Industrial vacancy across Australia’s Eastern Seaboard remains constrained, underpinning ongoing rental growth, but the rate of rental growth slowed slightly in Q2, according to the latest research from Knight Frank.

Knight Frank’s Australian Industrial Review Q2 2023 found vacancy was sitting at 526,806sq m across the Eastern Seaboard cities of Sydney, Melbourne and Brisbane, which was 36 per cent below the same time last year.

However, available space increased by 19.5 per cent in Q2, with an uptick in Melbourne and Brisbane, while Sydney tightened further.

Sydney’s vacancy fell by 27 per cent to 32,175sq m, while Brisbane’s availability increased by 15 per cent to 261,166sq m and Melbourne’s vacancy increased by 37 per cent to 233,465sq m, with this city now accounting for 44 per cent of total East Coast vacancy.

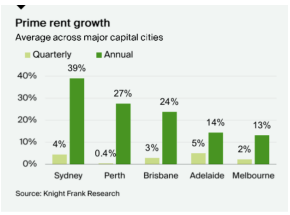

The Knight Frank research found the quarterly pace of rent growth slowed in all markets except Adelaide over Q2 but annual increases remain high with Sydney, Perth and Brisbane continuing to record annual growth above 20 per cent, and further rental growth is expected.

Adelaide recorded the strongest rental growth over the quarter of five per cent, with this market entering a catch-up phase. It was followed by Sydney at 4.4 per cent, with this city having the highest annual growth of 39 per cent, 12 per cent ahead of the city with the second largest growth, Perth (27 per cent).

Knight Frank Partner Research & Consulting Jennelle Wilson said increases to industrial vacancy over the second quarter of this year were largely due to new speculative constructions.

“Available speculative space now accounts for 48 per cent of total East Coast vacancy, with 42 per cent of this still under construction and unavailable for immediate occupation,” she said.

“Leasing take-up increased by 27 per cent in Q2 after a relatively quiet Q1, but remains lower than the frenetic levels of 2022, with activity still impacted by the lack of opportunities available.

“The strong supply pipeline for 2023 will help to ease the tight vacancy, particularly for the East Coast, with 2.6 million square metres on track to be delivered, but it won’t completely satisfy demand for modern industrial space.”

Knight Frank National Head of Industrial Logistics James Templeton said the relatively low volume of leasing deals over Q2 indicated tenants were taking a more critical look at their rental impost, with rising outgoings also pushing up total occupancy costs.

“However, sustained demand for new space and ongoing tight supply will continue to put upward pressure on rents, albeit at a slower pace,” he said.

“Growth is expected to revert towards an annual pace in the range of five to eight per cent over the next 12 months.”

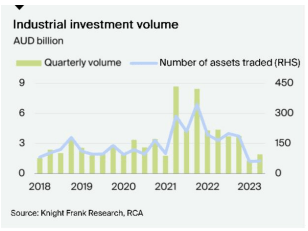

Knight Frank’s Australian Industrial Review Q2 found there had been renewed investment demand in Australia’s industrial market over Q2, with $1.9 billion in transactions and more high-value transactions taking place.

While there was a similar number of recorded sales in Q2 vs Q1, the turnover was $600 million-plus higher, reflective of significant sales of $100 million-plus.

Transactions were focused on the Sydney market, with $1.3 billion transacting in this capital city.

The research found land values have stabilised, with some select precincts starting to see a dip in value, while yield softening continued in Q2, albeit with greater variance between cities emerging.

Mr. Templeton said renewed investment demand, particularly for large-scale assets and portfolios, was returning liquidity and confidence to the investment market.

“Perceived resilient tenant demand and ongoing rental growth has ensured an engaged, if discerning, buyer pool for Australian industrial assets,” he said

“As inflation and the cost of funds landscape is appearing more settled, major investors have been quick to return to the industrial market.

“In the second half of the year the pace of activity is likely to pick up further as a more settled macroeconomic backdrop helps to narrow bid-ask spreads.”

A recent Knight Frank Active Capital webinar poll found logistics was the equal second most sought after sector for investors along with the office sector, with 34 per cent of respondents indicating they would target these property types over the next 18 months, after living sectors (46 per cent).