There will likely be a surge in office investment this year with growing momentum in the Australian market, according to the latest research from Knight Frank.

So far this year $4.9 billion has traded, with a further $6.9 billion worth of stock currently on the market across the six major cities of Sydney, Melbourne, Brisbane, Perth, Adelaide and Canberra, and expected to trade in the coming months.

Office investment volumes in major cities ($millions):

| Sydney | Melbourne | Brisbane | Perth | Adelaide | Canberra | 6 city total | |

| 2019 | 13,819 | 5,177 | 3,509 | 935 | 827 | 762 | 25,029 |

| 2020 | 4,746 | 2,880 | 1,456 | 282 | 564 | 81 | 10,008 |

| 2021 | 7,264 | 3,522 | 2,011 | 1,056 | 682 | 1,584 | 16,119 |

| YTD 2022 | 2,410 | 827 | 1,114 | 13 | 353 | 153 | 4,870 |

| On market (April 2022) | 1,392 | 3,441 | 876 | 400 | 369 | 442 | 6,920 |

Knight Frank National Head of Capital Markets Justin Bond said with the current momentum, total office investment volumes in 2022 are likely to easily exceed the 2021 total of $16.1 billion across these cities.

“We are seeing increased levels of investment opportunities coming to the market as borders open and confidence returns to the occupier market,” he said.

“We expect volumes to reach $20 billion in 2022, up 25 per cent from last year, but below the record level of $25 billion reached before the pandemic in 2019.

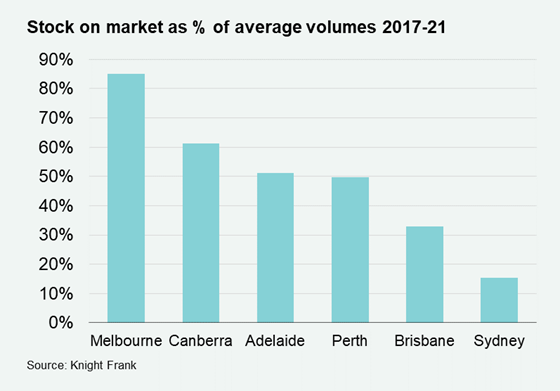

“Melbourne is expected to see a very strong year, with the most stock on market of any city, at $3.4 billion, driven up by the on-market sale of the Southern Cross Towers complex and 1000 La Trobe. Total volumes could approach the 2019 record of $5.2 billion.

“Following on from a robust 2021, Brisbane continues to be one of the most active Australian markets with current on market volumes approaching $1 billion. We expect increased debt costs will drive demand for greater returns and therefore influence investor appetite for Brisbane investments.

“Perth is set to benefit from the reopening of state borders which made it impossible for investors to visit and inspect assets during much of 2021. With just over $400 million of stock on the market, the city is also benefitting from a strong economy in Western Australia with the office market supported by rising demand for space from the mining sector.”

Mr Bond, who has recently returned from a trip to Europe and the UK, said overseas capital remained a key driver of the Australian office market.

“We expect to see increased foreign investment into Australia now that the international borders have opened,” he said.

“There is sustained demand from the US, in particular North America, and Singaporean buyers, and rising appetite from major German and Korean institutions.

“This reflects confidence in the near-term outlook for occupier market recovery in Australia and the longer-term prospects for Australian cities supported by a robust labour market and a large pipeline of infrastructure investment to be rolled out over the next decade.

“Australia offers tremendous fundamentals for foreign investors – political stability, low unemployment, strong corporate governance, market liquidity and favourable returns comparative to other global destinations.

“The uncertainty of the situation in Europe reinforces the desire of many European investors to increase allocations to foreign real estate investments.

“Asia Pacific will continue to attract European capital with increased weightings towards Australia, Japan, Korea and Singapore. However, we feel Australia will be well positioned to attract most of the foreign capital.”

Mr Bond said a common theme amongst investors was the genuine desire to invest in energy efficient assets or partner with Australian managers who are aligned to the implementation of ESG principles.

“As ESG becomes more pertinent for investors, we think that Australia will remain highly favoured due to our highly transparent and globally recognised ratings systems and the breadth of core assets meeting rigorous sustainability criteria,” he said.

Mr Bond added, historically Sydney and Melbourne remained the most favoured markets for overseas investors, while domestic institutions have been scaling up their allocations to Brisbane, Adelaide and Canberra due to their relative stability during the pandemic and strong return outlook.