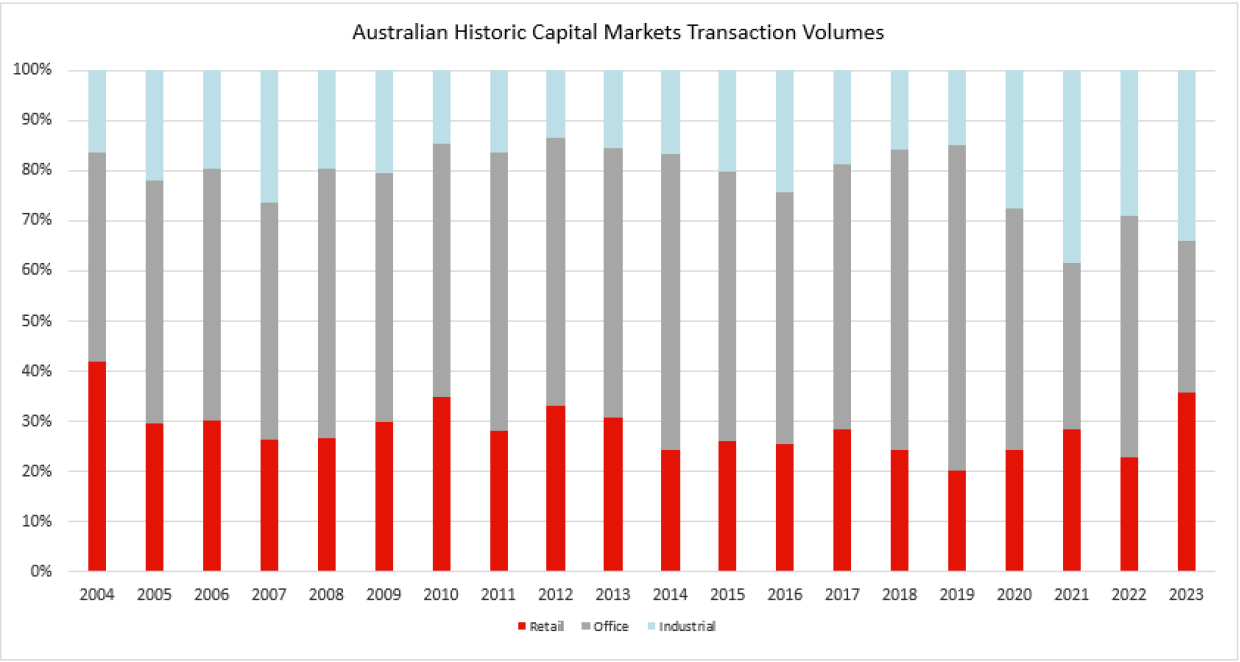

According to JLL Research, retail transaction volumes topped the charts in 2023 – the first time since 2004 – with AUD 6.25 billion of sales representing 36% of the traditional property sectors. Over this period, office transactions decreased to 30% market share (AUD 5.14 billion), and industrial transactions represented 34% (AUD 5.92 billion).

Mr. Nick Willis, Senior Director of JLL Retail Investments Australia & New Zealand said: “In a year of subdued transaction volumes in global capital markets, retail property in Australia has for the first time in 20 years been the most liquid sector with over AUD 6 billion transacted, demonstrating the returning capital demand.”

Mr. Willis explained: “Whilst formal on-market offerings for retail assets were significantly constrained in 2023, the weight of capital drove a year dominated by off-market transactions led by buyer mandates. Globally, the performance of the retail sector is driving renewed interest, and whilst the majority of this capital is focused on higher return opportunities, core capital is re-engaging given the attraction of the robust underlying fundamentals of the asset class.”

JLL Research has indicated that the Q4 2023 retail sales figures represented almost 60% of the total $5.52 billion of sales for the calendar year with $1.95 billion of Regional and Sub-Regional transactions dominating the final three months.

The buyer profile in 2023 was also dominated by local fund managers and syndicator capital across all retail sub-sectors accounting for more than 40% of total sales.

Mr. Willis noted “Managers have identified value in the Regional and Sub-Regional sub-sectors during 2023, notably Haben acquiring their first Regional classified shopping centre in Stockland Townsville for AUD 238.5 million. However, further to syndicate capital activity, the higher cost of debt has increased participation from ultra-high net worth investors who have a lower cost of capital, including the recent sale of Rosebud Plaza to a Sydney private for AUD 134.5 million.”

Mr. Sam Hatcher, Head of JLL Retail Investments Australia & New Zealand stated: “The retail thematic is validated by the continued strength in tenant performance, limited floor space supply across all sub-sectors and heightened deal flow aiding underwriting. Further, funding for retail remains positive given the diversification of income providing stable interest cover ratios compared to other traditional asset classes which are often linked to one or two major tenant expires.”

Mr. Andrew Quillfeldt, Head of JLL Capital Markets Research Australia, said: “Retail transaction volumes were only down by 8% YoY compared with -41% across all sectors, reflecting the slew of deals occurring in late-2023. While the outlook for rates has been volatile, global capital markets are now reflecting lower official cash rates for many of the major established markets, which is helping to improve conviction in underwriting future funding costs for real estate investors and that the current round of monetary policy tightening from central banks may have concluded.”