The weight of capital looking to be invested into the life sciences property sector continues to grow as superannuation funds and offshore capital increase their focus on the Australian market.

According to a new report by Colliers and Harrison Street, commercialisation has led to further investment in life sciences research over the past five years, with investors targeting the sector for its significant capital growth potential.

The sector also allows investors to support both their financial and social objectives; diversify their investment portfolios and provides insulation from broader economic conditions.

“The life sciences industry is clearly entering a significant stage of growth, accelerated by a renewed focus on health and biotechnology as a result of the COVID-19 pandemic and as such record levels of capital raising have occurred over the last 2 years. We expect that both the Federal and local governments will continue to invest further in the health and life sciences sector, in addition to an increase in private investment and PPP’s,” Joanne Henderson, Colliers’ National Director of Research, said.

The growth projections for Healthcare in general and the Life Sciences’ sector is attracting growing interest from venture capitalists and institutional & commercial real estate investors, as the sector’s strong fundamentals offer secure, reliable, and long-term income.

Index performance tracking from the ASX has shown that the listed health sector (which includes Life Sciences) has outperformed many other sectors. Over the period Nov-10 to Jun-22, the ASX 300 Healthcare sector grew by 319% – outperforming IT and other sectors such as Metals & Mining and Financials.

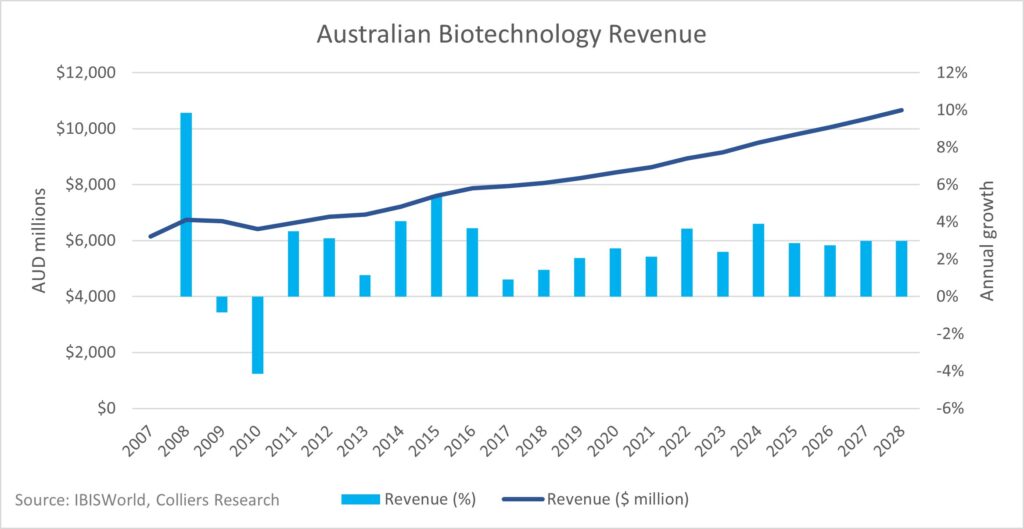

According to the report, real estate and its location are an integral part of the health and life sciences ecosystem, and real estate participants are in a unique position to leverage from the growth outlook for this sector. Industry revenue is forecast to grow at an annualised 3.0% over the five years through 2026-27, to $10.3 billion. In the wake of the COVID-19 pandemic, industry operators stand to benefit from government-led efforts to enhance Australia’s sovereign capabilities in the manufacturing of essential medical supplies, including vaccines.

“Due to the specialised requirements needed for both the location – such as being close to hospitals, health institutes and universities – and the type of building required for a life sciences operator including laboratories, R&D space and specialised storage requirements, new purpose-built developments will in many cases be the only option and therefore provide opportunities for real estate investors and developers to capitalise on the growth outlook for this industry, whether through direct development opportunities or fund-through development transactions,” Ms Henderson said.

“Also, the clustering effect on the success of health and life science companies has been proven and as such, opportunities will exist for owners of potential development sites within close proximity to existing and planned health hubs surrounding major hospitals and universities.”

Australia has several existing Biomedical/Life Science hubs, such as the Melbourne Biomedical Precinct, MedTech Knowledge Hub in NSW, Adelaide BioMed City and South Australian Health and Medical Research Institute (SAHMRI) and UNSW Health Translation Hub (Randwick).

Ian Sanders, Head of Transaction Services, Asia Pacific Healthcare and Retirement Living for Colliers said investor appetite for these types of stabilised assets was on the rise, particularly post pandemic, with more activity from institutional investors, particularly REITS, expected.

“Whilst the potential investment universe is large, the requirements for capital can be significant especially when linked to either the initial stages of the life sciences lifecycle, or alternatively at the mature end of the spectrum,” Mr Sanders said.

“Additionally, if the investments are made at the initial end of the spectrum, there is a significant risk that needs to be carried from an investment lens, until such time as either returns can be achieved commensurate with risk or the risk profile is reduced due to progression through life cycle.”

Colliers found the increased weight of capital targeting the Australian life sciences property sector has primarily been driven by superannuation funds, which continue to see retirement savings grow annually, as well as an increase in interest from offshore capital.

“Superannuation money tends to be ‘patient’ or long-term capital, with many superfund managers looking for long-term stable returns for their members or clients,” Mr Sanders said. “The life science real estate sector is a prime target for Superannuation funds investing either directly or indirectly through Australian Real Estate Investment Trusts (A-REITS).

“Like many alternative real estate asset classes, many life science companies look to lock in longer lease terms, given the more specialised nature of the space they occupy. Therefore, life science real estate offers a lower risk asset offering a long-term cash flow with reduced levels of rental downtime.

“Life science real estate also provides a more balanced portfolio through a more secure revenue stream in comparison to a portfolio which is highly skewed to more traditional asset classes, and are deemed more defensive through economic downturns and therefore viewed as a counterbalance for portfolios.”

Mr Sanders said the rise in demand for long weighted average lease expiry (WALE) assets has been apparent over the last two years through the pandemic.

“Many investors have been looking to assets that provide a more secure cash flow and lower risk beyond the short and medium-term uncertainty,” Mr Sanders said. “This has resulted in a strengthening of the buyer pool for assets with a long lease term and has created an asset class of its own for long WALE assets.

“Investor interest in long WALE assets is not a new trend, however the current uncertainty has increased focus and therefore competition for these assets. Yields have been driven downwards as a result.

“As this is a very specific profile of asset there is limited stock that meets this profile, this has created a separate office asset class of Long WALE assets, which is agnostic to location or grade as long as it meets this specific profile. The life sciences real estate sector is in a unique position to capitalise on this demand and due to the limited nature of completed stock, may spark investments in new development activity and potentially also fund-through sales.”