Flight to quality most pronounced in Melbourne’s CBD office market, according to Knight Frank research

29 March 2023

The flight to quality is becoming increasingly evident in the CBD office markets of Australia’s two major cities of Sydney and Melbourne, but is more pronounced in Melbourne as employers try to entice workers back into the physical office, according to the latest research from Knight Frank.

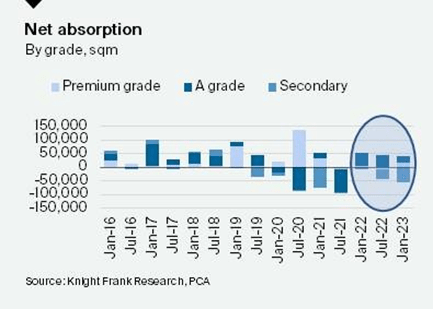

The latest Melbourne CBD Office Market Report found a clear bifurcation in Melbourne’s market, with net absorption noticeably split between premium and A-grade and B, C and D-grade space.

The research found that overall demand for office space turned negative in the Melbourne CBD in H2 2022, with total net absorption of -15,654sq m after two continued periods of positive demand, and this fell to -55,708 for B, C and D-grade stock.

However, demand for Premium and A-Grade space rose in contrast, with Premium Grade buildings having a net absorption of 15,243sq and A-Grade even stronger at 24,811sq m as flight to quality continues.

Knight Frank Head of Research and Consulting Victoria Tony McGough said the Melbourne Premium and A-Grade markets remained resilient as the overall leasing market weakened with the uncertainty in global markets and the slowing economy.

“Demand for A-Grade stock has been positive since COVID lockdowns finished in clear evidence of tenants trading up,” he said.

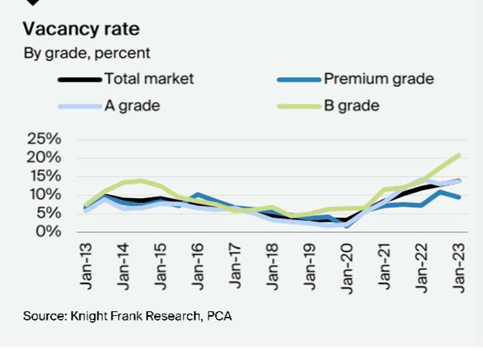

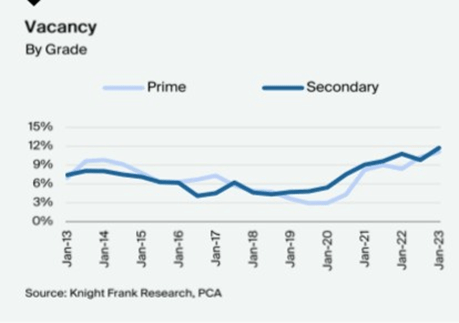

“The bifurcation of the market between Premium and A-Grade and B, C and D-grade is also clearly illustrated in the vacancy rate, which rose overall to 13.8 per cent in the second half of 2022, but this was concentrated in the secondary market.

“A final addition of new Grade A supply combined with negative net absorption pushed vacant space 51,829sq m higher to a rate last seen in 1999.

“However, it was driven by a jump in B-Grade vacancy of 3.4 per cent to 20.8 per cent.

“A Grade rates edged up to 13.7 per cent while Premium Grade fell from 10.9 per cent to 9.5 per cent.”

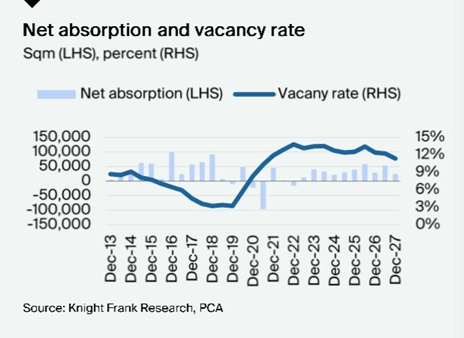

Knight Frank Head of Leasing Victoria Hamish Sutherland said it was expected demand would remain positive, if moderate, in the next five years as the economy initially slows before returning to average growth.

