Occupiers focus on creating enticing workplaces within budget constraints as return to office mandates rise, according to Knight Frank research

2 April 2025

More than half of Australian occupiers have a return to office mandate in place, either through an official mandate or unofficial guidelines, and an enticing workplace is seen as one of the tools to effectively bring people back into the office, according to a new Knight Frank report.

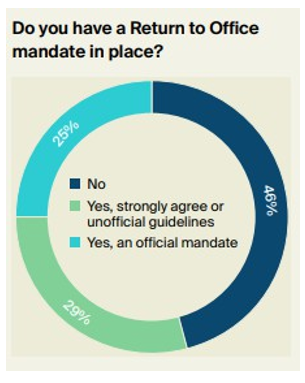

Knight Frank’s (Y)our Space – Australia and New Zealand report Q1 2025*, which largely presents the findings from a survey of Australian and New Zealand occupiers, found 25% of respondents had a return to office mandate in place, while a further 29% said they strongly agreed with a return to office mandate or had unofficial guidelines.

Despite the majority of occupiers favouring a return-to-work policy, the Knight Frank research found the majority of respondents (46%) intend to keep their average office occupancy stable over the next three years, while 42% said it would increase and 12% indicated it would decrease.

Knight Frank Partner, National Head of Occupier Strategy and Solutions Australia Neil Murray said the effects of COVID-19 were still being felt, with the workplace undergoing significant changes in office occupancy patterns.

“Nearly 40% of occupiers who responded to our survey said COVID had a huge and lasting disruption to their corporate real estate strategy, which is still being shaped by a mix of return to office mandates and flexible working agreements,” he said.

Despite the majority of occupiers favouring a return-to-work policy, the Knight Frank research found the majority of respondents (46%) intend to keep their average office occupancy stable over the next three years, while 42% said it would increase and 12% indicated it would decrease.

Knight Frank Partner, National Head of Occupier Strategy and Solutions Australia Neil Murray said the effects of COVID-19 were still being felt, with the workplace undergoing significant changes in office occupancy patterns.

“Nearly 40% of occupiers who responded to our survey said COVID had a huge and lasting disruption to their corporate real estate strategy, which is still being shaped by a mix of return to office mandates and flexible working agreements,” he said.

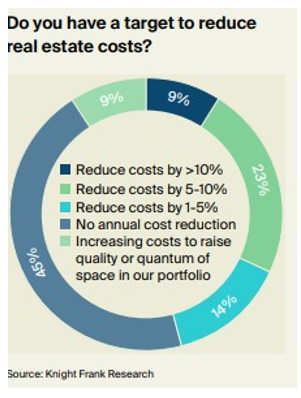

Reducing costs was also identified as a key challenge by half the respondents to delivering real estate strategy over the next three years, with 54% also indicating a challenge was enhancing the workplace experience.

For occupiers who are going to move, 77% said they would move to a premium CBD location to enhance workplace experience, while 80% of those who had moved within the past three years said it was for an “improvement in building quality/amenity”.

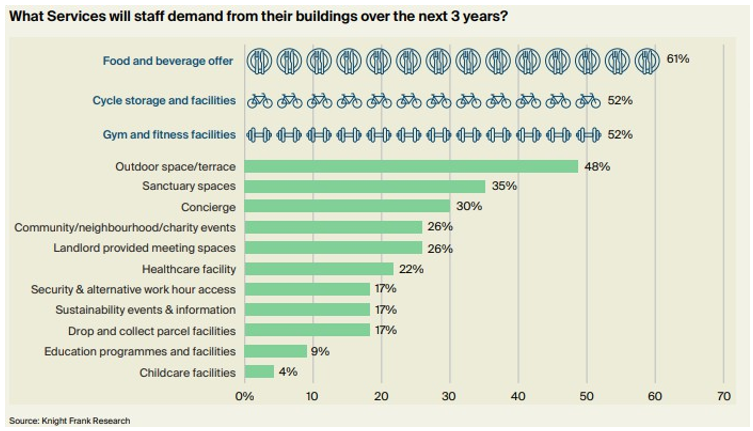

When considering what amenities to prioritise, respondents expect staff to value food and beverage offerings most in in their building (61%); followed closely by cycle storage and facilities, and gym and fitness facilities – both tied at 52% each.

Knight Frank Chief Economist Ben Burston said how businesses deal with the two overarching objectives of providing the optimal workplace experience while also providing excellent value for the investment outlay would be central to shaping the evolution of workplace strategy in 2025.

“Looking ahead, occupiers expect to see overall occupancy numbers continue to tick up, which will continue to ramp up expectations of the quality of the workplace experience,” he said.

Alongside this, however, is the spectre of cost pressure, which ranked second on the list of strategic priorities – up from fourth two years ago – and was cited by nearly 50% of respondents as a major consideration, no doubt reflecting cautious sentiment and a sluggish economy over the past 12 months.

“Corporates are wary of the potential for subdued growth and political uncertainty to drag on near term profitability and make decision making more difficult. In addition, higher construction costs and higher incentives have shifted the financial metrics driving the stay versus go decision faced by occupiers. A high level of incentives can still be obtained on lease renewals, making staying put more attractive, while steep rises in material and construction costs have driven up the cost of new fitouts.

“In the short-term cautious sentiment will win out, with a higher-than-normal proportion of tenants likely to opt to stay put. Those that do opt to move will be seeking good quality fitted space that can be adapted to suit a new user with relatively little cost.

“By late 2025, however, we expect that more tenants will be opting to move once again, as confidence picks up off the back of an improving economic picture and the prospect of a tightening supply dynamic starts to influence decisions. Despite rising costs, occupiers will have an eye on the need to future-proof their workplace and secure higher quality space ahead of the competition.”

Other key findings from Knight Frank’s (Y)our Space – Australia and New Zealand report Q1 2025 include:

- 95% of respondents agreed that sustainability considerations will influence their real estate strategy over the next three years

- 71% say a key benefit of occupying buildings with sustainability accreditations is to support their organisation’s ESG goals

To download Knight Frank’s (Y)our Space – Australia and New Zealand report Q1 2025 you can visit: ANZ (Y)OUR SPACE – download the report.

* Knight Frank’s (Y)our Space – Australia and New Zealand report Q1 2025, which surveyed occupiers in Australia and New Zealand, has been prepared with Knight Frank’s partner in New Zealand Bayleys. The report provides insights into the key themes and trends shaping workplaces, informed by survey data, and supplemented by the perspectives of what our experts are seeing and helping to solve for our clients.