Mirvac Group FY25 Results – Execution on Strategy, Positioned for Growth

19 August 2025

Mirvac Group (Mirvac) released its full-year result for the financial year ended 30 June 2025. We delivered in line with guidance, with an operating profit of $474m, representing 12.0 cents per stapled security (cpss), and a distribution of $355m, representing 9.0cpss.

Key financial metrics

- operating profit after tax of $474m (FY24: $552m profit)

- operating EPS of 12.0cpss (FY24: 14.0cpss)

- statutory profit of $68m (FY24: $805m loss)

- net tangible assets (NTA) of $2.26 (FY24: $2.36).

Operational results

- expanded our living sector exposure, with the completion of three new build to rent assets in Melbourne and Brisbane1, and the acquisition of three new communities in our land lease portfolio. Living sector EBIT increased to $54m, up 184% on FY24

- delivered a strong investment performance, including increased occupancy of 98%2, 159,300sqm of leasing3 and a positive average leasing spread of 8.6% across the portfolio

- settled 2,122 residential lots and exchanged 2,100 residential lots, up 39% on FY24, with pre-sales of $1.9bn4 providing good visibility of future earnings

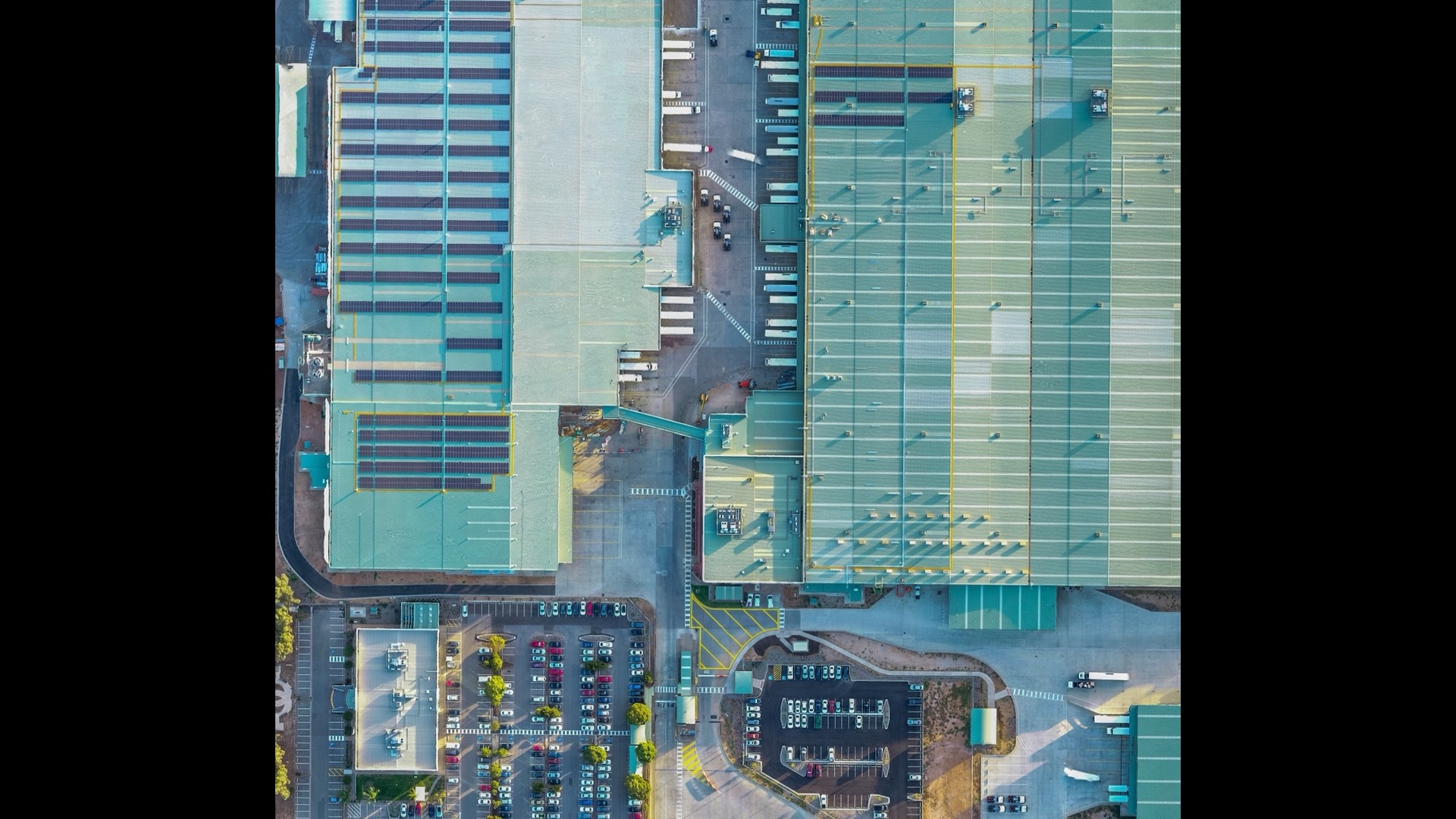

- successful capital partnering initiatives across the business, with the sell-down of a 49% interest in Stage 1 of our industrial development at SEED, Badgerys Creek to Australian Retirement Trust, and capital partners secured at three residential projects in Sydney

- maintained a strong balance sheet, underpinned by ~$340m in non-core asset sales and capital partnering success.

