427-451 Somerville Road, Tottenham

Long considered a niche corner of the industrial sector, cold storage warehouses are emerging as one of the fastest growing and most under-serviced asset classes. A perfect storm of e-commerce acceleration, supply chain shifts, change in consumer habits, and population-driven consumption is pushing temperature-controlled warehousing into the spotlight, particularly in Victoria. As a result, developers are shifting their attention to this sub-market and are diversifying their portfolios to deliver tailored solutions for occupiers in need.

Why cold storage?

The COVID-19 pandemic fundamentally disrupted global supply chains. In response, Australian businesses moved away from just-in-time inventory models and embraced a just-in-case approach – storing more stock onshore to mitigate future risk. This trend triggered a surge in demand for warehousing across the board, but particularly for cold storage, as shifts in consumer spending and delivery expectations made temperature-sensitive logistics a top priority.

E-commerce was another game-changer. The pandemic accelerated online shopping across all categories, but non-discretionary spending, particularly groceries and food items, led the charge. The shift toward more convenient options, combined with a growing health consciousness among the general population, has driven a 21.1% growth in online grocery and meal kit services since 2020, with operators like Marley Spoon, Hello Fresh, Raw and Fresh, Woolworths, and Coles investing heavily in their last-mile and cold chain infrastructure.

A nation behind in cold storage capacity

Despite rising demand, Australia’s cold storage infrastructure is struggling to keep pace. The country has just 0.4 cubic metres of refrigerated warehouse space per urban resident – well behind the US (0.6) and Netherlands (0.9).

According to JLL research, an additional 540,000 sqm of new cold storage is required just to match US levels, based on current population figures (assuming an average warehouse clearance height of 10m).

This gap is made more urgent by Victoria’s explosive population growth, which is fuelling consumption and driving demand for more warehouse space. JLL estimates that for every new resident, 4-8 cubic metres of warehousing are needed. By 2030, this equates to a nationwide requirement of just under 14 million sqm of additional floorspace, with cold storage accounting for 4-6%, or around 750,000 sqm.

Victoria: the epicentre of cold storage growth

Victoria has emerged as the clear leader in cold storage demand and development. With Melbourne surpassing Sydney as the top receiver of international freight, and the state accounting for 24% of the nation’s food and fibre exports, it is a natural hub for cold chain activity. The region is also home to Australia’s largest concentration of pharmaceutical and life sciences manufacturing sectors with strict temperature-controlled logistics needs.

“Cold storage requirements have surged across the Victorian market over the past 12 months,” said Lachlan Ferguson, JLL Director, Logistics and Industrial Victoria. “We’re engaging with a significant number of occupiers who are reviewing their networks to optimise operational efficiencies. New builds are particularly attractive as they offer substantial energy cost reductions and greater cubic capacity benefits. This combination of cost savings and increased storage volume is driving strong interest in modern cold storage facilities.”

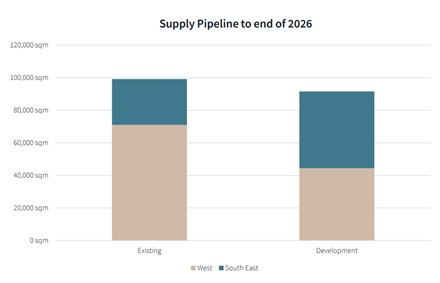

Supply crunch and opportunity

Despite the surging demand, the supply of cold storage facilities remains limited. Only six buildings are projected to become available in 2025 to 2027, while JLL is currently tracking over 300,000sqm of temperature-controlled requirements seeking occupation in this same period.

High construction costs for full freezer development, ranging from $3,400 to $3,600 per sqm and the complex engineering required for cold storage facilities have historically deterred speculative development.

However, the tide is turning. Developers are now recognising the opportunity to diversify their portfolios with bespoke cold storage solutions.

A recent brief run by JLL for a cold storage facility in Melbourne’s North and West drew over 30 leasing proposals – evidence of growing market appetite.

“There’s been a noticeable uptick in developer appetite to diversify portfolios and enter the cold storage market,” said James Jorgensen, JLL Head of Logistics and Industrial Victoria.

“Upcoming campaigns are being designed specifically to meet these highly technical requirements. It is becoming more evident that cold storage isn’t just a trend, but rather an essential component of future industrial strategies,” Jorgensen adds.

Over 40,000sqm of cold storage space is set for completion in 2025, and more than half is already pre-committed by occupiers demonstrating the urgency for new supply and the confidence from tenants in securing space early.

Among the limited existing supply is 28 Ordish Road, Dandenong South, an ex-Mondelez chocolate storage facility with temperatures ranging from 14°c -17°c, offering ambient temperature control.

New supply is beginning to emerge, with projects such as:

- 7 Princes Highway, Dandenong South – a new 16,000sqm cold storage facility with flexibility to be modified according to suit occupier’s requirements with temperatures ranging from –25°c to 2°c.

- 427-451 Somerville Road, Tottenham – a 21,000sqm cold storage facility, that can accommodate temperatures as low as –25°c.

“The recent planning approval of 7 Princes Highway reflects ISPT’s strategic focus on future-fit industrial assets that respond to structural shifts in the supply chain. We’re committed to delivering bespoke, high-performance cold storage solutions to meet the evolving needs of occupiers and support the increasing demand for temperature-controlled logistics, particularly in growth markets, like Victoria,” said Tim Jackson, ISPT, Head of Portfolio, Industrial.

What’s driving the momentum?

A range of macro trends are working in tandem to keep the pressure on cold storage demand:

- High population growth with just over 800,000 people expected to move to Victoria in the next 10 years

- Food and beverage accounts for 40% of Australia’s total retail spending

- Ageing population boosting demand for pharmaceuticals and healthcare products

- Shift toward more convenient options combined with a growing health consciousness has driven a 21.1% growth in online grocery and meal kit services since 2020.

- Climate conditions increasing demand for refrigerated cosmetic storage.

“We’re still seeing strong rental escalation, particularly in pockets like Melbourne’s South East” said Stephen Adgemis, JLL Senior Director, Logistics and Industrial Victoria. “Victoria remains the country’s most dynamic industrial market, supported by a high-growth population, increasing international freight volumes, and a strong local manufacturing base,” Adgemis continues.

For those in the industrial space, the message is clear: cold storage is no longer just a specialist solution but rather a core component of future proof property strategies. Those who invest early, partner smartly, and build for the future will be best positioned to capitalise on the next decade of industrial growth.