Melbourne CBD office market records the strongest quarterly net absorption result in six years.

The Melbourne Central Business District (CBD) exhibited strong market performance in the first quarter of 2025, with positive net absorption totalling 34,606 sqm, signalling a strong vote of confidence in the city’s CBD office market.

Annabel McFarlane, JLL Head of Strategic Research, “There are two noticeable trends going on here. Centralisation has accelerated and large businesses are in more cases expanding rather than consolidating. Additionally, we have several newly formed businesses taking space. Whilst demand is likely to moderate through the rest of the year, this result is a strong indication that Melbourne’s CBD office occupier market may be following Sydney CBD’s dramatic return to positive net absorption which happened in Sydney CBD in 2024”.

Key drivers of the resurgence

- Centralising tenants:

Centralising tenants included seven companies coming into the city from fringe or inner suburban locations (43,425 sqm). While the largest resulted in 30,000 sqm of space absorbed in Docklands, the five others totalled 11,620 sqm of positive CBD net absorption. In four cases the companies centralising to the CBD are taking more space than in their previous non-CBD locations.

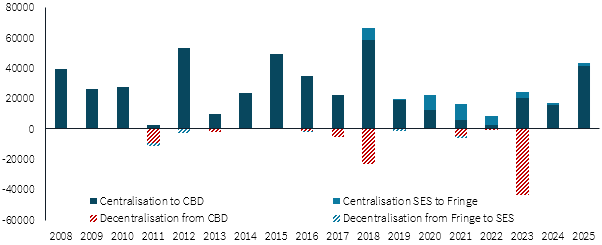

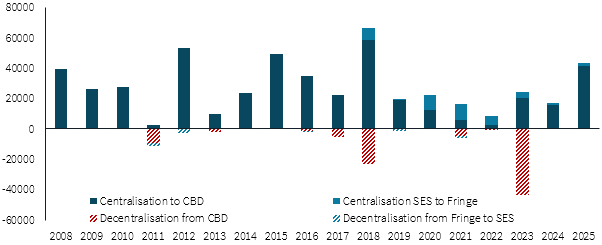

Centralisation has been a Melbourne office market feature for more than 15 years accounting for over 500,000 sqm of gross take up in CBD and Fringe markets. Decentralisation has occurred occasionally and is weighted to government entities, with the most recent being the Australia Post’s move to 480 Swan Street Richmond in 2023.

The volume of centralisation activity to the Melbourne CBD and Fringe has accelerated since 2023 with activity in 1Q25 exceeding the annual average (25,000 sqm) in both sqm and number. This suggests a record total for centralisation in 2025.

Melbourne CBD and Fringe office market centralisation and decentralisation since 2008.

James Palmer, Joint Head of Office Leasing VIC “Centralising groups have largely targeted value, with 242 Exhibition Street a significant beneficiary with multiple tenants relocating from fringe areas to occupy available Telstra sublease space, totalling 8,123 square meters. The opportunity provided a well located option with good quality fitout at a price point giving fringe occupiers a chance to reposition business activity and reenergise staff engagement. We anticipate these businesses will stay within the CBD when current subleases revert to direct, having experienced the benefits a CBD location provides.

- Expansion of large businesses

In an indication that business confidence is improving particularly for larger business, larger tenants, those >1,000 sqm accounted for 47,380 sqm of positive CBD absorption significantly greater than 12,770 sqm contraction of smaller occupiers. Professional service companies, Finance and successful coworking groups have expanded within the market.

Melbourne’s CBD’s headline vacancy rate improved from 19.8% in Q4 2024 to 18.6% in the current quarter.

These figures collectively paint a picture of a resilient and dynamic Melbourne CBD office market, characterised by strong demand, strategic relocations, and adaptive use of space. The positive absorption and declining vacancy rate suggest a market that is not only recovering but positioned for continued growth and stability.

James Palmer, Joint Head of Office Leasing VIC “There are 17 requirements >5,000 sqm in the market seeking options in both the CBD and Fringe. We have rarely had such a volume of potential activity to start the year. Whilst not all will result in a new lease and several will renew where they are, it bodes well for continuing strength in the leasing market this year. The uncertainty of the last five years is giving way to a clearer picture of what businesses want from their space”.