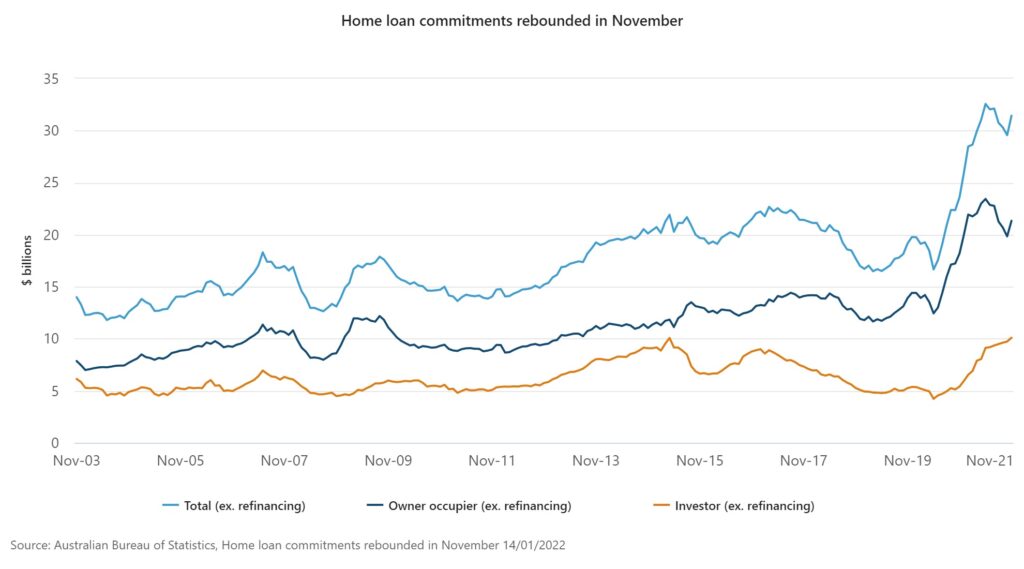

The value of new loan commitments for housing rose 6.3 per cent to $31.4 billion in November 2021 (seasonally adjusted) following three months of falls, according to statistics released today by the Australian Bureau of Statistics (ABS).

ABS head of Finance and Wealth, Katherine Keenan, said: “The value of new loan commitments for owner-occupier housing rebounded 7.6 per cent in November. The rise was the first since May 2021 and the largest since January 2021.”

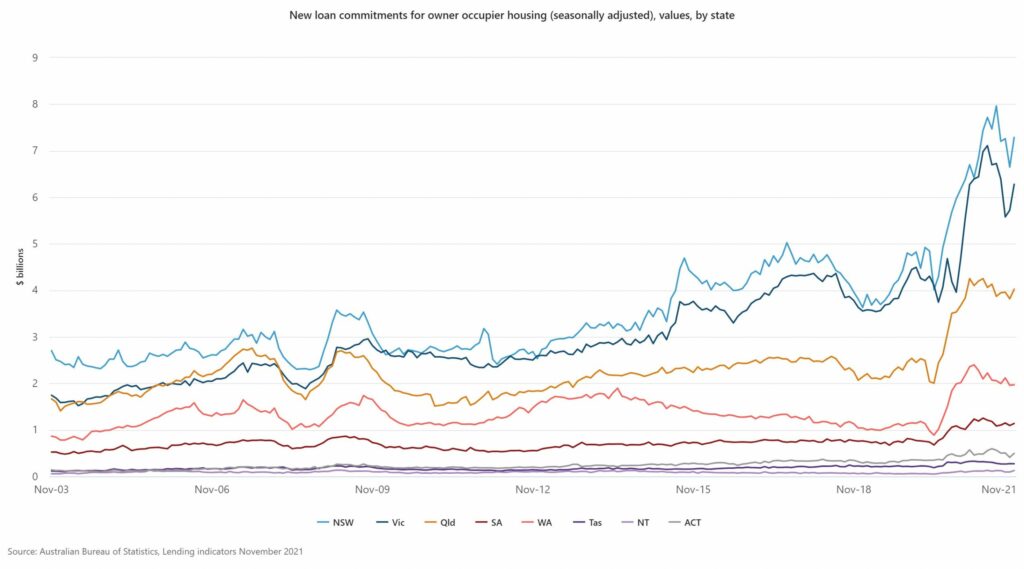

“Owner-occupier loan commitment increases were strongest in New South Wales, rising 9.6 per cent, and Victoria, rising 9.7 per cent, corresponding with restrictions easing in those states in October and November.”

At the national level, the average loan size for owner-occupier dwellings (which includes construction and the purchase of new and existing dwellings) rose to an all-time high of $596,000. Average loan sizes reached new highs in all states and territories except Western Australia.

“Activity in the investor market was also strong. The value of new loan commitments to investors rose 3.8 per cent reaching a new all-time high of $10.1 billion,” Ms Keenan said.

“Investor lending has grown for the past 13 months, and accounted for around one third of the value of new housing loan commitments in November 2021. The previous investor lending peak in April 2015 accounted for 46 per cent of new housing loan commitments.”

Increases in investor loan commitments were strongest in New South Wales (up 7.8 per cent), Queensland (up 5.0 per cent) and Victoria (up 3.6 per cent). All states rose, while both territories fell.

Owner-occupier first home buyer loan commitments

The number of new loan commitments to owner-occupier first home buyers rose 1.9 per cent in November 2021 (seasonally adjusted), breaking the decline since January 2021. The number of these commitments was 17.4 per cent lower compared to a year ago.

Ms Keenan said: “Victoria had the strongest rise of 12.3 per cent in the number of owner-occupier first home buyer loan commitments. The number of these commitments was 6.7 per cent lower than a year ago, after falling from record highs seen earlier in the year.”

Increases were also seen in New South Wales, rising 2.2 per cent, and Western Australia, rising 1.3 per cent. Queensland fell 1.5 per cent and South Australia fell 4.6 per cent.

Personal finance loan commitments

The value of new loan commitments for fixed term personal finance rose 4.5 per cent in November 2021 (seasonally adjusted), driven by a 4.8 per cent rise in lending for the purchase of road vehicles.