Co-living has emerged as one of the hottest sectors in the commercial property market’s Living Sectors in 2025, with 2026 set to see strong growth, according to the latest research from Knight Frank.

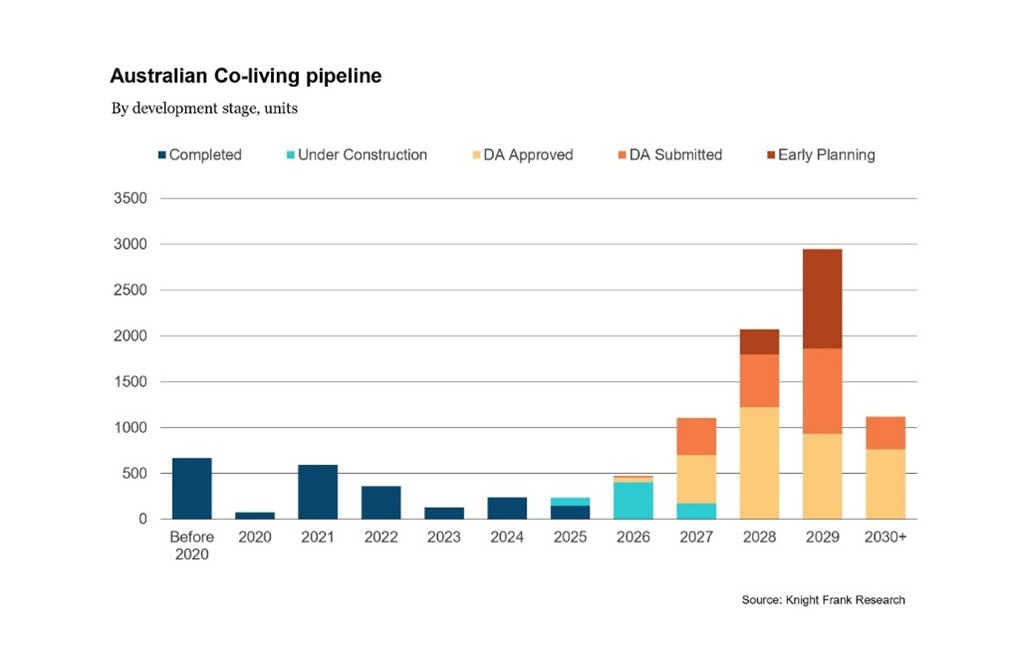

The firm’s The Co-Living Report, which includes insights from UKO tenancy data, found the total national supply has surpassed the 10,000 unit mark, taking into account units under construction and planned.

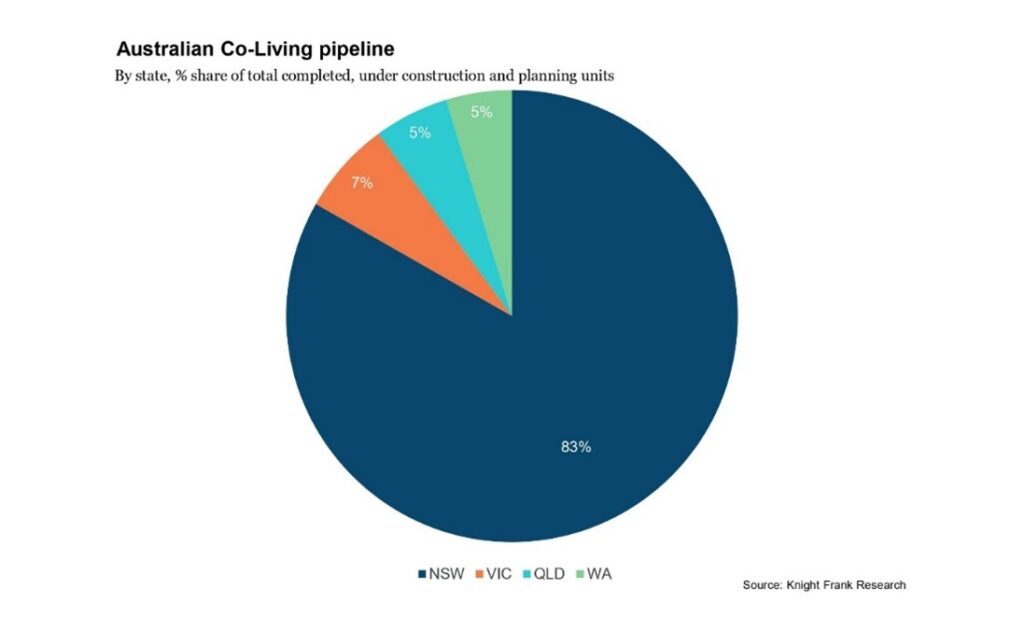

Sydney is the bellwether for the asset class in Australia, accounting for more than 90% of completed schemes nationally, with 1,639 units in the market.

Knight Frank Partner, Living Sectors, Valuation & Advisory John-Paul Stichbury said 2025 had been a landmark year for the co-living sector, with strong interest from developers and investors leading to significant growth in the sector.

“Co-living has established itself in Australia as a genuine alternative to traditional housing types, and its momentum is expected to continue next year with development spreading across the nation.