Mirvac’s CEO & Managing Director, Campbell Hanan, said: “Our FY25 results demonstrate the continued execution of our strategy and our focus on setting the business up for a return to growth in FY26 and beyond. We grew our living sector exposure, expanded third-party capital relationships, improved operating metrics in our investment portfolio and progressed our development pipeline, all while ensuring the balance sheet remained in good shape.

“We saw a strong pickup in activity in our residential business, with unconditional sales up almost 40 per cent, and $1.9 billion of residential pre-sales provide good visibility of future earnings. This is further supported by new investment income and funds under management growth from upcoming development completions, along with an improved NTA outlook.”

Capital management update

- strong balance sheet position, with headline gearing of 27.6%5, within our target range of 20% to 30%

- substantial available liquidity of $1.2bn in cash and committed undrawn bank facilities held

- weighted average debt maturity of 4.2 years

- debt is 57% hedged and well positioned to benefit from an easing of interest rates

- average borrowing costs of 5.4% as at 30 June 2025 (FY24: 5.6%)

- maintained A-/A3 ratings with stable outlooks from Fitch Ratings and Moody’s Investors Service.

Investment update

- EBIT of $602m (FY24: $612m), driven by a full year of income from land lease and completions at LIV Aston, Melbourne and Aspect Industrial Estate, Sydney, offset by the impact of non-core asset sales

- increased portfolio occupancy to 98%6 (FY24: 97%), with a WALE of 5.4 years7 (FY24: 5.3 years)

- delivered positive leasing spreads across the portfolio, including 49.1% in industrial8, 6.8% in office8, 2.8% in retail8, 3.3% in build to rent9 and 10.2% in land lease9

- achieved 390 land lease settlements, with the average settlement price up 11%10, and new acquisitions adding 900 lots to the development pipeline

- investment property devaluations of $102m, with gains across industrial, retail and the living sectors offset by further office devaluations. Investment portfolio valuations were up $37m in 2H25.

Mr Hanan said: “Our focus on owning the highest quality investment assets in the most attractive markets delivered strong portfolio metrics, with improved occupancy of 98 per cent, low capital expenditure and a positive average leasing spread of 8.6 per cent. We have good visibility of further growth, with $100 million of new net operating income to be generated from committed developments underway.

“We are beginning to see the benefit of our continued expansion into the living sectors, with earnings up 184 per cent on FY24, underpinned by strong market fundamentals. There is significant potential for continued growth across our established platforms, where we can leverage our market leadership position and our long history in living to deliver much-needed housing product.”

Funds update

- delivered EBIT of $33m (FY24: $33m), with higher capital expenditure fees offset by reduced fees due to lower asset valuations

- increased third-party capital under management to $16.2bn, with $1.6bn of new capital raised in FY25

- expanded the Mirvac Industrial Venture with Australian Retirement Trust, with development completions at Aspect Industrial Estate, Sydney and a 49% interest in Stage 1 of SEED, Badgerys Creek growing the expected end value of the fund to $1.7bn11

- increased our Build to Rent Venture to 2,174 apartments, following completions across Melbourne and Brisbane12

- launched a successful capital raise in Mirvac Wholesale Office Fund (MWOF), which maintained gearing of 26.3%. MWOF was the top performing fund over 3 months and second top performing fund over 12 months compared to its peers.13

Mr Hanan said: “We raised approximately $1.6 billion in FY25, meeting the continued strong capital demand for modern living, logistics and Premium-grade Australian office. Across the platform, MWOF raised the equivalent of approximately $350 million, we broadened our relationships with our valued capital partners, and grew our Build to Rent Venture, which is now the largest operating portfolio in Australia.

“Our unique alignment of interests and in-house development capabilities in growth sectors are resonating well with capital partners. There is clear visibility of future growth, with a further $2.7 billion in funds under management growth forecast as our committed developments complete, along with future opportunities identified.”

