Commercial Property Recovery to Strengthen Into 2026, According to Knight Frank Research

22 May 2025

The recovery in the commercial property market is expected to gradually strengthen and broaden to encompass all cities over the remainder of 2025 and 2026, according to the latest research from Knight Frank.

The firm’s update to its Australian Horizon 2025 outlook report found that nearly halfway through 2025, it was clear that commercial property markets are sequentially turning the corner back to growth, in line predictions at the end of last year.

While risks remain, including the potential for slowing economic growth due to tariffs imposed by the US, the fundamentals for long-term growth are firmly in place, with the only question marks being on the timing and speed of the recovery.

Knight Frank Chief Economist and report author Ben Burston noted that the good news for the commercial property market was that it was in a post devaluation cycle, with the bad news largely having already been priced in and markets insulated from further downside risk.

“In this respect property is better placed than other asset classes to withstand the trade war,” he said.

“Volatility in equity and fixed income markets highlights that they are subject to more immediate risks, so there is a strong case to raise allocations to property, reversing the 2022 to 2023 trend when many investors stepped back from the market.”

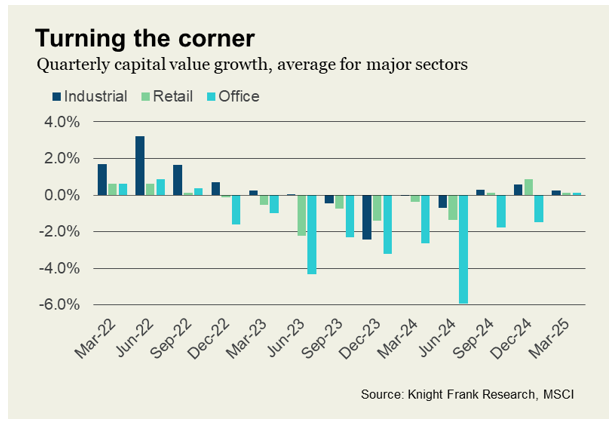

Mr Burston said after a divergent and disruptive downturn in the commercial property market, retail and industrial asset values were first to start the recovery, with all segments and cities returning to growth in late 2024.

“Office values have also now turned positive in Q1, off the back of improving prospects for core CBD assets despite pockets of over-supply elsewhere,” he said.

“Linked to a much-improved outlook for asset values, liquidity is also returning.

“Large single asset and platform acquisitions are now more frequent across all sectors, while capital raising is becoming easier as investors eye the opportunity for cyclical recovery from a more attractive entry point, with downside risks now much reduced.”

Mr Burston said the nascent recovery in the commercial property market had been due in large part to the gradual improvement in the macroeconomic outlook since the middle of 2024, despite some ongoing risks impacting sentiment.

“It started with the commencement of the rate cutting cycle overseas, which buoyed sentiment,” he said.

“Australia has been late to the party, with inflationary pressure more persistent than in other major economies during 2024, but sequential quarterly data releases in January and April have been reassuring and the RBA has now cut rates twice.

“Tariffs imposed by the US earlier this year came as a shock and have led to volatility in equity markets and uncertainty for property investors, and will likely impact economic growth.

“However, the heightened risk of a slowdown has now led to the expectation that three will be two or three more rate cuts by the end of the year, which will take the cash rate close to 3%.

“Property markets will respond to the rate cutting cycle, and the shift in the outlook raises the prospect of yield compression in the second half of the year, starting in the most favoured core markets.”

The report found demand for prime industrial and logistics property is resurgent, with competition ramping up for high quality assets in Sydney and Brisbane. Yields are already starting to edge down in Brisbane, and it is expected yields will sharpen in Sydney in coming months.

Office markets will be slower to pick up and performance will continue to vary by asset, location and grade. However, the development pipeline is quickly thinning out, with asset values well below replacement cost and current market rents well below the level required to trigger new development. Consequently, a growing pool of investors are seeking to deploy capital in core markets to position themselves for cyclical recovery and growing rents over the medium term.

Living sectors are also in the frame, with around 6,900 student beds and an estimated 8,900 build-to- rent (BTR) apartments under construction nationally under construction and a further 20,000 approved for development over the next five years. The recent election result will reinforce this momentum and means recent policy measures to support development will remain in place most notably the reform of the managed investment trust framework to reduce the withholding tax rate for BTR investment to 15% in line with other sectors.