Hotel Transaction Volumes See Substantial Boost as Capital Looks Towards Australia

2 May 2025

A total of $676 million was transacted in Australia through the first quarter of 2025, as capital takes advantage of favourable market conditions.

Investor confidence in the Australian Hotels market has rebounded strongly to start 2025, as transactions in the first quarter doubled that recorded in the same period in 2024.

Colliers research shows a notable increase in Q1 2025 to total $676 million, which included three high-value transactions that had been in play for an extended period of time.

“Deal activity appears to be picking up while there is also an uptick in listing activity. Renewed investor confidence is being spurred by continued strength in hotel trading, recent transaction evidence and the interest rate cut, with expectations of more to come,” Colliers Head of Hotels, Karen Wales said.

“In a marked contrast to the last few years, Asian capital has become active again as the Australian dollar remains historically low. Offshore capital accounted for 41 per cent of hotel deal flow.”

The expectation that demand and supply find a balanced medium in 2025 appears to be coming to fruition already, with domestic demand tracking at historical levels and international demand also on the rise. On top of this, the hotel development cycle has slowed considerably after eight strong years, with only 3,200 rooms expected to open in major markets through 2025. This represents growth of just 2.5% on the base stock.

“This represents a considerable drop from the cycle peak and has potential to moderate further given the potential impact of tariffs on global supply chains,” Ms Wales said.

“Quality assets continue to draw strong interest but deal times have lengthened as investors continue to navigate unprecedented global events. As a result, we expect full year volumes to be in line with our forecast $2.2 billion.”

“Whilst globally, hospitality continues to attract more capital, we expect to see investors pivot to new regions, whilst expanding in existing geographies, as they adapt to new regional alliances.”

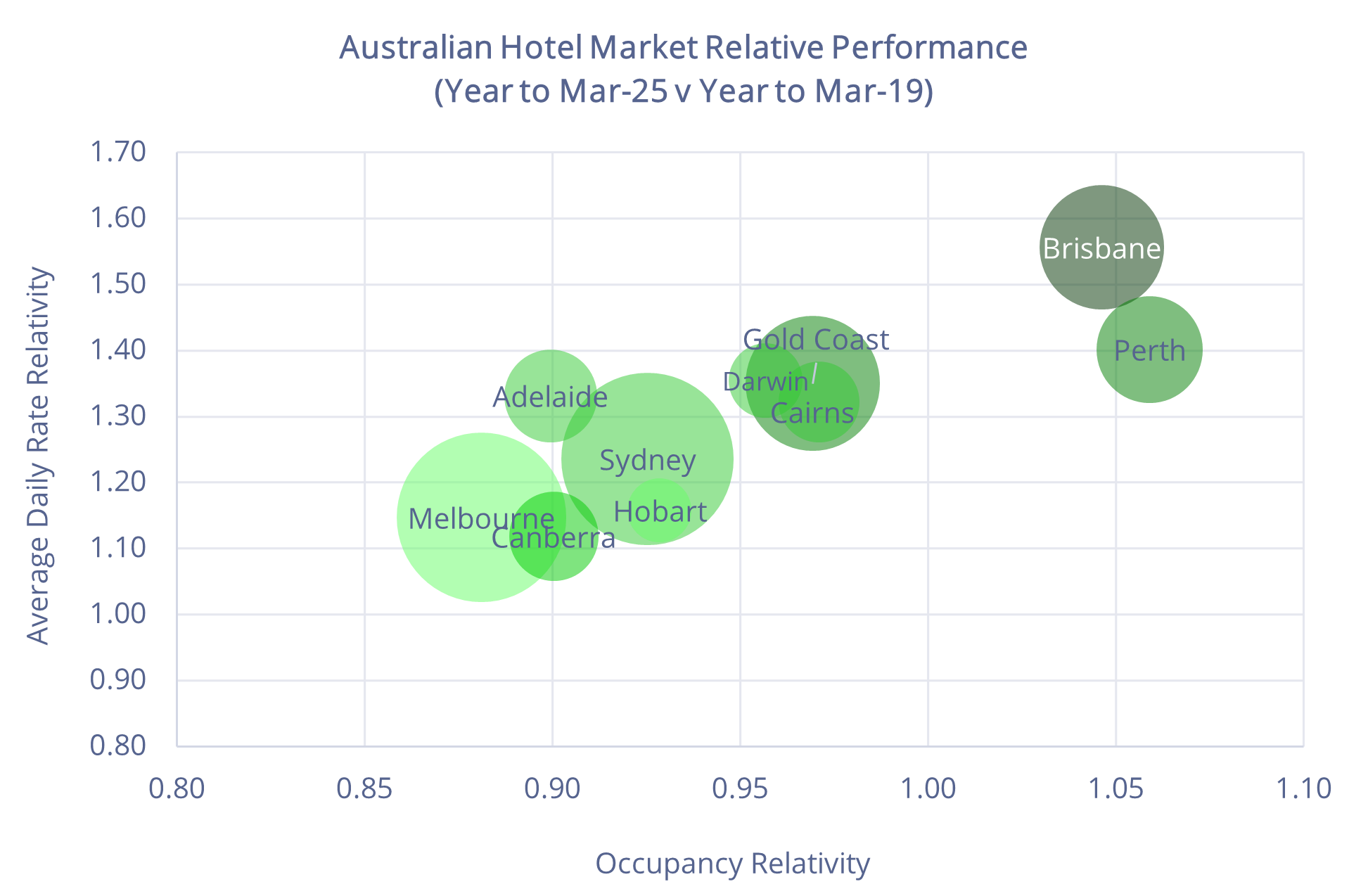

It is expected that investors will focus on high-growth markets in 2025, as RevPAR outperformance fuels liquidity. The driving force varies between key markets, but the return of international tourism and corporate travel has really diverted attention back to core markets like Sydney, Brisbane, Perth and Melbourne.

RevPAR growth in these core markets has ranged between 6.7% for Perth to 1.7% for Sydney.

Markets continue to rebalance as inbound visitation rebounds resulting in strong growth in occupancies, offsetting a slight moderation in ADR. This reflects a broadening of the demand base particularly when compared to Q1 2024 when performance was boosted by a range of music events and a March Easter school holiday period.

With several major sporting events on the cards across the country, performance is poised for a positive run to the end of 2025.