Melbourne’s CBD faces a tightening premium office market, as new supply slows and pre-commitments rise, creating an opportunity for future developers to fill the gap, according to the latest research from Knight Frank.

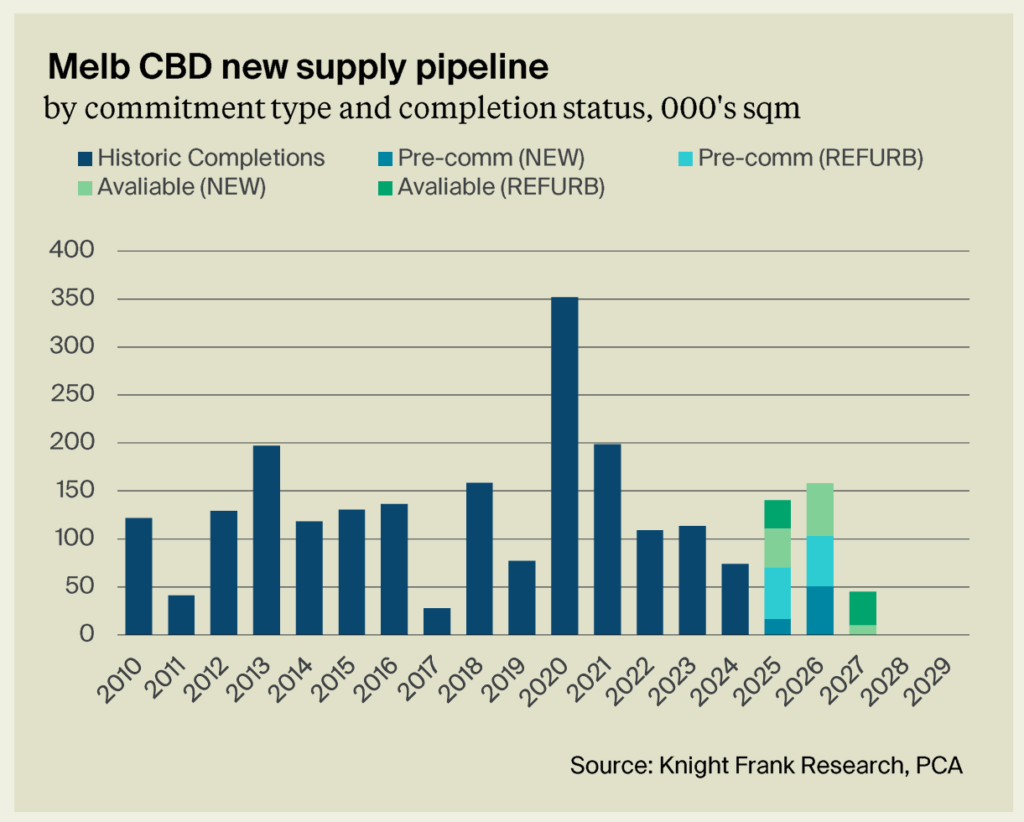

The report, entitled Is now the time to develop? found forecast supply in Melbourne’s CBD office market had sharply declined since its 2020 peak, and was now running low, with new premium office space about to become especially scarce.

“Post GFC, Melbourne’s CBD experienced a substantial wave of new office supply, driven by historically low vacancy rates and robust economic growth, however, with increasing global uncertainty and a recovering local economy, development conditions are now brittle,” said Knight Frank Head of Research & Consulting, Victoria Dr Tony McGough.

“As a result, the forecast pipeline has contracted significantly, with only three new office buildings larger than 25,000 square metres currently expected to complete before the end of 2029.

“While headline figures suggest a robust delivery in the near term – 140,000 square metres in 2025 and a further 158,000 square metres in 2026 – genuine leasing opportunities remain constrained.

“High levels of pre-commitment and a growing share of refurbished or reintroduced stock limit the volume of truly new, uncommitted, space entering the market.”

The research found that at present, only 48% of forecast total supply is from new developments, with 34% pre-committed.

