Australia Was the 6th Most Active Market Globally for Commercial Real Estate Investment in 2024

5 March 2025

- Knight Frank’s The Wealth Report 2025, released today, found Australia was the 6th most active market globally for commercial real estate investment in 2024, up from 9th in 2023

- In Australia CRE investment volumes rose by 57% in US dollar terms over 2024

- Globally CRE investment rebounded last year, rising by 8% to US$806 billion, marking a significant recovery following the sharp 43% contraction recorded in 2023

- In Australia, industrial was also the most invested sector in the CRE market over 2024, with US$15.9 billion, while office and retail volumes totalled $6.1 billion each

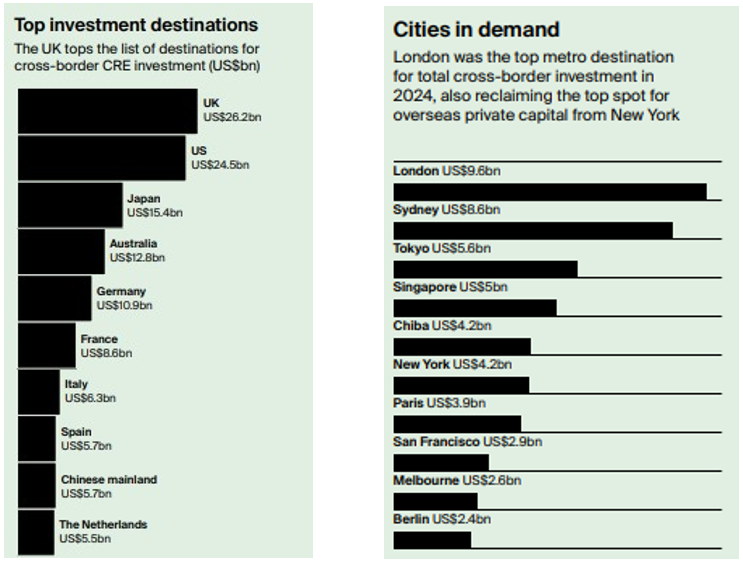

- Australia was the 4th top investment destination for cross-border CRE investment in 2024, at US$12.8 billion, behind the UK (US$26.2bn), the US (US$24.5bn) and Japan (US$15.4bn)

- Sydney was the 2nd top metro destination for total cross-border investment in 2024, with US$8.6 billion, behind London with US$9.6 billion. Melbourne was 9th, with US$2.6 billion

Australia was the sixth most active market globally for commercial real estate (CRE) investment in 2024, according to Knight Frank’s The Wealth Report 2025, released today.

The report found that globally CRE investment rebounded last year, rising by 8% to US$806 billion, marking a significant recovery following the sharp 43% contraction recorded in 2023.

Australia was the sixth most active market globally in 2024, up from ninth in 2023. Total volumes grew by 57% in US dollar terms, reflecting a strong bounce back after a subdued 2023.

Top 10 countries by total commercial real estate investment volumes over 2024 (US$ billions):

| 2024 | 2023 | change | |

| United States | 368,870 | 323,291 | 14% |

| United Kingdom | 58,095 | 46,116 | 26% |

| Japan | 52,171 | 43,030 | 21% |

| China | 35,476 | 43,599 | -19% |

| Germany | 33,236 | 30,566 | 9% |

| Australia | 32,842 | 20,903 | 57% |

| South Korea | 27,765 | 21,288 | 30% |

| Canada | 25,258 | 30,557 | -17% |

| France | 24,290 | 30,806 | -21% |

| Spain | 14,120 | 10,183 | 39% |

Knight Frank Chief Economist Ben Burston said of the countries with the highest CRE investment volumes over 2024, Australia saw the largest year-on-year increase by far.

“Globally CRE investment saw a recovery in 2024, rebounding from the challenges of the previous year,” he said. “The overall picture was one of economic resilience. The global battle against inflation was ultimately won, with interest rates drifting downwards and many economies were navigating a soft landing.

“Australia came in ahead of South Korea, Canada, France and Spain in terms of commercial real estate investment volumes over 2024, and recorded the strongest annual growth among the leading markets.

“Australia’s increase was partly due to improving sentiment and less uncertainty over the macro outlook, with an increase in activity in each of the office, industrial and retail sectors, but it was also boosted by the exceptional acquisition of AirTrunk by Blackstone and CPPIB.

“We expect continued momentum in 2025, with a further pick-up in activity in the office, retail, and alternative sectors, although the volume of entity-level activity in data centres unlikely to be repeated.

“The market is firmly in recovery mode, and while 2025 won’t be without its challenges, a significant pool of capital is seeking deployment in Australia and additional interest rate reductions are likely to buoy sentiment further as the year goes on.”

Just as in 2023, Industrial was the most invested CRE sector globally, accounting for just over a quarter of all global investment at US$216 billion. Living was close behind at US$205 billion, while Office investment reached US$173 billion. Although the Industrial, Office, Hotel and Living sectors all increased their share of total investment in 2024, Retail investment declined, its global share falling from 18% in 2023 to 16%. Similarly, Senior housing & care shrank from 3% to 2%.

In Australia, industrial was also the most invested sector in the CRE market over 2024, with US$15.9 billion, underpinned by significant activity in data centres, while office and retail volumes totalled $6.1 billion each.

Knight Frank’s The Wealth Report 2025 found, via a survey of 150 family offices* that In Australia the top three real estate sectors for investment moving forward are industrial (42%), data centres (21%) and infrastructure (18%), compared to living sectors (14%), industrial/logistics (13%) and luxury residential (12%) globally.

Global cross-border capital regains momentum

Global cross-border capital also regained momentum in 2024, rising 12% to $171 billion, underscoring the return of global investor appetite.

Australia was the fourth top investment destination for cross-border commercial real estate investment, at US$12.8 billion, behind the UK (US$26.2bn), the US (US$24.5bn) and Japan (US$15.4bn).

Sydney, meanwhile, was the second top metro destination for total cross-border investment in 2024, with US$8.6 billion, behind London with US$9.6 billion. Melbourne was 9th, with US$2.6 billion.

Investors from the US, Canada and the UK were the most active sources of cross-border capital in 2024.

Who were the most active buyers?

Globally private capital dominated CRE investment for the fourth consecutive year, contributing US$360bn or 45% of total global investment volume, down slightly from 48% in 2023. Institutional buyers were the second most active group, deploying US$268 billion, some 33% of the total. Private, Institutional and Public buyers all recorded a rise in investment compared with 2023. Buyers in public markets saw the largest rise, posting a year-on-year increase of 22% in 2024.

In Australia, investment from private buyers totalled US$8.9 billion in 2024, representing 27% of total activity, down from 36.7% in 2023. Cross-border investors were much more active in 2024, accounting for 40.9% of total volumes, up from 27.5% in 2023.

Data source: The above is based on Knight Frank’s analysis of RCA data and Knight Frank’s Research

*Definitions:

Family office – A family office is a privately held company that handles investment management and wealth management for a wealthy family. The goal of a family office is to grow and preserve the family’s wealth across generations.

Knight Frank 150 – A survey of 150 family offices. Through November and December 2024, Knight Frank interviewed 150 single and multi-family offices across the globe. The family office (FO) panel covered 121 single- family and 18 multi-family offices as well as 11 heads of more diverse structures. The FOs were headquartered in 29 cities across Asia, Europe, the Middle East and the Americas, with strong representation from FOs based in London, Singapore, New York, Geneva, Sydney and Hong Kong SAR.