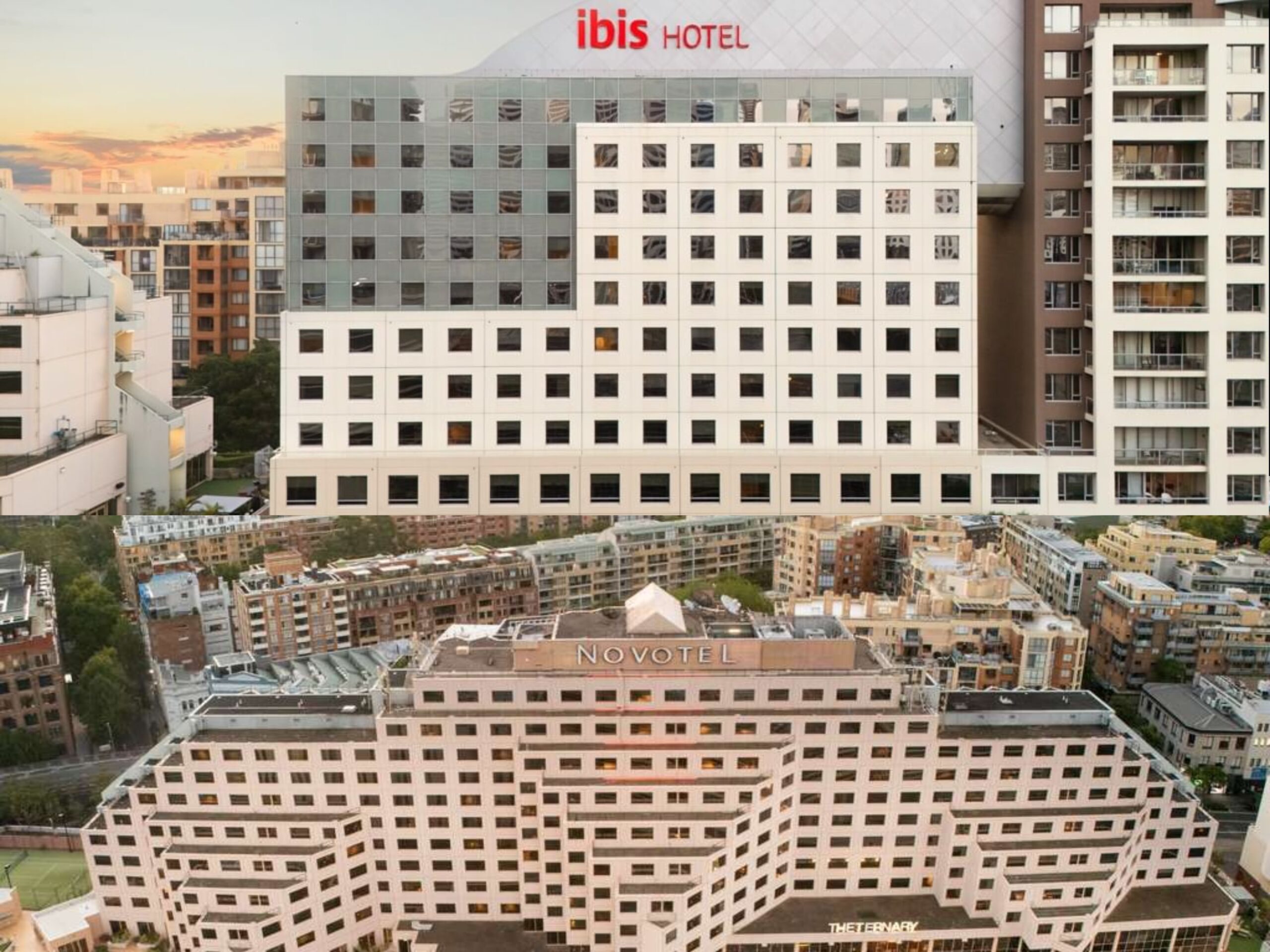

Claridge House presents a unique chance to acquire a versatile accommodation asset in Sydney’s cultural heart

A rare inner-city opportunity has come to market, with the landmark Claridge House in Darlinghurst being exclusively offered for sale by Colliers, on behalf of Jonathan Henry, Kathy Sozou and Damien Pasfield of McGrathNicol appointed as Receivers & Managers.

Located at 28-30A Flinders Street, Darlinghurst, steps from Oxford Street and Taylor Square, Claridge House occupies a prime position at the heart of Sydney’s cultural, entertainment and lifestyle precinct. The sale campaign is being led by Matthew Meynell, Karen Wales and James Cowan of Colliers, with the property to be sold via Expressions of Interest closing Monday, 15 December 2025 at 12pm (AEDT).

The multi-level building allows for up to 63 accommodation rooms, plus a ground-floor activation space suited for retail, food and beverage, cultural use, or flexible communal areas such as co-working, all encased within a striking art deco flatiron design. Currently presented as a cold shell, the property offers buyers the chance to deliver a bespoke accommodation or mixed-use concept in one of Sydney’s most sought-after urban markets.

Benefitting from MU1 Mixed Use zoning under the Sydney LEP 2012, the site supports diverse uses including tourist accommodation, shop-top housing and co-living. Offered with vacant possession, the property enables an incoming purchaser to operate under an owner-operator model, Third-Party Operator (TPO) or unlock significant upside through adaptive reuse as a living accommodation asset.

“Sydney has been one of Asia Pacific’s best-performing hotel markets over the past decade. Claridge House presents a rare opportunity to create a boutique accommodation experience in one of the city’s most vibrant inner-city precincts. With vacant possession and flexible zoning, investors can deliver a curated hotel, co-living model or mixed-use project that aligns with the growing demand for lifestyle-led accommodation,” said Karen Wales, Head of Hotels, Australia | Transaction Services.

“Claridge House is ideally positioned to capture this momentum, supported by infrastructure investment and the ongoing revitalisation of Oxford Street,” added Matthew Meynell, Managing Director, Capital Markets & Investment Services.

“Investor interest for boutique accommodation assets is accelerating. Claridge House combines scale, versatility and blue-chip positioning in one of Sydney’s most culturally vibrant precincts, while recent capital works further reduce delivery risk and enable immediate repositioning or redevelopment. The offering of Claridge House follows strong interest for Hotel South Bondi and Hotel Diplomat,” added James Cowan, Head of New South Wales | Investment Services.

Surrounded by Oxford Street’s celebrated dining and nightlife, Moore Park’s entertainment precinct and Paddington’s luxury retail, Claridge House sits within an area undergoing cultural resurgence. Sydney’s hotel market continues to outperform, with average room rates of $324 and occupancy of 82.7% in the year to September 2025. The Eastern Suburbs market recorded 80% occupancy and $300 average daily rates, reinforcing the appetite for unique accommodation offerings.