EG’s Australian Core Enhanced acquires 50% Grand Plaza Shopping Centre, QLD

23 March 2022

In a deal reported to be worth $220m, EG’s Enhanced Core Fund has finalised its acquisition of a 50% stake in the sub-regional shopping centre in the Brisbane – Gold Coast Corridor.

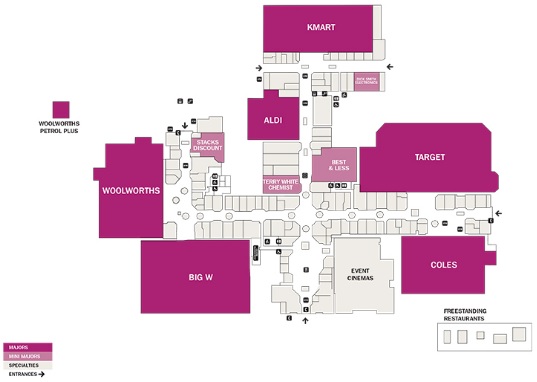

Located at 27-49 Browns Plains Road, 22km south of the Brisbane CBD, the centre is 97% occupied, anchored by seven major tenants, including Woolworths, Coles, and Aldi, and 105 specialty stores across 53,363sqm of NLA. The Centre includes a recently refurbished food court supporting an Events Cinema complex and attracts over 7m visitors per year.

The 50% stake was sold off-market by US investment manager Invesco, with another 50% stake held by Vicinity Centres who currently manage the Centre. Invesco acquired that interest four years ago from a Vicinity-run wholesale fund invested by the Future Fund & CPBIB for $215 million.

“EG’s Australian Core Enhanced Fund now owns 14 core-plus assets across Australia in Sydney, Brisbane, Melbourne and Perth, eight of which were purchased in the last 12 months. It was a case of acting quickly and intelligently when the pandemic triggered an abrupt reset of values and we identified the opportunity to grow a diversified portfolio of office, retail and industrial assets worth over $1 billion for our investors,” said ACE Fund Manager and Executive Director, Chris Pak.

“Value can be extracted from this asset with an active asset management strategy to enhance the retail offering and tenant mix,” said EG’s Head of Capital Transactions, Sean Fleming.

“Based on the data EG has interrogated, Grand Plaza mall is expected to benefit from the anticipated capital growth and cap rate compression across Australian retail markets in 2022.”

Vicinity hold their stake in the Centre based on a value of just $375m and a cap rate of 5.75%, though sources say the Browns Plains transaction was struck at an acquisition core capitalisation rate of close to 5.25%.

The transaction was brokered by CBRE’s Head of Retail Capital Markets, Simon Rooney.

Mr Rooney said the sale highlighted rising demand for sub-regional shopping centre investment opportunities and continued a run of retail investment activity in Queensland.

“There has been a surge in capital flows into the sub-regional sector, fueled by a rebasing in values and rents and the attractive yields on offer compared to other asset classes,” Mr Rooney said.

“The Grand Plaza transaction also highlights continued strong demand for Queensland retail investments, with over $4.5 billion in sales occurring since the beginning of 2021.”