New CBRE report shows strong projected growth for athleisure brands will drive increased demand for prime retail tenancies

Driven by the rise of remote work, active lifestyles, social media and a generational shift, demand for athleisure clothing in Australia is booming with many brands looking to expand their online success into physical retail stores, a new CBRE report shows.

CBRE’s Fitness Becomes Fashion report notes Australian retail trade has shown resilience, despite ongoing uncertain economic conditions and subdued consumer confidence, with total sales increasing by 9.5% since 2022.

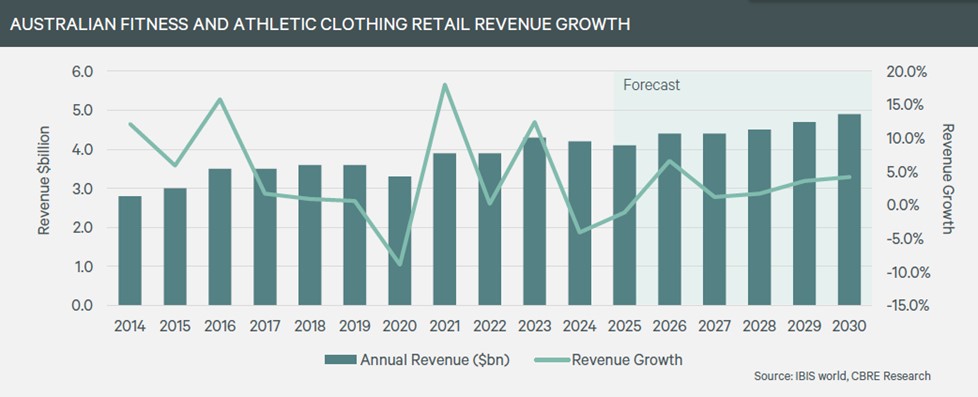

In 2024, Australia’s fitness and athletic clothing stores market was valued at $4.2bn. Sports apparel is expected to account for the largest share of the activewear retail market in 2025, generating $2.3bn (55%) of total revenue. Footwear and accessories follows, representing $1.5bn (37%) and $308.6m (7.5%) of total revenue respectively.

The report shows that growing demand for activewear as streetwear has driven strong industry revenue growth, with the market reporting a CAGR of 3.0% between 2019-2024. It’s expected this trajectory will continue with revenue forecast to increase by 3.4% (CAGR) between 2025-2030.

The report’s author, CBRE Senior Research Analyst Charlotte Fordyce said the shift towards remote work, accelerated by the pandemic, was just one of the trends influencing the growing popularity of athleisure wear.

“In recent years, there has been an increasing shift towards health and wellness with more people pursuing an active lifestyle. Consumers are opting for more versatile and functional clothing which supports their exercise activities and daily routines without compromising style,” Ms Fordyce said.

“Gen Z and Millenniels have been keen drivers of activewear market growth. This age group tends to be heavily influenced by fashion trends and have a high use of social media, such as Instagram and TikTok, which features celebrities and influencers aligned with activewear brands. Additionally, this age group are more health-conscious, prioritising fitness and wellness, so that is also influencing consumer behaviour,” Ms Fordyce added.

In the report, Lorna Jane’s Head of Property & Retail Development Anna Strzelczykowski noted over the past decade, athleisure has evolved from performance wear into a powerful expression of identity, confidence, and connection.

“As a brand, we’ve adapted alongside our community: introducing innovations like our Shop The Look concept, where retail spaces feel like curated style guides, and partnering with initiatives like parkrun to deepen our commitment to movement and community,” she said.

“Today, athleisure isn’t just about what women wear—it’s about how it makes them feel. Our growth reflects that shift: elevated in-store experiences, community-driven activations, and product designed for the way women live now. We’re proud to be leading the future of athleisure—not just through the product itself, but through the meaningful, intentional experiences built around it,” Ms Strzelczykowski added.

CBRE’s Head of Retail Property Management and Leasing – Pacific Sheree Griff noted as the popularity of athleisure continues to rise, the number of physical stores is also expected to grow.

“Many brands that have built a strong online presence are now seeking to further elevate their brand visibility and create a deeper connection with consumers by opening standalone stores in premium shopping districts,” Ms Griff said.

Ms Griff noted athleisure brands were increasingly seeking locations alongside other luxury boutiques, including other athleisure brands, which reflected another growing trend – the rise of athleisure precincts.

“The emergence of retail athleisure precincts, such as Armadale in Melbourne, featuring brands including Lululemon, Nimble, Style Runner and 2XU, are particularly attractive to tenants as they benefit from increased foot traffic of their target demographic. These athleisure precincts also provide significant opportunities for landlords to secure high quality activewear brands,” Ms Griff said.

“In addition, we are increasingly seeing prominent brands with an existing physical presence occupy larger floorspaces. We expect athleisure brands to continue to expand their floorspace to refresh fit outs and incorporate more experiential retail,” Ms Griff added.