BY Kathryn Pacey, Shae McCartney and Stephane Daveson, Clayton Utz

Fundamentally, ESG is about doing business responsibly. It is about having the trust of your stakeholders. It is about businesses acting in a way that is “right” – doing only what achieves legal compliance is no longer enough.

Environmental, social and governance or ESG is the hot topic of the moment. Regulators, shareholders, board members, investors, financiers, communities and other key stakeholders are holding companies that fail in their ESG obligations to account, and are demanding a clear agenda, open reporting and auditing.

ESG is a complex web of aligning a corporate purpose with risk, governance, culture and trust. The focus of ESG is consistent with the findings of the Hayne Royal Commission where it was said:

“If what has happened in the past is to be avoided in the future, entities have no choice but to grapple with culture, governance and remuneration. All three are related. Culture obviously affects governance but it also affects remuneration (because remuneration will be structured to reward what the entity values). Governance obviously affects culture but governance will not only affect, it will ultimately determine, how remuneration and incentive arrangements are given practical effect. And remuneration and governance inform and reinforce the culture of the entity.”

But what is ESG, and how do you show your company is good at it?

What is ESG?

ESG means different things to different companies. How you define ESG for your company will depend on:

- your industry

- your stakeholders

- your exposure (size, public v private company and profile).

ESG is further complicated by the fact that it is dynamic, and changes over time and with changing expectations. There are financial and non-financial components of ESG, and there is no universally accepted way of measuring or scoring ESG (but more on that later).

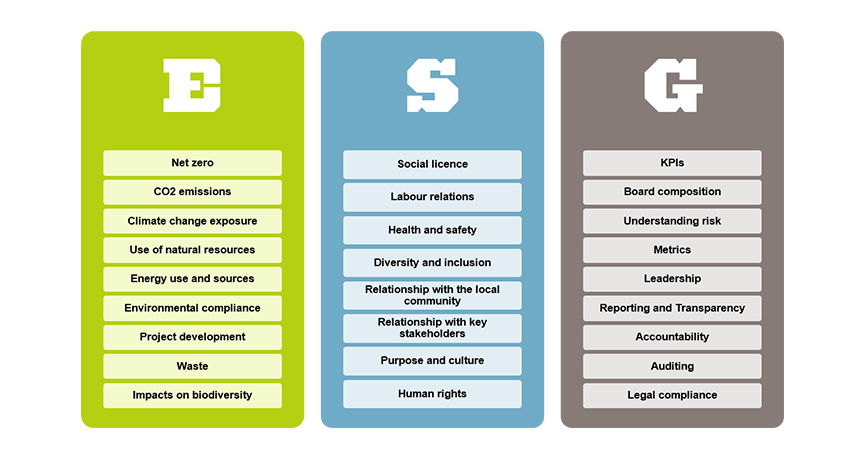

The diagram below attempts to capture the many facets of ESG, however the importance or weighting of a particular component will be unique to every company.

How do you manage ESG?

Fundamentally, ESG is about doing business responsibly. It is about having the trust of your stakeholders. It is about businesses acting in a way that is “right” – doing only what achieves legal compliance is no longer enough.

Managing ESG requires companies to:

- understand their corporate purpose, and have a corporate purpose that creates value for all stakeholders

- apply the corporate purpose to strategy and business decisions including performance metrics;

- identify and engage with stakeholders to understand expectations and requirements (and how these change over time). Stakeholders are no longer limited to shareholders. Stakeholders include:

- customers

- regulators

- financiers

- investors

- local communities

- workforce

- suppliers

- providers

- understand the key features of their social licence;

- understand what competitors are doing and what is best practice in their industries;

- understand risk to the business, in terms of people, revenue, reputation, resilience, transparency and legal compliance (it does still matter);

- ensure that there are appropriate governance mechanisms in place at a board and executive leadership level so that strategy is implemented, and accountability is ensured.This may require a review of board and committee structure, executive remuneration and bonuses, key performance indicators and reporting mechanisms;

- ensure that there is accountable, verifiable and transparent reporting of progress against ESG metrics.

The consequences of being “bad” at ESG

Research suggests that companies who are “good” at ESG will generally experience improved revenue and profitability, when compared with companies who do not actively pursue an ESG agenda. The reason for this may simply be that companies who focus on ESG have a more rigorous risk management agenda and more sophisticated governance and review structures.

However the consequences of being “bad” at ESG are becoming increasingly severe, and we have seen poor management of ESG issues result in:

- financial penalties in executive remuneration

- difficulty in obtaining project approvals

- difficulty in obtaining finance

- increased exposure to litigation

- reputational damage resulting in suppliers or customers not supporting a company

- §negative consequences for share price

- poor outcomes for companies in the event of environmental or safety incidents

- difficulty in attracting employees

- increased oversight by regulators

- removal of executives

Apples and oranges

ESG is difficult not only to define, but to measure and report on. A number of ESG reporting frameworks have been developed, and the quality and robustness of those reporting frameworks is variable.

Most recently, the World Economic Forum has development a set of universal ESG metrics and disclosures – “Measuring Stakeholder Capitalism“. The metrics are designed to be used by companies to align reporting on performance against ESG indicators on a consistent basis to bring greater consistency to the reporting of ESG disclosures, and broadly cover four pillars of governance, planet, people, and prosperity, which are designed to align with the Sustainable Development Goals.

What to do?

No matter where your company is on its ESG journey, the process requires constant re-evaluation and measurement – it is not a set and forget. So where do you start?

BY Kathryn Pacey, Shae McCartney and Stephane Daveson, Clayton Utz

GET IN TOUCH

Kathryn Pacey

Shae McCartney

Stephanie Daveson

Disclaimer

Clayton Utz communications are intended to provide commentary and general information. They should not be relied upon as legal advice. Formal legal advice should be sought in particular transactions or on matters of interest arising from this communication. Persons listed may not be admitted in all States and Territories.