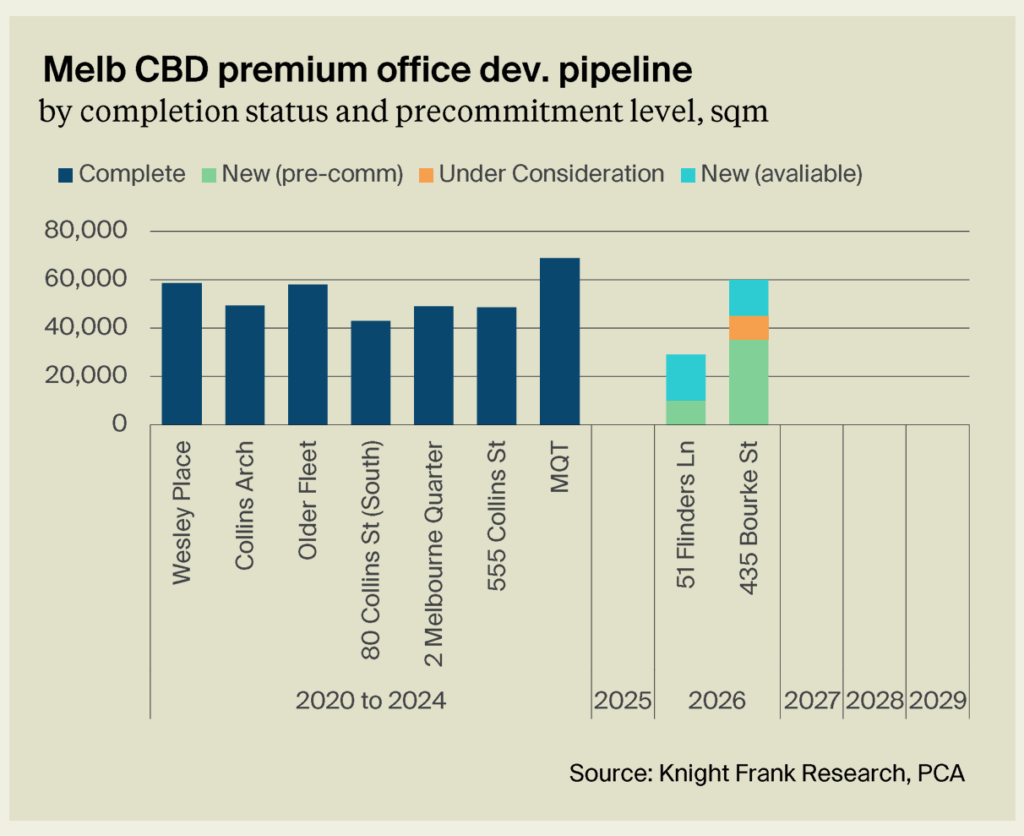

Only two premium-grade developments are currently under construction in the CBD – 51 Flinders Lane and 435 Bourke Street. 51 Flinders Lane, developed by GPT, has achieved a 34.5% pre-commitment, while 435 Bourke Street, led by Cbus Property, is more than 50% pre-committed.

With a large law firm looking at 10,0000sq m at 435 Bourke St, it would leave only 30,500sq m of new premium office space available for leasing in the CBD over the next five years.

“Combined with the solid letting performance of many recent premium completions, this points to an emerging shortfall and presents an opportunity for developers to respond to a tightening segment of the market,” said Dr McGough.

Knight Frank Head of Leasing in Victoria Hamish Sutherland said vacancy rates in the Melbourne CBD were reflective of the flight to quality trend, with vacancy for new premium buildings proving to be consistently low.

While Property Council of Australia figures show there is a 16.8% premium-grade vacancy rate, this is concentrated in the older premium buildings, he said.

“Over the past five years, seven premium-grade towers have been added to Melbourne’s CBD, with leasing outcomes consistently strong. Most of these assets reached sub-five per cent vacancy within a relatively short period following completion, with standout performers such as 80 Collins Street South and 2 Melbourne Quarter achieving full occupancy.

“These low vacancy outcomes are particularly compelling when benchmarked against the broader CBD vacancy rate, which remains elevated at 18 per cent.”

Mr Sutherland said new premium space is clearly a strong performer, but the buildings that perform the best will be those that are in the right locations.

“In a market with elevated incentives and vacancy rates, access to transport, retail and key business nodes has become increasingly important in driving leasing outcomes,” he said.

“The performance of Melbourne’s newest premium towers highlights the strength of demand for well-located, high-quality stock and suggests a lower risk profile for developers considering future premium office projects.”

Dr. McGough pointed out rental growth – rather than total yield recovery – would drive capital value recovery in the future as it has in the past, and with new premium buildings in strong demand amongst tenants and limited supply, these assets were perfectly placed to see capital value recovery.

“With strong tenant demand for premium space but limited new supply, delivering a premium building in this market strengthens the likelihood of obtaining this rental growth,” he said.

“Falling supply augurs well for the overall Melbourne CBD office market and the prospect of the return to rental growth.

“When capital values fell during the GFC or Dot Com crash there was a high development pipeline, but this is not the case now, it points to a more rapid return to capital value growth in the future.”