“For now, New South Wales has dominated co-living development with a clear and supportive planning pathway, which the other states don’t currently have.

“The model has also been demonstrated to work in the land-constrained Sydney market, but co-living is beginning to gain traction in other states as first movers enter the sector.

“We anticipate a further acceleration in the overall pipeline in 2026 as developers respond to growing demand for this product type.”

The Knight Frank report found that there are around 1,110 units in the pipeline across Victoria, Western Australia and Queensland, which is a relatively small figure that highlights both the nascent stage of the market and the opportunity for growth.

The analysis also found that co-living schemes are getting larger, with the pipeline data showing the average number of units for a co-living development is 37, rising to 60 for schemes under construction, 78 for those with development approval and 130 for projects that are proposed.

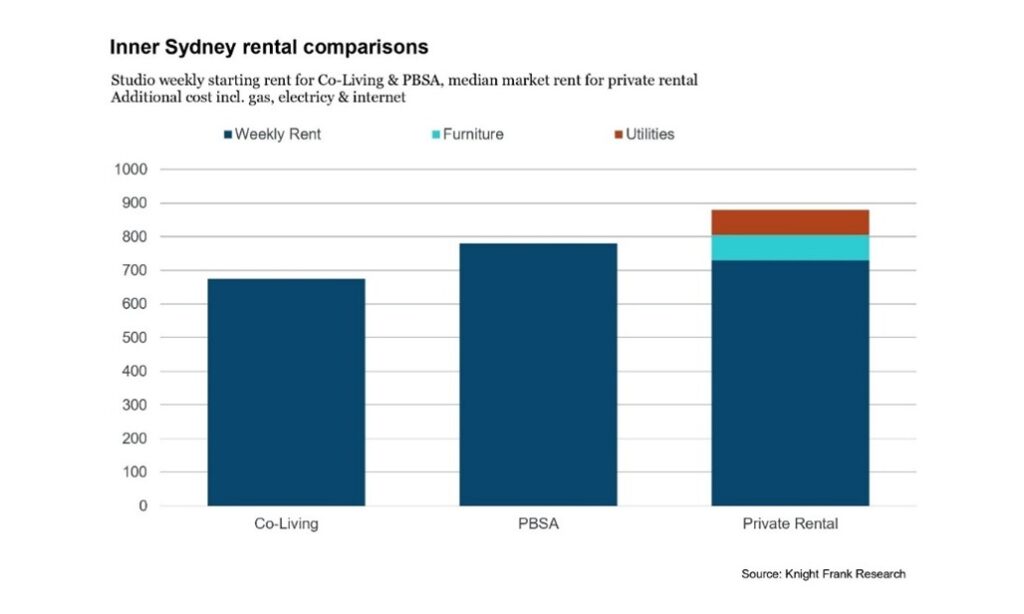

According to The Co-Living Report, there is strong tenant demand for co-living units, with affordability being a key driver, along with location and lifestyle, with developments typically in densely populated urban areas with good access to existing amenity, transport links and employment.

The research found average rents for completed co-living developments in Inner Sydney started at $675 per week, which is all inclusive, compared to $730 for privately-leased apartments, rising to $880 when costs are included.

The units appeal to a broad demographic – they’re popular amongst younger age groups, with almost 90% of tenants aged between 20 and 40, most of whom are working professionals, but also around 1 in 10 tenants are aged over 40.

Knight Frank Partner, Head of Alternatives, Australia Tim Holtsbaum said co-living was attracting increasing interest from investors.

“Over the past two years, meeting feasibility thresholds has been challenging across the living sectors, but co-living has weathered the storm and in many cases developers have found it easier to proceed with co-living schemes rather than larger format and larger scale build-to-rent (BTR) or build-to-sell (BTS) developments.

“This is due to a combination of several factors, including smaller scheme sizes, less land required and higher rental rates per square metre.

“With bond yields settling above 4%, the bar that real estate is assessed against is higher than it was previously, and a product that is highly efficient and derives a relatively higher cashflow on a per square metre basis compared to its peers has enabled co-living to buck the trend.”

Mr Holtsbaum said while co-living had gained a foothold in Australia and proven its worth, it was still very much in its infancy.

“The next five years will see the first wave of large scale co-living assets come online, increasing participation from institutional investors and wider acceptance of co-living as an effective tool to both improve housing diversity and accelerate housing delivery.

“In many ways co-living is following in the footsteps of the Build to Rent sector, which has passed through its early growth phase and is now gearing up for a second stage of expansion.”

Rhys Williams of UKO, which has more than 30 co-living assets under operation or construction, said all major capitals of Australia had significant demand for co-living with very low residential vacancy rates and transient professionals being attracted to city life.

“The bottom line is that co-living is a great way to live and rent, it solves housing for singles and provides flexibility and community, which is very valuable to a significant portion of the rental market,” he said.

“Co-living is an absolute winner for consumers, developers and investors, so it is here to stay.

“I see co-living transitioning out of a misunderstood ‘nascent’ asset class to be understood better for exactly what it is – a highly desirable, very defensive living sector product which solves housing for singles and young couples.

“It will be integrated into more BTR designs and will become part of mixed-use developments with hotels and serviced apartments.”