Growthpoint reaffirms the previous guidance for FY23 distribution of 21.4 cps, equating to a 6.6% yield at the current price however the group are keeping an eye on interest costs as rates rise.

Timothy Collyer, Managing Director of Growthpoint, said, “Growthpoint has had a strong start to the financial year with continued positive leasing outcomes across our directly owned property portfolio, maintaining our portfolio WALE at 6.3 years and occupancy at 96%.

Growthpoint intend to grow the recently announced funds management business, targeting 10% to 20% of Group EBIT, over the medium term with the aim of delivering incremental growth to earnings and income stream diversification for securityholders.

“The majority of the Group’s office markets saw positive net absorption in the quarter, while occupier activity remained robust across all industrial markets with strong rental growth persisting in the face of low vacancy. Yields softened (to various degrees) over the quarter across most office markets, with yields also softening in most industrial markets, in response to the rapidly changing macroeconomic environment.

During the quarter, the Group successfully settled on the acquisition of a high quality, predominantly government leased office asset in Dandenong, Victoria and entered funds management with the acquisition of Fortius, a key growth opportunity for the business. Growthpoint is committed to operating in a sustainable way and we are pleased that GRESB has recognised the Group as a Sector Leader in the 2022 Sustainability Benchmark with a score of 81 out of 100, our highest achievement to date.

Growthpoint have conditioned the earnings outlook with respect to the risk of rising interest rates, with the Group assuming an average FY23 floating cash rate of 2.8% per annum. With 1 year BBSW swap rates now at 3.97% per annum, the impacts on Growthpoints’ earnings will largely depend on the term of existing debt and the extent of hedging the Group has in place. The Groups’ FY22 Annual Results indicated that 60% of the Group’s debt was fixed for near to 4 years, however as fixed rates roll off, higher costs of debt could eat into future earnings.

At the end of the quarter, Growthpoint says it is well positioned to continue to manage the Group through the current period of higher inflation, central bank rate rises and higher interest costs. Their exposure to favoured industrial and metropolitan office markets and secure income from large corporate and government tenants provides a resilient foundation for the Group. The Group’s gearing of 35.2% is at the bottom of the target range of 35% to 45%, providing flexibility to invest in property or funds where we see value for securityholders.

During 1Q23, Growthpoint entered into nine leases across its office and industrial directly owned portfolio, representing 2.6% of portfolio income. The WALE of the new leases was 4.5 years and the weighted average rent review was 3.5%.

New leases include a seven year lease to 101 Warehousing at 3 Maker Place, Truganina, Victoria (lettable area: 31,092 square metres), a five year lease with Automotive Imports at 6 Kingston Park Court, Knoxfield, Victoria (lettable area: 7,645 square metres) and a two year lease with the Commonwealth Government at 333 Ann Street, Brisbane, Queensland (lettable area: 1,369 square metres).

In the quarter, Growthpoint was pleased to confirm an additional 2.5 year lease extension with Woolworths for their major Queensland distribution centre at Larapinta, the Group’s largest industrial property by value. This followed Woolworths exercising its five year lease option in the latter half of FY22, resulting in a 7.5 year lease term from February 2022.

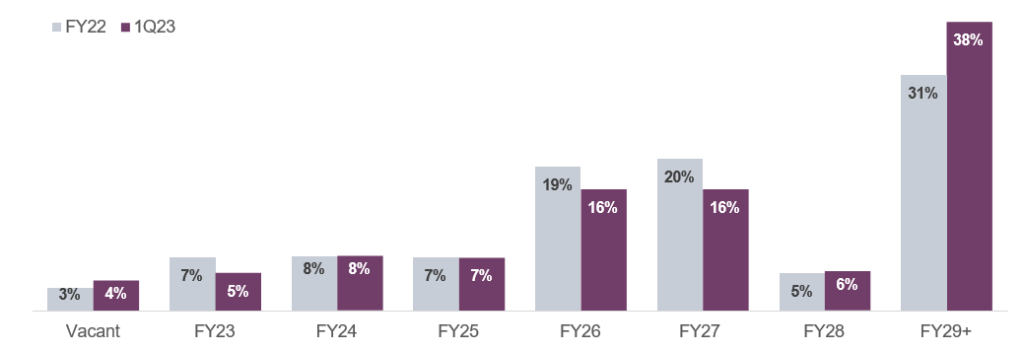

Portfolio lease expiry

per financial year, by income, as at 30 September 2022

At 30 September 2022, the Group’s directly owned portfolio WALE remained 6.3 years (6.3 years at 30 June 2022), and portfolio occupancy saw a slight decline to 96% (97% at 30 June 2022). The Group’s office portfolio WALE saw a moderate decline to 6.6 years (30 June 2022: 6.7 years), and the industrial portfolio WALE increased to 5.7 years (30 June 2022: 5.3 years). Office portfolio occupancy declined slightly to 94% (95% at 30 June 2022) and the industrial portfolio continues to be 100% leased.