“The vacancy rate is expected to peak in 2023 and with limited supply moving forward we expect to see consistent downward pressure on the vacancy rate,” he said.

“It is likely to expect vacancy rates in secondary buildings will remain high, while prime rates will fall more quickly.”

“Owners of lower-grade buildings will have to increasingly look at refurbishing their buildings, or alternatively repurposing the buildings into hotels for example, with brands like Marriott announcing they would like to open more hotels in the city, or as a last resort, redeveloping, to attract tenants.”

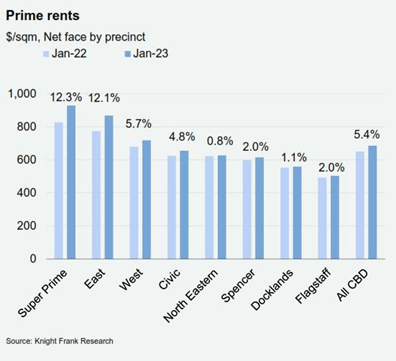

The Knight Frank research found that in line with the bifurcation of markets in Melbourne’s CBD office market, prime net face rents rose 0.7 in Q4 2022 and 5.4 per cent year on year to hold onto the gains made in H1 even as the market calmed.

Rents edged up in most precincts over the fourth quarter of 2022, but again the East outperformed with 1.9 per cent growth,” said Dr McGough.

“The year has seen rental growth concentrated around the best precincts with the Paris quarter seeing growth of 12.1 per cent over 2022, whilst Flagstaff saw two per cent.

“Not only are tenants preferring prime over secondary, but there is a clear preference for the better locations and better buildings within that category.

“Going forward we expect to see very modest growth in 2023 for face rents with effective rents virtually flat as incentives remain high on the back of high vacancy rates.”

Sydney CBD office market

Knight Frank’s recently-released Sydney CBD Office Market Report found that In the Sydney CBD office leasing market vacancy edged slightly higher to 11.3 per cent over 2022, largely due to the large influx of new supply, but again the bifurcation in the market due to the flight to quality was evident.

By grade, prime vacancy increased slightly to 11.1 per cent despite recording positive absorption of 25,476 over the period, with the increase driven by supply rather than a lack of demand.

In the secondary market, vacancy increased from 9.8 per cent to 11.7 per cent, which was the result of 45,214sq m of negative net absorption, stemming from the flight to quality trend in the market.

Knight Frank’s research found that In the Sydney CBD office market vacancy has likely peaked for the next 12 months and will hold at current levels with optimism and active tenant enquiry to boost the market in the long term, despite some challenges in the near term.

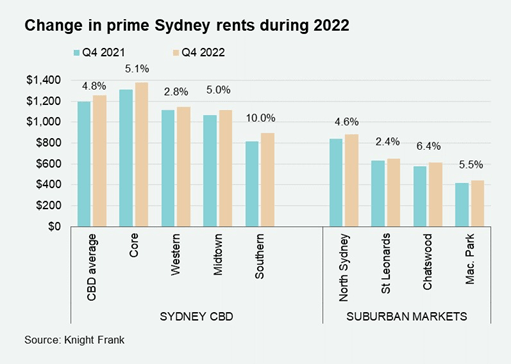

It found solid demand for best-in-class stock had underpinned a return to rental growth, with the average net face rent rising by 4.9 per cent for the prime market and 3.2 per cent for the secondary market.

Amid the inflationary pressure and premium buildings delivered on the market, the Sydney CBD office prime face rents growth rate bounced back for the first time since 2020.

Again highlighting the preference for the better locales, rental growth in the Core precinct was strong, while the Southern precinct has continued to catch up owing to the prospect of connectivity improvement in 2024 and ongoing urban regeneration.

The current rental discount between prime and secondary rent is 28 per cent, which is the widest gap in over five years, again driven by the flight to quality trend.