Development update

Commercial and Mixed-Use

- delivered EBIT of $46m (FY24: $146m), with contributions from Aspect Industrial Estate, Sydney and the sell-down of Stage 1 at SEED, Badgerys Creek partly offset by a lower contribution from 55 Pitt Street, Sydney and a construction loss at LIV Anura, Brisbane

- completed LIV Aston, Melbourne (474 lots), with LIV Anura, Brisbane (396 lots) and LIV Albert, Melbourne (498 lots) completing in July 2025, and we remain active on new pipeline opportunities

- completed our second and third warehouses at Aspect Industrial Estate, Sydney (100% leased to Winnings and B Dynamic respectively), with all warehouses in the precinct now under construction

- progressed construction at Harbourside, Sydney, with pre-leasing across the office and retail component increasing to 18%14 and 60% of the residential component pre-sold15

- progressed construction on 55 Pitt Street, Sydney, with the building core now at level 28 and the structure at level 18. Pre-leasing increased to ~42%.14

Mr Hanan said: “We made good progress on our development pipeline in FY25, which included the completion of our second and third warehouses at Aspect Industrial Estate, Sydney, as well as the completion of two further build to rent assets in Melbourne and our first one in Brisbane.

“Our committed development pipeline plays an important role in our future growth. Along with new annualised income in our Investment portfolio over the coming years, this includes approximately $540 million of value creation through EBIT and revaluation uplift, along with funds growth. This is a strong demonstration of the value of our integrated model.”

Residential

- delivered EBIT of $179m (FY24: $212m), driven by lower residential lot settlements and lower gross margins, offset by the contribution from the selldown of three projects into joint venture arrangements (Highforest, Cobbitty, and Mulgoa, all in Sydney)

- improved sales momentum, with 2,100 residential lots exchanged, up 39% (FY24: 1,509), and a further

279 conditional sales on hand, driven by successful launches across Highforest, Riverlands and Harbourside Residences in Sydney, along with improved sales activity at MPC projects in Brisbane, Sydney and Melbourne

- settled 2,122 residential lots (FY24: 2,401 lots), which was within guidance, with defaults remaining low at ~1.2%16

- residential pre-sales increased to ~$1.9bn17, skewed to upgraders and right-sizers

- gross margins of 15%, including the impact of impaired projects yet to settle18. The impact of these projects has been quarantined to FY25. We expect margins to return to our through cycle range of 18-22% in FY26

- secured a new 1,200 lot masterplanned community site in South Bullsbrook, WA.

Mr Hanan said: “We achieved strong sales at Highforest and Riverlands in Sydney, along with near sell-outs across the first two stages of our flagship Harbourside development in Darling Harbour, Sydney. It has also been encouraging to see a pickup in sales rates at our masterplanned communities in Brisbane and Sydney, as well as improved momentum in Melbourne, with buyers gravitating to the quality of our communities and our upfront amenity provision.

“With approximately 10,000 new lots secured over the past two years, a significant release program with five upcoming launches across middle-ring and greenfield sites and $1.9 billion in pre-sales secured, we are very well positioned to capitalise on an improved residential market.”

Outlook

Mr Hanan said: “Market conditions are expected to improve across all sectors over the next financial year, supported by lower inflation and a further easing of interest rates. We have multiple levers for future growth, supported by more favourable market conditions, as well as our unique development capability and ability to attract high-quality third-party capital to our business.

“Our modern, best-in-class Investment portfolio will benefit from new development income, positive rental growth and stabilising asset valuations. Improved returns in FY26 are also expected to be driven by capital partnering initiatives, improved residential gross margins and sales activity, and an increase in our residential release program, particularly at our middle-ring projects.

“We expect a return to growth in FY26, and subject to no material change in the operating environment we are targeting operating earnings of between 12.8cpss to 13.0cpss, reflecting growth of between 6.7 per cent to 8.3 per cent and distribution of 9.5cpss, reflecting growth of 5.6 per cent.”

- LIV Anura, Brisbane and LIV Albert, Melbourne completed in July 2025.

- By area, excludes co-investments.

- Across office, retail and industrial.

- Represents Mirvac’s share of total pre-sales and includes GST.

- Net debt (at foreign exchange hedged rate)/ (total tangible assets – cash).

- By area, excludes co-investments.

- By income, excludes co-investments.

- Gross leasing spread.

- Net leasing spread.

- Twelve-month average price to June 2025 compared to 12 months to June 2024. Excludes GST and DSA projects.

- Represents 100% current expected end value including committed pipeline assets, subject to various factors outside Mirvac’s control.

- LIV Anura, Brisbane and LIV Albert, Melbourne completed in July 2025.

- MSCI June 2025. Peer set includes pooled wholesale office funds only.

- Includes Agreements for Lease and non-binding Heads of Agreement (HoA), excluding HoA, Harbourside was 13% pre-leased and 55 Pitt St was 34% pre-leased as at 30 June 2025.

- Pre-sales based on total lots.

- Twelve-month rolling default rate 30 June 2025.

- Represents Mirvac’s share of total pre-sales and includes GST.

- Includes NINE at Willoughby, Sydney and Charlton House and Quay in Brisbane. Excluding impaired apartment projects, gross margins were 17.5%.