- Australian bank commercial real estate debt hits record high of $415.7 billion in June 2025

- Growth of CRE debt led by industrial property, driven by the evolution of online retail sales

- Regulatory constraints on banks creating opportunities for private lender expansion

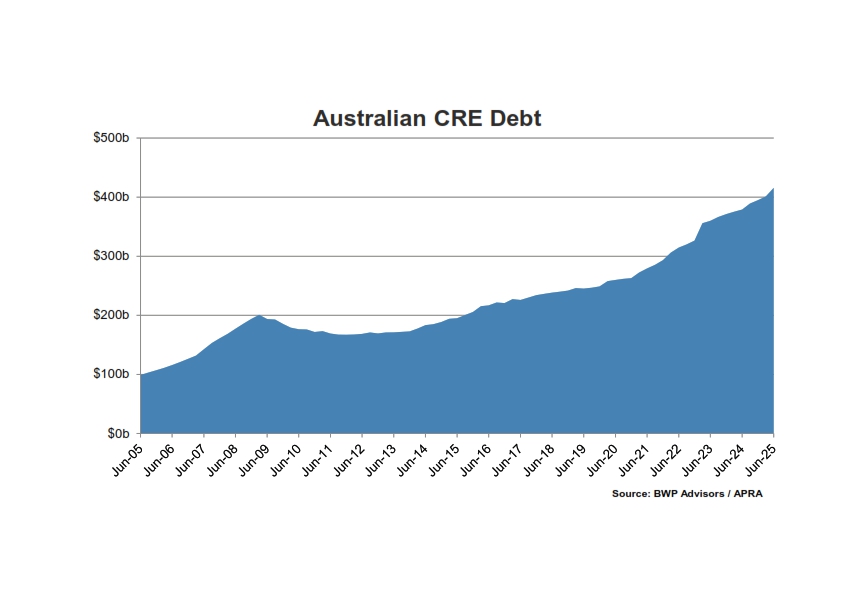

Australian bank commercial real estate debt reached another all-time high of $415.7 billion in June 2025, growing by 9.6% over the past year – the strongest growth since 2023.

BWP Advisors Founder Richard Jenkins said, despite the current uncertain economic environment with values of Australian commercial real estate (CRE) assets stabilising, the share of non-performing loans has also fallen since its recent peak of September 2024.

Mr Jenkins said, “the health of Australia’s banking system contrasts debt pressures and lender exits in other markets such as the US, where commercial real estate distress hit $116 billion in March, up 23% over the year and are now at their highest level since 2014.

“Total CRE debt grew by $36 billion over the past 12 months – the largest annual increase since December 2023, well above the 10-year annual average growth of $20 billion.

“The pace of growth reflects the confidence that lenders have in the Australian commercial real estate market with Australia’s population growing at one of the fastest rates globally and a general undersupply of property sectors.

Mr Jenkins said the growth of Australian CRE debt was led by industrial property, which has now reached an all-time high with banks’ exposure to the sector increasing by 17% over the 12 months to June 2025.

“With industrial and logistics properties benefiting from the acceleration in the structural shift to online retail trade, lenders have increasingly sought to increase their exposure to the sector. Australian industrial CRE debt has doubled over the past five years, far surpassing the gains of the other sectors,” Mr Jenkins said.

Buoyed by the resilience of consumer spending patterns, banks’ exposure to the retail sector has also increased to all-time highs as at June 2025 having grown for the past eight consecutive quarters. The trend of lower interest rates, ongoing population growth and the strength of the labour market is expected to result in banks continuing to increase their exposure to the retail sector.

Despite office vacancies remaining stubbornly elevated, the banks’ exposure to the office sector surpassed $120 trillion for the first time on record with the sector accounting for 26% of all authorised deposit-taking institutions (ADIs) CRE debt in Australia.

However, with work patterns evolving coupled with climate-related and broader ESG risks increasing, lenders remain wary of office assets, leading to tighter scrutiny of loans for assets requiring significant investment to meet sustainability standards. The integration of ESG considerations into lending decisions is expected to limit finance opportunities for certain borrowers,” Mr Jenkins said.

Although, banks have been forced to reweight their portfolios to loans backed by income-producing real estate assets in response to APRA’s revisions, CRE debt for high density development and residential sub-division hit all-time highs in June 2025 which may help alleviate the chronic undersupply of Australia’s housing development pipeline,” he said.

Jenkins said the current share of Australian CRE debt held by the major banks (ANZ, NAB, CBA and Westpac) is 73.3% well below their peaks of 84.7% in 2013.

According to Mr Jenkins, foreign banks have also seen a shift in their approach. Despite a $2.9 billion increase in their CRE debt exposure in the past year, their share of Australian CRE debt has waned in recent years and remains below their peak.

Overall, foreign banks now account for 21.5% of total Australian CRE debt, below their peak share of 24.7% three years ago.

Foreign bank involvement in the office and retail sectors both declined in the 12 months to June 2025, however their exposure to the industrial sector has increased to all-time highs, similar to other lender trends.

Beyond traditional bank financing commercial real estate, regulatory constraints and increased capital requirements have created opportunities for private lenders.

“According to BWP Advisors research Australia’s CRE debt market is also facing a significant refinancing wave, with nearly 30% of outstanding debt set to mature between 2026 and 2028. Borrowers looking to refinance will encounter higher capital costs, increased vacancies, and moderating lender appetite, especially for secondary assets. This environment will likely benefit non-bank lenders, who continue to grow their presence in the market.

Underpinned by the increased participation of institutional investors, private credit (which encompasses real estate along with business loans) in Australia has surged from $33 billion in 2016 to more than $200 billion in 2025, highlighted by the recent acquisitions of Capitaland’s of Wingate, Salter Brothers purchase of Causeway Asset Management and Regal Partners’ acquisition of Merricks Capital along with Apollo Global Management’s half-share stake in MaxCap.

“Given Australia’s projected population growth will lead to increased demand for all property asset classes, the level of Australian debt for CRE construction is forecast to grow to $350 billion in 2027.”

The absence of a more receptive environment from traditional lending sources means more construction projects are turning to non-bank financiers,” Mr Jenkins said.

The supply of new housing is near its lowest level in a decade with 177,000 new dwellings completed in 2024, falling significantly short of underlying demand for housing. According to national Housing Accord introduced by the Federal Government, a target of 1.2 million new dwellings will be built across Australia by mid-2029.

Mr Jenkins concluded given the regulatory constraints and increased capital requirements imposed on banks, the outlook for non-banks is positive.

The ability of private credit to bridge funding gaps and offer customised lending solutions, means that private credit will continue to play a crucial role in diversifying Australian CRE debt and Australia’s private credit market is projected to grow beyond $100 billion in 2030, up from its current participation of $60 billion according to BWP Advisors research.

According to Mr Jenkins, Australian banks are among the best-capitalised financial institutions globally, with the country exceeding Basel III banking regulations, highlighted by the low level of “non-performing” loans (which are regarded as past 90 days due) which totals $3.5 billion (or 0.8% of total CRE debt in Australia), far below the levels seen during the GFC.