Businesses continue to show a desire to be in our cities, with demand for CBD office space remaining positive, according to fresh data from the Property Council of Australia.

The Property Council’s latest Office Market Report released today has revealed demand for office space increased by an average 0.1 per cent across the country’s CBDs over the last six months.

The report shows vacancy rates declined in half of Australia’s CBDs, and revealed a reduction in national sublease vacancy, which is a healthy sign, as more companies are fully utilising their existing space.

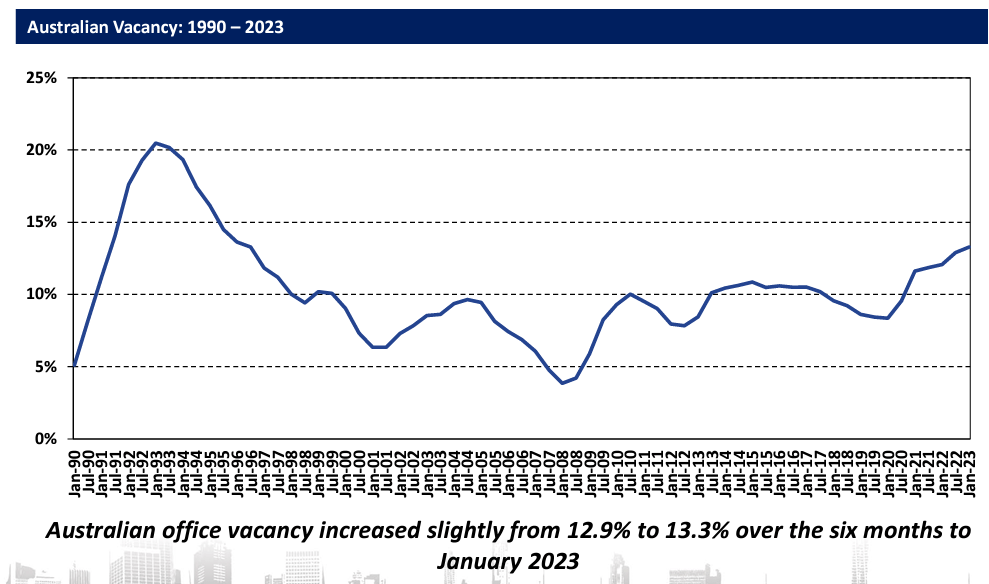

While the overall Australia-wide vacancy rate increased, it comes on the back of solid office construction activity, with the supply of office space exceeding the historical average in five of the last six half-yearly reports.

Property Council of Australia Chief Executive Mike Zorbas said the latest Office Market Report figures were encouraging, and demonstrate that large levels of supply, rather than demand, are influencing vacancy results.

“This is the third six-month period of positive demand nationally for office space in our CBDs,” Mr Zorbas said.

“Organisations see that an office presence in our cities is an essential part of doing business.

“While new supply has increased total vacant space in some areas, these latest numbers are a vote of confidence in our CBDs,” he said.

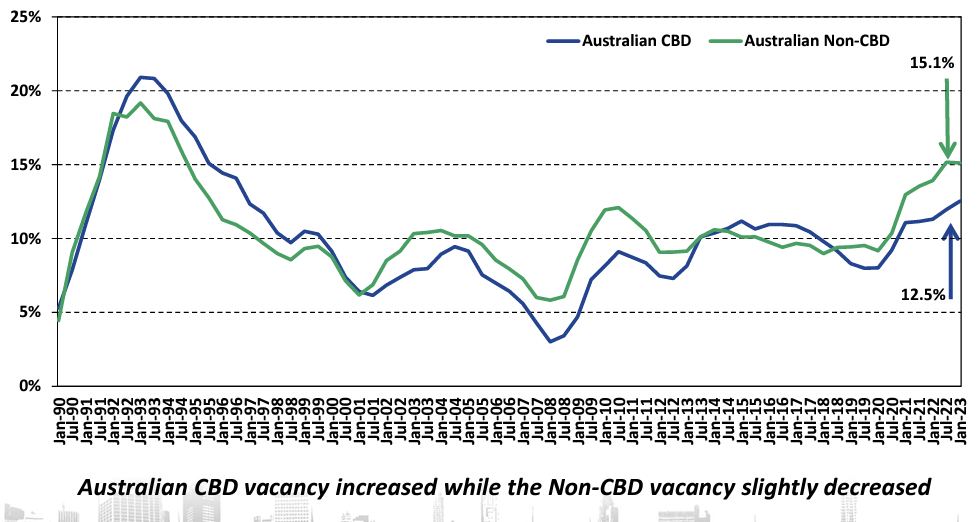

The January 2023 edition of the Office Market Report, which is released twice a year, showed overall CBD vacancy increased from 12 to 12.5 per cent nationally. Non-CBD areas saw a decline from 15.2 to 15.1 per cent, with tenant demand lifting 0.3 per cent.

