Lendlease’s Real Estate Partners 4 fund and Realside have signed contracts to acquire 108 St Georges Terrace, Perth, WA from Brookfield.

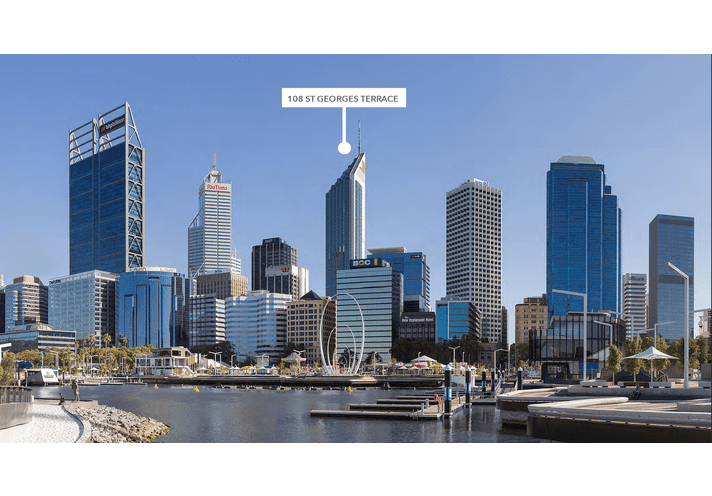

Occupying a prime corner site on St Georges Terrace and William Street in the heart of Perth’s CBD, the iconic A Grade tower comprises 38,332 sqm of net lettable area over 51 levels with most floors benefitting from sweeping views over the Swan River and the wider Perth metropolitan area. The building is well tenanted with a high-quality and diverse tenant base and substantial recent leasing momentum.

Perth has experienced the highest level of net absorption in the last 12 months, outperforming other capital cities, with low sublease levels and strong economic momentum positioning it favourably to continue to achieve attractive rental growth over the immediate term.

108 St Georges Terrace is complemented by the three-storey, heritage listed Palace Hotel built in 1897, which provides offices, café, restaurants and multiple conference facilities.

Over the last decade, $110 million has been invested in a whole-of-building refurbishment.

Paul Snushall, Head of Private Equity, Lendlease Investment Management said “This is a great acquisition for the REP4 portfolio. In line with our recent Blue Tower acquisition in Brisbane and Collins Street acquisitions in Melbourne, we’re keen to enhance 108’s ground plane and end-of-trip facilities, along with creating quality fitted suites to deliver a superior product for current and future tenants.”

Mark Vonic, Founding Partner, Realside Financial Group said “There are limited buildings in the Perth CBD of such quality, location and amenity to that of 108 and we are truly excited by this acquisition. Realside’s purchase of 108 is an

example of our approach to seeking out opportunities that provide our clients access to core assets that provide attractive returns. The acquisition of an asset of this calibre is reflective of the team’s approach, patience and discipline. We have been delighted by the positive response from our investor base.”