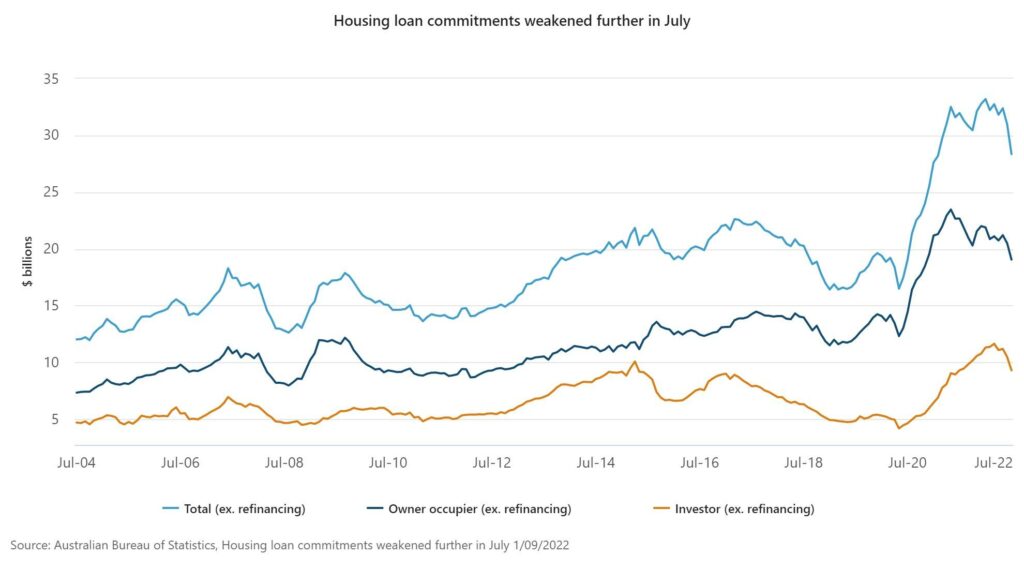

The value of new loan commitments for housing fell 8.5 per cent to $28.4 billion in July 2022 (seasonally adjusted) after a fall of 4.4 per cent in June, according to data released today from the Australian Bureau of Statistics (ABS).

Katherine Keenan, ABS head of Finance and Wealth, said: “The value of new owner-occupier loan commitments fell 7.0 per cent in July 2022, while new investor loan commitments fell 11.2 per cent.

“Although lending has fallen from historically high levels recently, the value of loan commitments remained significantly higher than pre-pandemic levels. Owner occupier loans in July 2022 were 40 per cent higher than February 2020, while investor loans were 78 per cent higher.”

The value of new owner-occupier loan commitments fell in all states and territories except the Northern Territory, a smaller and more volatile series which rose 3.1%.

The value of borrower refinancing of owner-occupier housing loan commitments between lenders fell 1.9 per cent in July 2022, to $12.4 billion, following the record high reached in June.

The number of new loan commitments to owner-occupier first home buyers fell 10.7 per cent in July 2022 to 8,388. This is the lowest number since May 2019. Falls were seen across almost all states and territories, particularly Queensland (down 18.8 per cent), Victoria (down 12.6 per cent) and New South Wales (down 11.6 per cent).

The value of new loan commitments for fixed term personal finance rose 7.7 per cent (seasonally adjusted) in July 2022, after falling 15.2 per cent in June. Lending for personal investment rose 73.8 per cent after falling 37.1 per cent in June. Lending for the purchase of road vehicles rose 5.2 per cent, while lending for travel rose 1.6 per cent, to just below the pre-pandemic level seen in February 2020.