The global healthcare sector remains buoyant and is expected to grow despite a challenging economic outlook, according to global property advisor Knight Frank.

The firm’s Global Healthcare Report found investors remain confident in the long-term opportunities presented by the sector, with investment in care-related real estate reaching circa $38 billion in the year to June 2023, accounting for 4.3% of total global real estate investments.

This comes as the global population shifts rapidly towards an ageing demographic, which is anticipated to drive demand for elderly care beds, particularly for full-time nursing care delivered in specialised facilities.

An ageing demographic is one of the seven factors found to be driving global investment in healthcare, with the other factors including:

• Secure income – operator revenue is reinforced by a healthy mix of self-funded care and publicly funded care. Income is supported by high occupancy and patient demand across the healthcare arena

• Long-term income – Weighted average unexpired lease terms (WAULT / WALE) average 25-30 years in the residential care and hospital sectors. Leases are commonly indexed-linked to inflation

• Investment performance – Returns are historically stable, offering investors protection and diversification

• Demand for safe havens – Healthcare’s long-term and often government- supported income offers further defence

• Structural change in real estate – Real estate investors already de-risking from traditional sectors into alternatives like healthcare

• Social impact – The influence of impact or ESG investing in real estate is growing at a faster pace than ever. A range of investors are now focusing on social infrastructure investments, and healthcare is part of this

North American capital was the biggest contributor to the global healthcare sector over the year to June 2023, accounting for almost 68% of funds deployed last year, whilst France and Belgium attracted the highest levels of cross-border investments.

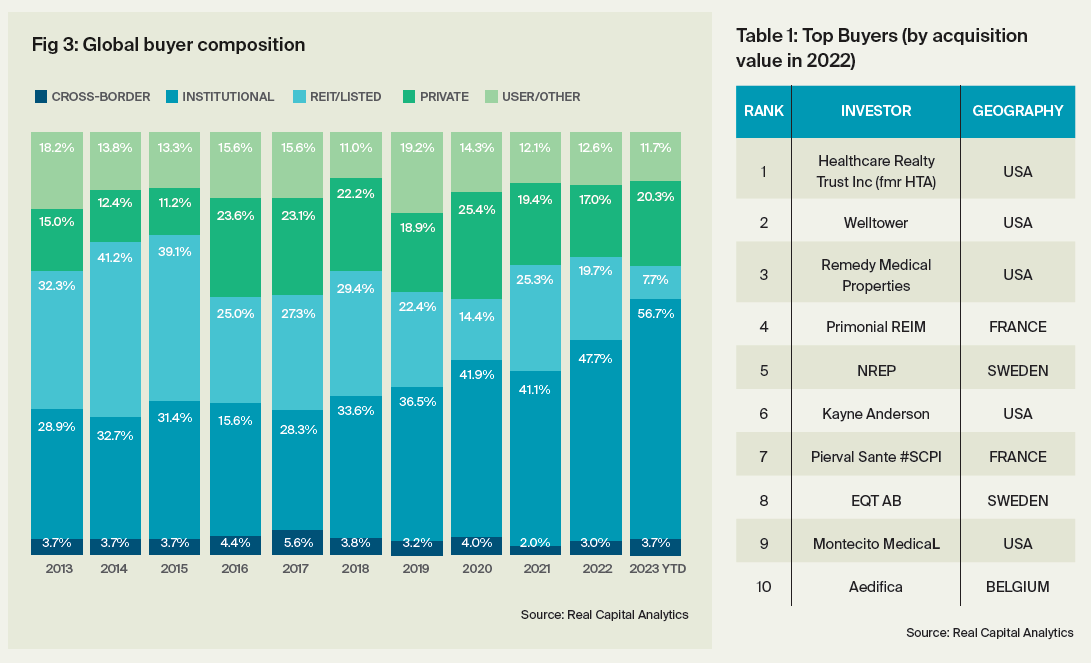

Among different buyer types, private capital emerged as the most active purchaser overall. However, when considering net purchases, cross-border investors, institutions, and REITs were the dominant buyers. Key players in this market include companies such as Healthcare Realty Trust, Welltower, and Aedifica.

In the Australian commercial property market, healthcare assets performance has been second only to industrial, with average capital growth per year between 2017 and 2022 being 6.8%, behind industrial at 10.7%.

Knight Frank National Head of Healthcare and Life Sciences in Australia Sam Biggins said the defensive characteristics of the sector and the demographic tailwind continue to attract new capital.

“Institutional investment in Australia’s healthcare and life sciences sectors has gathered significant momentum in recent years, driven initially by domestic investors seeking defensive assets, and now sees strong market participation by regional and global sector specialists and their capital partners,” he said.

“Healthcare and health-related expenditure account for over $241 billion annually in Australia, which represents approximately 10.5% of the country’s GDP, with an estimated 73% of this provided

by the Commonwealth and State Governments. Of the remaining $65.3 billion, an estimated $17.5 billion is spent by private health insurers.

“The significance of this expenditure to healthcare real estate in Australia cannot be understated, and when considered in tandem with the fact that 23% of the population will be over 65 years old by 2062, provides strong support for investment across all subsets of the sector.”

Australia’s securitized healthcare real estate comprises approximately $22 billion in assets, with dominant players including NorthWest Healthcare REIT, Australian Unity, Dexus and HealthCo.

Additionally, there are a number of specialist asset managers such as Centuria, RAM, Elanor Investors and Barwon Investment Partners who are actively scaling their AUM in the sector.

“A number of these groups have progressed from single asset, syndicate-style vehicles targeted at HNW private investors and are now securing mandates from global institutional and sovereign wealth capital partners including MSREI, PNB and GIC,” said Mr Biggins.

“The portfolio composition of the smaller managers is maturing from smaller primary care and allied health assets to be more reflective of the portfolios of the larger institutional and global investors, with assets such as mental health, day, short-stay and tertiary hospitals.

“In 2023 we have begun to see capital recycling occur with a number of primary care assets being placed on market to fund development of larger precinct-style assets.”

The Knight Frank report found Australia’s senior living sector was experiencing strong demand, with the growth in the over-65 population cohort outpacing the supply of new accommodation across the land lease communities (LLC), retirement village (RV) and aged-care (RAC) sectors.

“Affordability is becoming critical, and as such the market is attempting to respond, with LLCs in particular becoming more popular and significant M&A activity occurring across the sector,” said Mr Biggins.

“Notable recent transactions include Swedish-based EQT Partners acquiring Stockland’s retirement portfolio for $987m in 2022. Prior to this divestment, Stockland changed its senior living focus from RVs to LLCs, having acquired 3,800 sites from Halcyon in July 2021 for $620m.

“The aged care sector continues to face headwinds, particularly due to staffing availability and operating costs.

“Notable recent M&A activity includes Bain Capital’s acquisition of the listed 6,500-bed Estia Health platform for $838 million in August 2023.”