Looming 2M Sqm Lease Expiry Cliff Set to Test Office Demand Across Sydney and Melbourne CBDs

25 June 2025

Source: Cushman & Wakefield Research

Australia’s largest CBD office markets are poised to enter a crucial period, as structural shifts in tenant demand, preferences and return-to-office strategies collide with a wave of upcoming lease expiries in Sydney and Melbourne.

Cushman & Wakefield’s Reshaping the City report reveals ~2 million square metres of office leases are due to expire across the Sydney and Melbourne CBDs between 2026 and 2028. It examines the concentration of lease expiries and how building quality, vacancy risk, and tenant behaviour are shaping leasing activity from CBD sub-markets down to individual buildings.

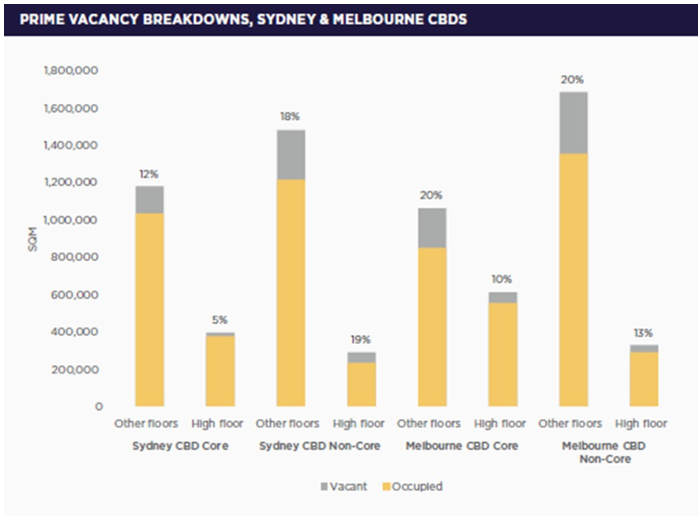

The first factor is clear demand for centrally located, higher-grade stock and a preference for space on upper building floors. In Sydney, 45% of prime office space is in the core, yet it accounts for only 36% of the total CBD vacancy, with similar trends observed in Melbourne. In both markets, prime vacancy rates for high floors in core areas are also roughly half that of mid- and low-rise floors.

For upcoming lease expiries, 40% are in Sydney’s core, while in Melbourne, one-third fall between the prime Bourke and Collins St corridor.

Even in the same grade, building quality can vary significantly and impact vacancy risk. To distinguish assets more deeply than traditional grading, Cushman & Wakefield developed the Building Quality Index (BQI), measuring 12 key factors. The BQI reveals contrasting risk profiles for Melbourne and Sydney, where a lower BQI correlates with higher vacancies. In Melbourne, buildings in the bottom BQI quartile account for 27% of upcoming lease expiries, all on lower-rise floors.

In Sydney, 19% of upcoming lease expiries are in bottom-quartile buildings. Meanwhile, 40% of expiries are in top- quartile buildings mostly in core locations, which may support tenant demand, and increase pressure on lower-tier and fringe CBD locations.

Cushman & Wakefield Building Quality Index

Sydney (% of total prime assets by NLA) Sydney (total % of upcoming vacancy) Melbourne (% of total prime assets by NLA) Melbourne (total % of upcoming vacancy) Quartile 1 (top) 41% 40% 35% 21% Quartile 2 22% 18% 22% 25% Quartile 3 17% 23% 23% 27% Quartile 4 (bottom) 20% 19% 20% 27%

Another key factor influencing leasing demand is the evolution of workplace strategies, in particular, return-to-office (RTO) mandates. The research shows that the top 250 tenants by office footprint in Sydney and Melbourne CBDs collectively occupy a third of all office space and half of prime-grade space.

In Sydney, 60% of these major tenants have implemented some form of strict RTO mandate, representing 1.1m sqm of space, and 40% in Melbourne, corresponding to 800,000 sqm. In both cities, RTO mandates are being led by financial and professional services, and government sectors.

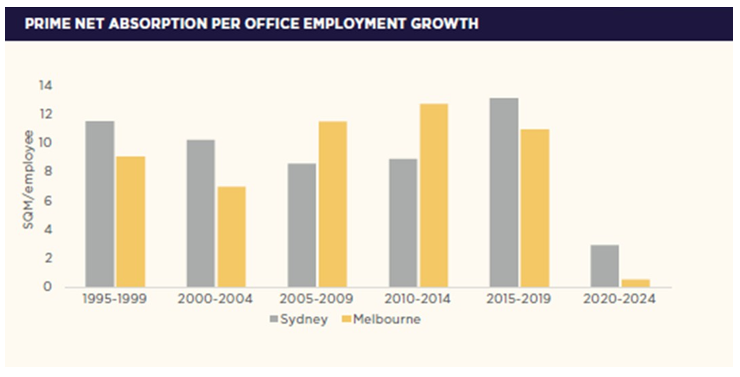

The shape and stringency of these policies have significant implications for office demand. Historically, Sydney and Melbourne saw around 10 sqm of prime office absorption for each additional office worker. Since 2020, that ratio has sharply declined to 3 sqm for Sydney and 0.5 sqm for Melbourne.

Prime net absorption per office employment growth

With financial services representing around a third of upcoming lease expiries and legal firms an additional 7%, there is the prospect that around 800,000 sqm of high-value tenant space will be expanded, renewed or relocated due to higher in-office attendance.

Cushman & Wakefield’s Head of International Research, Dr. Dominic Brown, said that the structural changes in major CBD office markets present challenges and opportunities for all real estate stakeholders.

“We’ve heard about the ‘flight to quality’ in office leasing markets for some time, but that label suggests a one- dimensional trend. What we’re really seeing is a ‘climb to the core’, where centrality, elevation and deeper building quality markers have an outsized impact on leasing decisions.

“With a wave of leasing expiries on the horizon, emerging occupier preferences combined with return-to-work momentum have a bearing on the risk profile of buildings across CBD markets. The decisions that tenants make have the potential to significantly impact the face of office demand on a larger scale.

“This means that some sub-markets, precincts and buildings will benefit as competition intensifies, while others will come under increasing pressure. For assets with more renewal risk, a shift from passive leasing to active capital investment and repositioning may be required. Where broader sub-markets are impacted, there could be a need for precinct-wide interventions to reinject vibrancy.”