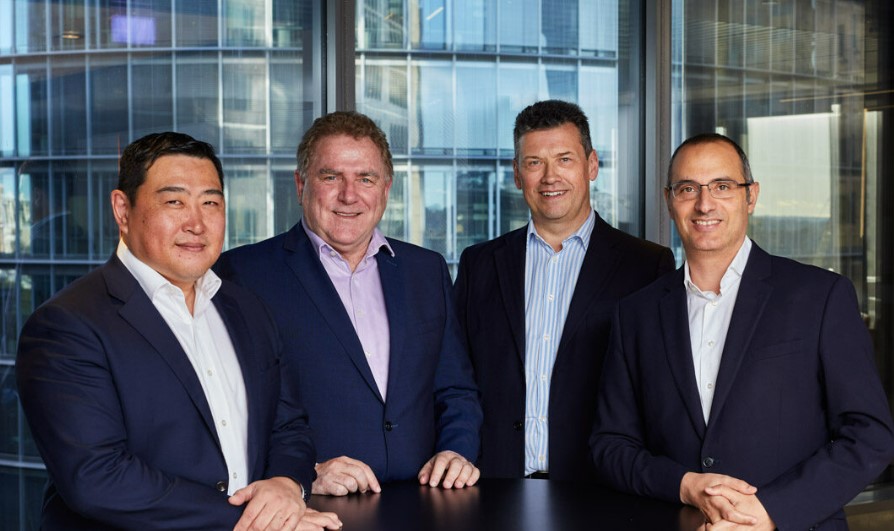

EG has reacted to 18 months of rapid organisational growth by appointing joint Managing Directors, Roger Parker and Chris Pak, alongside existing leadership, CEO, Adam Geha and Chairman, Michael Easson.

The move has been orchestrated to ensure the continued delivery of outstanding returns and lasting positive social impact for EG after we recently doubled our size of assets under management, now $5.1 billion, and almost doubled our team size since January 2020.

CEO Adam Geha will now be liberated from the operational aspects on the business while still maintaining his oversight as Chair of both the Executive and Investment Committee. Geha will now focus on advancing the strategic direction of the group by doubling down on EG’s long-term investment in property technology.

“EG has always been a data-driven investment manager. Now that investors are looking for greater capital returns post-pandemic, the appetite for major investments in prop-tech such as data engines and visualization, digital twins and ESG platforms has never been greater. EG is already incubating the next “tiny-giant” start-ups that will shake up the industry,” said Geha.

Roger Parker, EG’s Executive Director of nine years, will assume the title of Head of Distribution leading all capital raising, business development and marketing endeavours across the business. Over the course of his career, Roger has been directly responsible for equity capital raisings across Australia and the UK exceeding AU$4 billion and capital transactions of assets across domestic and offshore investment sectors totaling over AU$3.5 billion. Roger has previously held senior positions at Lend Lease, Colonial First State and Investa Property Group.

Chris Pak will step into the role of EG’s Chief Investment Officer working closely alongside Head of Capital Transactions, Sean Fleming and Divisional Director of Asset Management, Gemma Moulang. With over 25 years’ experience in the real estate investment industry, Chris has worked on creating over $10bn of listed and unlisted fund products across both real estate equity and debt investments in companies such as Westfield, Colonial First State and Challenger.

Founded in 2000, EG has $5.1 billion under management on behalf of super funds and private wealth clients to generate outstanding returns with lasting social impact. With $3.9 billion in development pipeline, and 16.7% per annum in realised IRR for institutional funds, EG is committed to finding a better path to better returns.