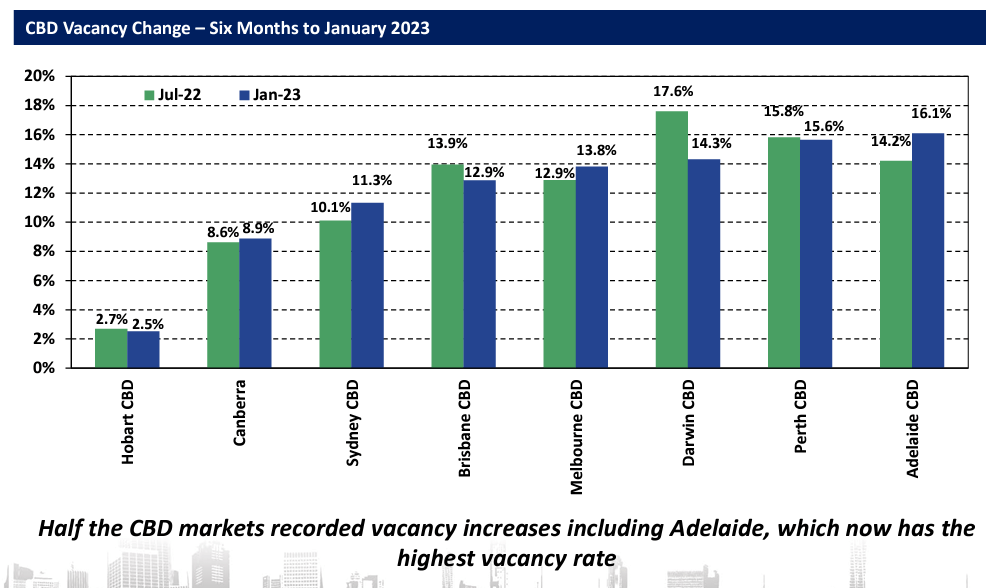

Vacancy rates in Brisbane fell from 13.9 to 12.9 per cent, Perth dropped from 15.8 to 15.6 per cent, and Hobart recorded a drop from 2.7 to 2.5 per cent.

In other capitals, vacancy rates rose from 8.6 to 8.9 per cent in Canberra, 10.1 to 11.3 per cent in Sydney and 12.9 to 13.8 per cent in Melbourne. Adelaide’s vacancy lifted from 14.2 to 16.1 per cent driven by above average supply additions. In those markets where vacancy increased, there were moves toward prime stock over secondary stock.

The future supply of office space in CBD markets is forecast to be higher than the historical average through 2023 before retreating under the average for the next two years. Supply in non-CBD markets is set to be higher than the historical average in the first half of this year before declining in the following years.

Sublease vacancy declined in both the CBD and non-CBD markets, with all CBD markets below the historical average, except Sydney and Melbourne.

Despite this, Melbourne witnessed a 0.7 per cent decrease in sublease space. Darwin and Hobart both have no sublease space available.

Mr Zorbas said Brisbane’s office market has proven to be a strong performer over the last six months.

“Tenant demand outstripped supply in Brisbane, pushing the vacancy rate down from 13.9 to 12.9 per cent,” Mr Zorbas said.

“Looking forward, there is less than 100,000sqm of office space coming online in Brisbane over the next three years, of which 72 per cent has already been pre-committed,” he said.

According to the latest Property Council Office Occupancy survey, occupancy has continued to rise across Australia as people return to the workplace.

The November survey recorded Perth offices at 80 per cent occupancy compared to pre-pandemic levels, Adelaide at 74 per cent, Brisbane at 67 per cent, Sydney at 59 per cent, Melbourne at 57 per cent and Canberra at 52 per cent.

Mr Zorbas said that while the office market had a modest increase in the level of demand, more attention on our CBDs is required.

“Growing skilled migration and the return of overseas students is most welcome. The leadership role of governments and the active engagement of their teams in CBD life should remain front of mind for decision-makers in 2023,” Mr Zorbas said.

“The Property Council will continue to work with governments to unlock the full potential of our capital cities,” he said.

Andrea Roberts, Knight Frank National Head of Leasing said “Pleasingly 2022 saw rental growth return, albeit subdued, in most major capital cities. The bifurcation of markets continues to cause some misrepresentation where average market-based deals are reported. For example, there are many core buildings and developments with low vacancy pressure or new developments in core locations in high demand achieving solid rental rates and respectable incentives whilst buildings off core, with high vacancy and lacking amenity need to provide over and above market incentives to secure tenants. Put simply if your asset has the amenity that the market is demanding in this generation’s “Flight to Quality”, the better it will perform.

“Activity wise, 2022 was up and down based on time of year. My observation is after two years of lockdown, Australia really went hard on school holiday breaks with a noticeable pause on activity in Easter and September school holidays. Pleasingly mid-year months of May and June were the busiest in terms of tenant briefs as well as November.

“Despite the negative economic headwinds we are hearing from the Northern Hemisphere, financial markets and capital markets, tenants are continuing to make lease commitments to remain competitive in the war for talent in this low unemployment market. Occupancy levels are finally rising in Melbourne and Sydney and we expect these to continue to improve. Tuesday, Wednesday and Thursday worker profiles demonstrating the impact of hybrid working are expected to stick. Where large tenants intend to dispose of a major oversupply of space due to change in working policies, any major well located sublease also attracts interest and readily trades.

“In spite of tenants prudently looking at cost management as we face economic uncertainty in 2023, we forecast that the 12-month rental outlook for Australia will continue to increase, due to the desire for new or improved office amenities, and a lack of significant stock supply in Sydney and Melbourne to derail this.”