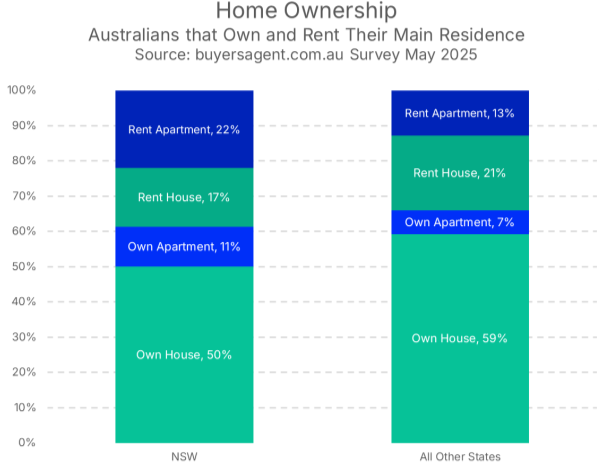

New research from Buyersagent.com.au reveals NSW has Australia’s lowest home ownership rate at 60.6%, trailing all other states which average 66% and leaving 190,000 families locked out of home ownership compared to if NSW matched the rest of Australia.

The survey exposes a 5.4 percentage point gap between NSW and the rest of Australia, with the state’s major cities the reason for the nation’s worst ownership rate at just 59% compared to the it’s regional result (64%).

NSW’s housing crisis is concentrated in major urban centres like Sydney, Newcastle and Wollongong, where ownership rates fall 6.7 percentage points below the average in all other major cities across Australia.

If NSW’s 3.5 million dwellings achieved the national ownership average, 190,000 additional families would own their homes instead of renting.

Queensland and Victoria demonstrate that major eastern states can achieve better outcomes for aspiring buyers, while smaller states across Australia consistently deliver superior ownership rates, leaving NSW trailing the entire nation.

“The numbers tell a clear story about Sydney’s market dynamics,” says Shaun McGowan, founder of Buyersagent.com.au. “When home prices become so prohibitively expensive, you see a fundamental shift where properties increasingly end up in the hands of investors and landlords rather than families trying to buy their first home. NSW’s low ownership rates reflect a market that’s pricing out ordinary Australians.”

It gets worse for NSW renters

It gets worse, with fewer people in NSW renting houses compared to the national average while significantly more are forced into apartment rentals. This trend highlights

the growing pressure on urban living options, where traditional family housing becomes increasingly inaccessible and renters are pushed into higher-density accommodation as their primary option.

The data also reveals a dramatic housing divide between owners and renters. A staggering 87% of homeowners live in houses compared to just 56% of renters, highlighting the apartment-heavy rental market versus house-dominated ownership.

Nationally, regional areas have significantly more houses available, with 85% of residents living in houses, though home ownership levels remain consistent at 64%. Regional rental markets reflect this housing stock, with 71% of rentals being houses compared to an even split between houses and apartments in cities.