Melbourne’s industrial market has remained resilient amid variable demand and moderating supply, according to the latest research from Knight Frank.

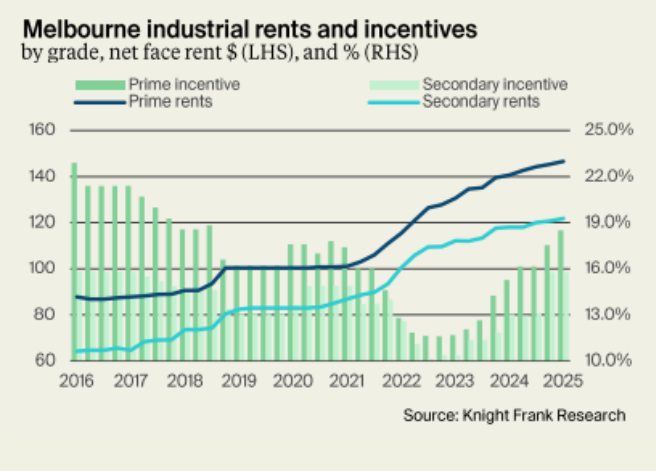

The firm’s Melbourne Industrial State of the Market Q2 2025 report found rents had remained stable over the June quarter this year, with prime net face rents rising by 0.9% to $147/sq m, while secondary rents were up by 1% to $122/sq m.

Incentives also ticked upwards, rising by 1% over Q2 to an average of 18.5%, with prime incentives having risen markedly in the West.

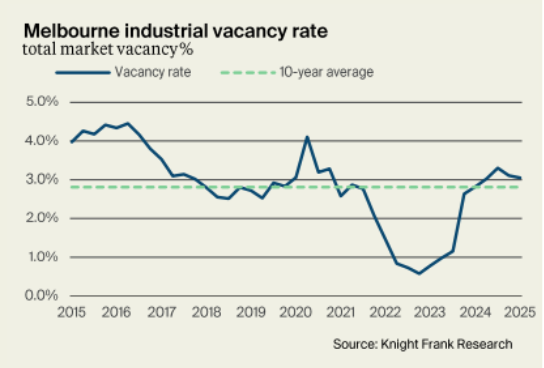

Knight Frank Head of Research & Consulting, Victoria Dr Tony McGough said while leasing activity fell over the quarter, the vacancy rate held steady at 3.1%, with supply having moderated.

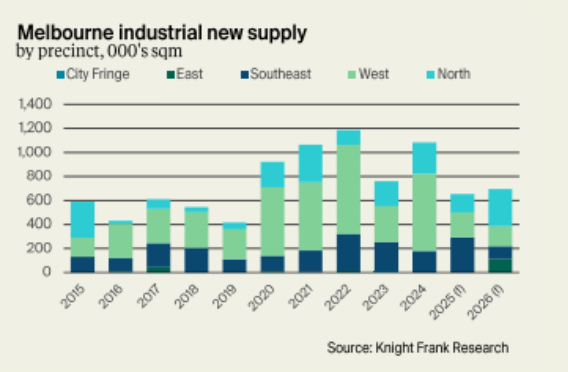

The research found 654,459 sqm of new supply is forecast to complete in 2025, down 39.6% from 2024.

“Melbourne’s Southeast is expected to deliver 44.6% of 2025’s new supply, the most of any precinct, and more than 60 per cent of this space is pre-committed.

“The Southeast also currently has one of the lowest vacancy rates, at 1.8%, significantly lower than the West, which is sitting at 3.7%, and the North, which is 5.3%, but just above the East, at 1.3%.

“This precinct also has the lowest prime incentives of any industrial precinct in Melbourne, at 16.9%.”

Knight Frank Partner, Head of Industrial Logistics, Victoria Joel Davy said like many sectors of the commercial property market, Melbourne’s industrial leasing market had taken a breather, but activity was expected to pick up.

“We are anticipating more transactions to take place over the second half of 2025,” he said.

“The market is expected to tighten as supply moderates, and demand will solidify as economic conditions improve, particularly if further interest rate cuts are delivered.”

Knight Frank National Head of Industrial Logistics James Templeton said conditions in Melbourne’s industrial investment market were also expected to improve, for the same reasons.

Knight Frank’s research found prime and secondary yields remained flat over Q2, while prime capital values increased by 0.9% and 3.7% over the year, with secondary values up by 1%.

“With small-sized lots becoming increasingly scarce, land values were up 2.7% over the quarter.

“Industrial assets and land remain highly sought after by investors, and we expect to see higher transaction levels over the next six months and into 2026.”

To subscribe to Knight Frank’s research reports, please click here.