CBRE survey highlights impact of construction costs as demand for unrenovated properties decreases

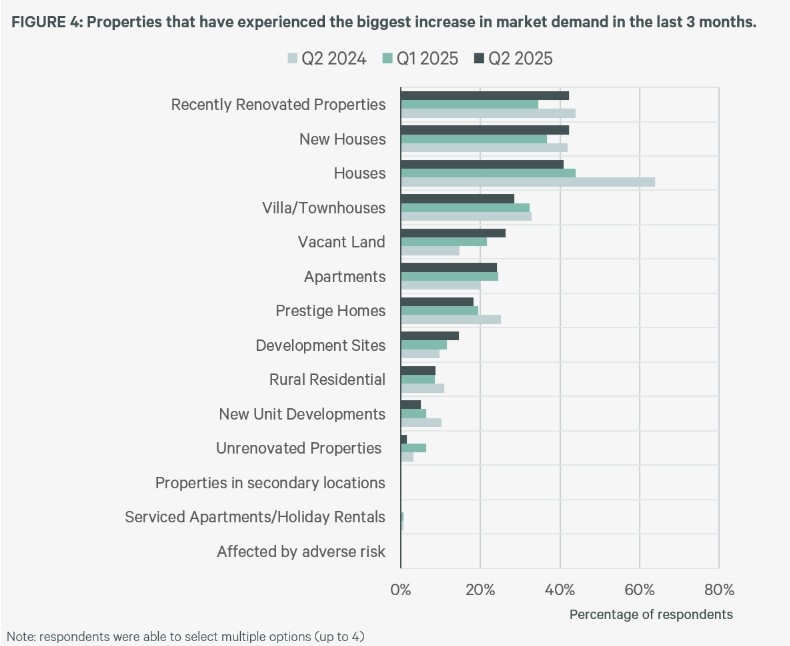

Established and new houses as well as recently renovated properties are in high demand across Australia, a new CBRE survey shows, as high construction costs soften buyer interest in homes requiring upgrades.

CBRE’s Residential Valuer Insights Q2 2025 surveyed CBRE’s residential Valuers around Australia to provide expert insights on local and national trends.

A total of 42% of Valuers reported increased demand for recently renovated properties and new houses, similar to reported demand in Q2 2024. While 45% of Valuers said they had seen a decrease in demand for unrenovated properties, up slightly from Q1 2025 (41%).

Kat Hale, CBRE’s Residential Valuations National Director said, “Although demand for recently renovated properties has risen since last quarter, we’re still seeing a relatively balanced market with most Valuers reporting moderate demand in recent months. Looking ahead, Valuers are optimistic with about half of those surveyed anticipating an increase in demand in the next 12 months accompanied by a boost in available stock.”

Overall, Australia’s property market remains balanced with most CBRE Valuers (61%) reporting ‘moderate’ demand in their local markets, up from 42% compared to this time last year. Only 28% of Valuers reported ‘strong’ to ‘very strong’ demand in this survey, compared to 54% at this time in 2024.

First home buyers and upgraders continue to be the most active groups in the market. According to the Valuers surveyed, first home buyers in Adelaide and the ACT were the most active while upgraders were most active in ACT and the Gold and Sunshine Coasts.

Other key findings:

- 74% of Valuers predict house values will grow in the next 12 months, an increase from 55% in the previous quarter.

- House price growth is expected to be highest in Adelaide, Perth and Sydney Metro.

- 48% of Valuers expect an increase in apartment values in the next 12 months, up from 35% in the last quarter.

- Apartment price growth is expected to be highest in Brisbane Metro, Perth and the Gold and Sunshine Coasts.

CBRE’s Pacific Head of Research, Sameer Chopra said, “Fundamentals for residential in Australia remain compelling but it might take three to four rate cuts to start boosting transaction volumes. It’s worth highlighting that the gap between houses and apartment values could continue to persist and even grow. ”