ESR Australia Closes Out EALP II with an additional $158.6million of national acquisitions

8 September 2022

ESR Australia is maintaining the momentum of its acquisitions for its core plus logistics investment programme EALP II, deploying A$158.6million to acquire two well-located income-producing portfolios comprising eight assets spanning Brisbane, Melbourne, and Perth.

These most recent acquisitions expand the Fund’s core plus strategy and sees the A$600 million of equity

committed to EALP II fully allocated, with the holdings forecast to have a gross built-out value of over A$1.3 billion.

The portfolios were acquired in quick succession at an attractive blended cap rate of 5.27%. The Portfolio

benefits from a weighted average lease expiry (WALE) of approximately 3.4 years, providing the ability to

capture rental reversion during the initial hold period.

ESR Australia CEO, Phil Pearce, said: “ESR Australia will continue to scale up our national presence in premium industrial locations. Our acquisition strategy continues to focus on identifying quality, well-connected areas with low supply, where there is a demand for world-class industrial space for customers prioritising amenities and location.

The supply shortage and increasing demand in the industrial markets along the Eastern seaboard are resulting in high expected growth in the Queensland region, and we’re delighted to expand our footprint to capitalise on the broad opportunities up north.

With site coverage of only 33.8% across the Portfolio, ample opportunity exists to extract further value through the development of key sites.”

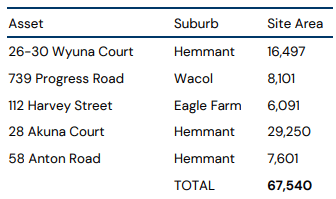

The Brisbane portfolio containing five assets was acquired for A$61.6 million with an equivalent yield of 5.85%

and an average WALE of 2.7yrs. ESR Australia estimates the Portfolio is approximately 5% underlet, providing

scope to actively work with tenants to manage lease expiries effectively and backfill vacancies as and when

they arise. Three of the acquired assets are in the well-positioned Brisbane suburb of Hemmant, adjoining one

another and providing a combined site of 4.5ha, which, over time, will provide redevelopment opportunity.

Approximately 90% of the assets within the Portfolio are located on the Trade Coast, providing ESR Australia

with exposure to Brisbane’s premier industrial and logistics precinct. Proximity of the assets to the port, airport

and motorways, paired with current supply shortage, will enable ESR Australia to capitalise on positive rental

growth as they backfill vacancies and welcome new customers.

The assets of the Brisbane portfolio include the following;

Pent-up demand in Queensland is expected to continue stimulating further growth. Total take-up in Q4 2021

across Brisbane was 140,665sqm, above the 10-year average of 120,000sqm. The wider Brisbane market

currently has a record low vacancy rate of 2%, with buildings above 3,000sqm recording an even lower rate of

1.4%.

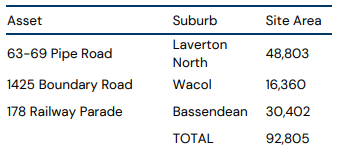

The supplementary acquisition, acquired from Harmony Investments, was acquired for A$97million and

comprises a further 92,805 sqm across three sites in Melbourne, Brisbane and Perth. This Portfolio has strong

rental reversion potential estimated at 29% across all three assets, equating to a blended 4.9% cap rate.

The assets of the Harmony portfolio include;

With a scarcity of industrial accommodation, the assets in Brisbane and Melbourne provide ESR Australia with

an opportunity to capture upside from active asset management, driving value predominantly through

capitalising on market rental reversion. The asset in Perth provides ESR with an income-producing land bank

that will provide optionality in the future as Perth’s industrial vacancy continues to tighten.

Mr Pearce concluded, “Whilst we expect these growth rates to moderate somewhat as the supply pipeline

increases, the pent-up demand is expected to continue, which will provide a stimulus to sustained future

growth.”