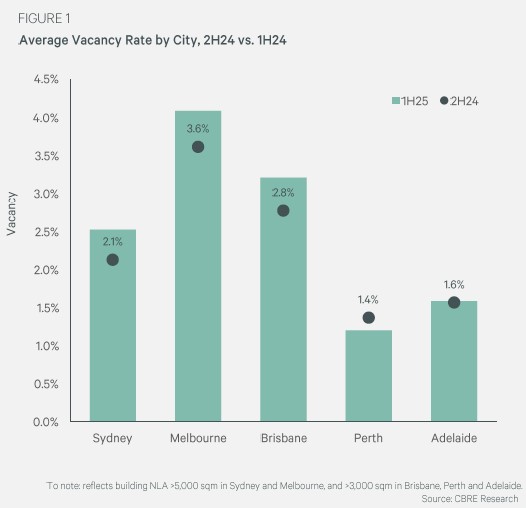

Australia continues to have one of the lowest industrial and logistics vacancy rates globally, despite the national average increasing slightly to 2.8% in the first half of 2025.

CBRE’s H1 2025 Australia’s Industrial & Logistics Vacancy Report shows the vacancy rate lifted for each of the major Eastern Seaboard markets which now sit at 2.4% in Sydney, 4.1% in Melbourne and 3.2% in Brisbane.

Perth’s average vacancy rate lowered from 1.4% to 1.2% while Adelaide remained steady at 1.6%.

CBRE’s Head of Industrial & Logistics and Data Centre Research Australia, Sass Jalili noted the gradual upward trend nationally was broadly in line with expectations and remains below the 4% ‘equilibrium’ threshold.

“Vacancy in Sydney and Brisbane has risen more gradually than anticipated – each edging up by only 40 basis points over the past six months. Melbourne, meanwhile, continues to exhibit a pronounced bifurcation in vacancy across its precincts. Melbourne’s South East and East remains exceptionally tight with vacancy below 2%, while other precincts report vacancy rates exceeding 5%. This dynamic is expected to persist in the second half of 2025,” Ms Jalili said,

Sub-lease availability increased slightly in Perth and Adelaide but Sydney’s sub-lease share continues to decline – now accounting for less than 20% of total vacancy.

Looking ahead, Ms Jalili said Australia’s supply of serviced, zoned industrial land is expected to remain structurally constrained, limiting new development pipelines in the medium-term.

“This supply scarcity, combined with the ongoing expansion of e-commerce and food & beverage occupiers, as well as sustained population growth, will remain key drivers of long-term sectoral growth,” she added.

Michael O’Neill, Regional Director Pacific Industrial & Logistics and Managing Director of Western Sydney said transactional activity strengthened in Q2, driven primarily by owners willing to offer more competitive terms, including enhanced incentives.

“This renewed momentum in take-up is expected to maintain vacancy rates below 4% nationally in the second half of the year – tighter still in infill markets,” Mr O’Neill said.

“Face rents have largely held firm, particularly for super prime stock under 7,000 sqm, with some steady rental growth sub-3,000 sqm. For new developments we have seen examples of rental growth, but nearly always accompanied with increased incentives. The letting up period in nearly all markets has increased to 3-6 months, and examples of up to 12 months for owners not willing to be competitive.

“The Pacific Industrial & Logistics Market is progressing through a normalistion phase, with momentum expected to build through 2H25, reflected in increased transaction volumes on a quarter-on-quarter basis,” Mr O’Neill added.

Sydney

Sydney’s average industrial vacancy rate rose from 2.1% in 2H24 to 2.5% in 1H25. The greatest upward movement over this period was recorded in the Inner South West.

Sublease availability continues to decline, accounting for just 18% of total vacancies in assets over 5,000 sqm.

CBRE’s Head of Western Sydney Industrial & Logistics Tom Rourke noted industrial rents were expected to stay relatively stable heading into mid-year.

“The recent wave of new developments – particularly in emerging areas such as Kemps Creek – has contributed to an increase in stabilised vacancy as occupiers relocate to newly completed facilities.

The delivery of speculative stock in the Outer West has also expanded tenant choice, placing downward pressure on rents and supporting more competitive pricing,” Mr Rourke said.

“We have recorded leasing volumes broadly in line with 2024. The outlook for 2025 remains positive, with most of the leasing activity expected in the second half of the year. This is anticipated to help maintain vacancy below 4% for the remainder of 2025.”

Melbourne

Melbourne’s vacancy rate rose from 3.6% to 4.3%, with increases across all precincts.

Sublease availability has moderated, now representing around 18% of total vacancy – primarily concentrated in the West.

CBRE State Director Thomas Murphy said vacancy across Melbourne’s industrial market continued an upward trajectory through H1 2025, driven by a sustained imbalance between elevated supply levels and subdued occupier demand.

“While face rents have largely held firm, incentives have edged higher across all precincts, reflecting the competitive leasing environment. Sublease availability remains limited across most precincts, with only the West continuing to offer a moderate amount of sublease options,” Mr Murphy added.

“Looking ahead, the anticipated slowdown in supply completions from 2026 is expected to provide some relief to upward vacancy pressures. Despite current cyclical headwinds, super-prime assets in core locations are expected to outperform in the current environment.”

Brisbane

In Brisbane, vacancy increased from 2.8% to 3.2% which was largely driven by the completion of larger speculative developments (20,000 sqm+), delivered in 1H25.

Sub-lease availability in Brisbane remains limited, accounting for just 5% of total vacant space.

CBRE State Director Matthew Frazer-Ryan said although Greater Brisbane’s leasing market and broader occupier enquiry remains subdued, he expected to see improved take up numbers off the back of larger leasing and pre-commitment deals being finalised in the coming month.

“The transaction data shows moderate rental growth across 1H25 coupled with an uptick in incentives to help alleviate relocation costs to configure new facilities to suit occupier needs. Brisbane continues to provide a cost benefit for occupiers when compared to southern states and we expect this value proposition to enhance enquiry and increase transaction volumes across Greater Brisbane in the second half of 2025,” Mr Frazer-Ryan added.

Perth

Perth vacancy remains the lowest in Australia, with a decrease of 0.2 percentage points to 1.2% in the first half of 2025.

CBRE Senior Director Jarrad Grierson noted Perth’s strong population growth and sustained domestic economic momentum underpinned strong industrial leasing demand.

“A rise in global economic uncertainty has introduced some caution to the market, which may slow the rental growth rate seen in recent years. Despite uncertainty, Perth’s vacancy rate has continued to decrease, now sitting at circa 1.2% – the lowest in the country. The lack of existing available options has resulted in high numbers of pre-lease briefs in the market. As these pre-leases convert to occupancy, backfill space is expected to emerge, gradually increasing the pool of available stock,” Mr Grierson added.

Adelaide

Adelaide recorded the second lowest vacancy rate in the country, holding steady at 1.6%.

There was a rise in sublease availability with sublease space accounting for approximately 13% of total vacant stock for assets ≥ 3,000 sqm.

CBRE State Director Paul McKay noted occupier demand remained steady in the past quarter, which is reflected in Adelaide’s consistently low vacancy rate.

“There has been a slight increase in sublease activity, although in many cases this reflects tenants leasing larger spaces than required due to a lack of smaller alternatives in this very tight market. Letting up periods remain short, although occupier turnover is somewhat down, again reflecting the lack of available alternatives in the market,” Mr McKay added.