and increased liquidity is expected to intensify competition and capital inflows,” he said.

Knight Frank’s report found the three key themes for the retail property market in 2025 are:

- Major retailers becoming more active – Australia’s major supermarkets are becoming increasingly active in the market for retail assets reflecting continued competition for retail space and market share.

- Retail specialists to dominate transactions – Retail specialists are expected to remain the dominant buyers of retail assets despite increased interest and inquiries from non-retail specialists.

- Growth in mixed-use retail developments – There is a growing trend of new retail assets selling that have, or are finalising, a development approval for mixed-use. Currently, these development approvals do not appear to be adding significant value to the sale prices of these assets. However, more retail facilities selling with approval for mixed-use could expand the marketability of these developments.