In July 2022, the Group successfully settled the acquisition of a high quality modern, A-grade office asset at 165-169 Thomas Street, Dandenong, Victoria. The GSO Dandenong asset, predominantly leased to the Victorian State Government with a long WALE of 9.4 years, was acquired by Growthpoint for $165 million on an initial yield of 5.3%.

Following discussions during the quarter, Growthpoint and Lion, the tenant in our 5 Murray Rose Avenue, Sydney Olympic Park, New South Wales property, have entered an early surrender of lease with effect from 31 October 2022. The lease represents approximately 2% of the Group’s portfolio income and was due to expire in April 2024. The surrender was formally entered into in October 2022 and will enable Growthpoint to obtain the approximate net present value of the remaining Lion lease in FY23, with the aim to release the premises ahead of the FY24 expiry. The property is a modern A-grade office building of 12,386 square metres, with 6-star NABERS Energy rating and a high- quality fit out in-situ, will be presented to the leasing market after minor works. Situated in the Sydney Olympic Park precinct, the location has been supported by the State Government of NSW via office leasing transactions for the emergency services departments of Fire, Ambulance and the Police.

Development update

During the quarter two developments were completed to accommodate the growth of existing portfolio tenants:

- 75 Dorcas Street, South Melbourne, Victoria – the $26.1 million expansion of ASX listed Autosports Group’s state of the art Melbourne BMW dealership headquarters in October 2022, entered into as part of the 15 year and 11 month lease extension in late FY21. The works included ground floor and level one showroom extension and the addition of mezzanine offices, increasing the lettable area by approximately 3,773 square metres.

- 120-132 Atlantic Drive, Keysborough, Victoria – the $3.4 million warehouse expansion, with a seven year lease from completion, for Symbion, a national wholesaler of healthcare products and services, extending the warehouse by 2,910 square metres. Growthpoint have separately agreed with Symbion to add a 330kW solar array on the roof of the property and Symbion have committed to the property until 2032.

Funds management

Growthpoint completed the acquisition of 100% of the shares in Fortius in September 2022. The transaction comprised a $45 million initial purchase price, with a net asset adjustment, paid in cash and was funded from the Group’s existing liquidity and debt facilities. An additional earn out component of up to $10 million is payable based on agreed milestones being met over the period to June 2024.

A key strategic priority and growth opportunity for the business, the Group intends to grow the funds management business, targeting 10% to 20% of Group EBIT, over the medium term with the aim of delivering incremental growth to earnings and income stream diversification for securityholders.

Capital management

Growthpoint’s gearing was 35.2% at 30 September 2022, increasing 360 basis points on 30 June 2022, as the Group used debt to fund the acquisition of GSO Dandenong and Fortius, completion of the developments noted above and its security buy-back. Growthpoint’s gearing is at the lower end of the Group’s target range of 35% to 45%.

Growthpoint’s weighted average cost of debt has increased to 3.85% per annum predominantly as a result of increased floating interest rates (increasing 1.5% over the quarter) as well as management of the Group’s swap book in the period.

In February 2022, the Group announced that it had extended its on market securities buy-back program for up to 2.5% of issued share capital for a further 12 months. In the quarter, the Group purchased 5,976,994 securities (0.8 % of issued capital) for $20.9 million. Growthpoint has purchased 0.9% of issued capital under the program as at 30 September 2022.

Outlook

Growthpoint reaffirms the guidance provided on 16 August 2022 of FY23 FFO of 25.0 to 26.0 cps and FY23 distribution of 21.4 cps. A key assumption to guidance is in respect of rising interest rates, with the Group assuming an average FY23 floating cash rate of 2.8% per annum.

This guidance also anticipates no significant market movements or unforeseen circumstances occurring during the remainder of the financial year.