Queensland is emerging as a standout economic performer, underpinned by strong population growth, surging infrastructure investment and resilient real estate markets, according to new research from JLL.

The report, ‘Unlocking Queensland’s Potential’, reveals the state is attracting growing capital interest ahead of the Brisbane 2032 Olympic and Paralympic Games, with Brisbane’s commercial property sector offering a rare combination of stability, scale and growth.

Paul Noonan, JLL Managing Director – Queensland, said the state’s economic fundamentals are aligning to place Brisbane firmly in the spotlight.

“Queensland’s economy is firing on all cylinders, propelled by diverse industries and record infrastructure investment,” he said.

“We’re seeing strong momentum across all sectors, with strengthening demand and constrained supply being a key similarity of the office, industrial and retail sectors.”

He said a disciplined approach to state finances had also enabled Queensland to lead the nation in infrastructure investment.

“Public infrastructure investment is forecast to total 5.7 per cent of economic output annually over the next four years, leading all major Australian states,” Mr Noonan said.

“This has been enabled by strong state government fiscal management, which has delivered consistent surpluses over the past decade, with the only exception during the COVID-19 pandemic. A responsible approach has enabled strategic infrastructure investments that will underpin growth across property sectors.”

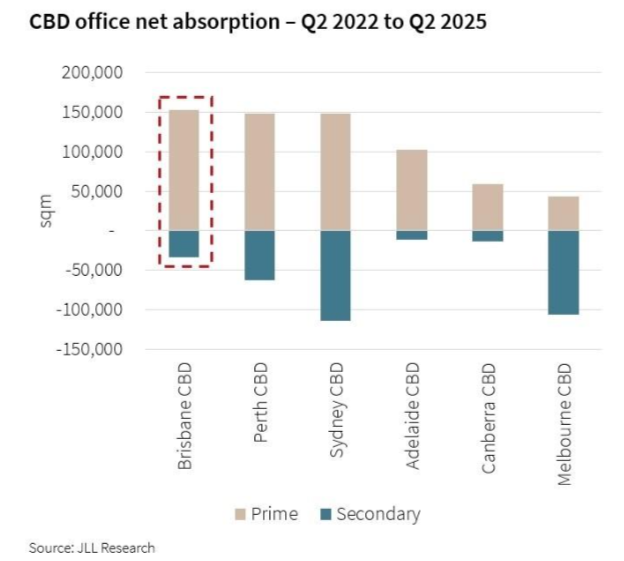

Brisbane’s CBD office market has recorded the lowest volatility in vacancy rates nationally over the past decade, supported by steady growth in white-collar employment – up 12 per cent, led by healthcare, education and finance.

Industrial and logistics are also gaining ground, with Queensland’s $29.2 billion per annual infrastructure pipeline over the next four years representing 5.7 per cent of the state’s GSP – well ahead of NSW (3.8 per cent) and Victoria (3.1 per cent).

Retail is currently the tightest market in the country. Queensland has recorded the strongest shopping centre turnover growth since 2019, up 22.9 per cent – yet new retail space is falling short. Current pipelines are meeting less than half the projected demand.

The report also found Brisbane recorded the least pronounced correction in commercial property values between 2022 and 2024 of any major city, reinforcing its appeal as a low-volatility, long-term investment market.

JLL real estate economist Ronak Bhimjiani, said the state’s performance across multiple sectors is building long-term confidence.

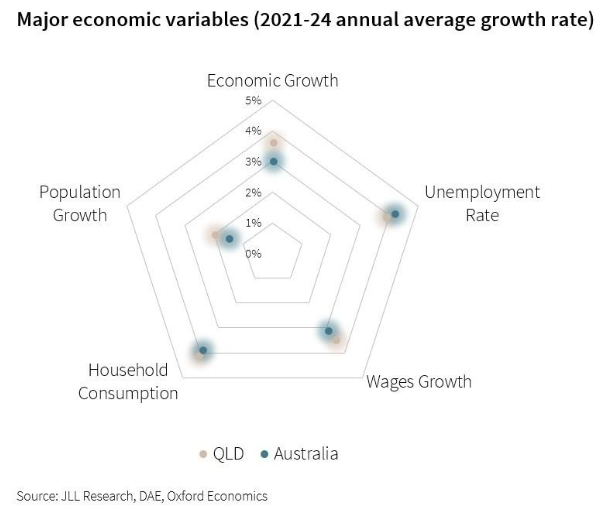

“Queensland’s economy has demonstrated remarkable resilience since 2021, with a range of economic variables positioning the state among the strongest nationally,” he said.

“The state’s strategic diversification across sustainability, technology, advanced manufacturing and healthcare is expected to sustain growth over the medium to long term, thereby creating opportunities for the real estate sector.

“Queensland has also recorded strong growth in Gross State Product and employment over the past three years, and our analysis suggests the outlook remains positive.”