Swathes of office space are set to be removed from CBDs across the country in the next five years in a move that’s been dubbed “the great withdrawal.”

Led by Sydney, it’s one of the lesser-known trends set to drive Australia’s office market recovery, according to a new CBRE research report.

CBRE Research Manager Thomas Biglands noted, “There is now reason to believe that vacancy rates in most Australian markets have reached their cyclical peaks as leasing activity gathers steam, more workers return to offices and new construction remains on the backburner. A less talked about factor has been the anticipation of significant levels of inventory withdrawals, which are likely to be well above historic levels in most CBD markets, helping to drive vacancy rates down.”

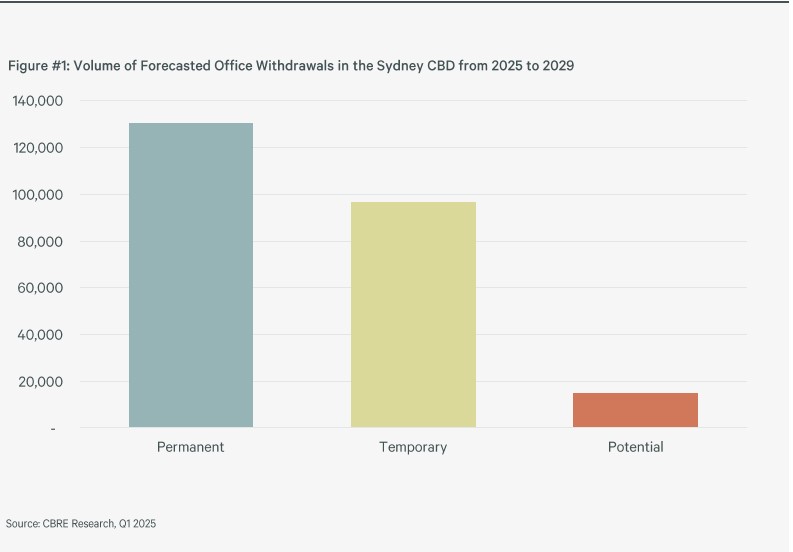

The Sydney CBD is at the forefront, with CBRE identifying 241,336 sqm of office space that could be withdrawn from the market by the end of the decade – representing 4.6% of the city’s existing office inventory.

That’s a significant shift in a city where new supply has typically far outweighed withdrawals.

Based on CBRE forecasts, new Sydney CBD supply will be down 61.2% over the next five years compared to the trailing five-year period, while withdrawals will be up 92.6%.

Some office stock is set to be permanently withdrawn as these buildings are converted or redeveloped for an alternative use such as apartments or hotels. These building are all outside the CBD Core in the city’s Midtown, Western Corridor, and Southern precincts, which have been hardest hit by a tenant flight-to-quality migration.

Temporary withdrawals are also on the cards, involving sites that are earmarked for new office towers. Given new construction can take five or more years, these withdrawals will still have a material impact on vacancy rates and rental growth, Mr Biglands said.

These building are all in either the city Core or the northern end of the Midtown precinct – the only areas of the CBD where new office development is feasible given the current construction climate.

Potential withdrawals are also included in CBRE’s figures, involving existing office properties which have mooted redevelopment plans.

Office space in these buildings is still available but the leases are either short term or include demolition clauses, with the projects not likely to move forward until later in the decade.

CBRE’s report notes that additional withdrawals are also highly likely in the coming years.

“The ongoing bifurcation between Prime and Secondary office leasing fundamentals has resulted in a significant pool of struggling lower grade assets in the more challenged precincts and submarkets across Sydney,” Mr Biglands said.

“While these properties are struggling to compete as office assets, fundamentals in other property sectors are more compelling. Market dynamics in residential, hotels, education, and data centres sectors are all much stronger than for secondary office at present.”

CBRE Office Leasing Director Chris Hanley believes the withdrawal trend will change the game for lower grade and less active Sydney CBD submarkets.

“Tenants in these lower grade assets are usually on very cost-effective terms so they’re unlikely to trade up to prime grade stock,” Mr Hanley said.

“If we look back to the last cycle, withdrawals associated with residential conversions sent B-Grade and lower A-grade rents sharply higher and this may play out again if all the withdrawals are realised.

“We are already seeing a significant uplift in enquiry across Midtown and the Western Corridor as value-seeking tenants start to seek relocation options as leases in buildings like 175 Liverpool Street and 338 Pitt Street approach expiry. Quality stock with existing fitout is moving very quickly and availability of this product is getting thin.”

CBRE’s report notes that the withdrawal of 50,000 sqm of office space equates to circa 1.0% of vacancy rate tightening – highlighting the major impact that the withdrawal trend could have.

The current CBRE base case forecast for the Sydney CBD is for the overall vacancy rate to declining from 12.8% as of year-end 2024, to 9.1% in 2032 when the next major wave of new supply is expected.

However, the vacancy rate could shrink to as low as 5.4% by 2032 if all the identified withdrawals proceed, or 7.0% taking a more conservative view that only the permanent withdrawals will proceed.