Australia records 4.9% growth in house prices over the past year, putting it in 18th spot out of 56 countries

13 December 2023

AUSTRALIA has come in at number 18 out of 56 countries around the world ranked for house price growth over the 12 months to the end of September this year, according to the latest Knight Frank Research.

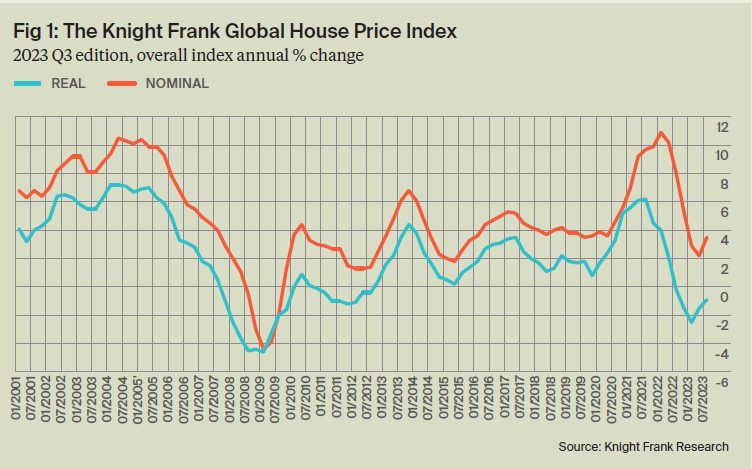

Knight Frank’s Global House Price Index Q3 2023, which provides a quarterly snapshot of trends in mainstream housing markets across 56 countries, found house prices remained robust in the face of higher debt costs, with average annual price growth across the global market sitting at 3.5% in the year to the end of Q3, up from 2.2% the previous quarter.

Australia’s house price growth over the past 12 months was well above the average annual house price growth globally at 4.9%, with 1.9% growth over Q3.

Turkey has held the top spot in the rankings since Q1 2020 and once again saw the strongest growth with an annual 89.2% rise and quarterly increase of 18.1%.

Croatia (13.7% annual growth) and Greece (11.9%) rounded out the top three.

Sweden saw the lowest growth, with house prices falling by 11.1% over the 12 months to the end of September.

Knight Frank Head of Residential Research Michelle Ciesielski said Australia was one of 35 markets to experience annual price growth, while 21 of the 56 witnessed price declines.

“The rate of annual price growth reached a peak of 10.9% in Q1 2022 but sharply slowed to 2.2% in Q2 of this year,” she said.

“The upturn in the latest quarter indicates strengthening price growth in several markets, including Australia, Ireland, Sweden, the UK and the US, despite rising interest rates and therefore higher costs for mortgage borrowers.

“The resilience of house prices can be attributed to limited available stock, strong employment and robust wage growth.

“Remarkably, despite the fastest rise in interest rates in history, globally residential prices only dipped slightly at the beginning of this year, and have since resumed growth.

“They now stand 3.5% above their 2022 peak. Even when adjusted for inflation, real house prices are only 2% below their 2022 peak despite higher rates.”

Knight Frank Head of Residential Erin van Tuil said there continued to be a shortage of homes for sale, with sales volumes declining by 15% to 25% from recent peaks across developed economies.

“The absence of a pricing correction indicates that this constraint on activity is expected to persist, likely through 2024 and potentially well into 2025. Activity is anticipated to rebound when rates are substantially lowered.

“In Australia, on one hand, this is the ideal opportunity for first home buyers to enter the market, but overall numbers are down. Many have seen their deposit absorbed by rental growth, the overall cost of living and/or they’ve been unable to prove serviceability of the loan required to be borrowed.

“On the other hand, there are a significant portion of cash buyers such as the growing number of downsizers itching to make their low maintenance living a reality.

“This pent-up demand, plus those currently less active in the market, including families seeking to upsize, and those much-required investors to keep weekly rents at bay as our population grows, will place further pressure on capital values across the country in the coming years.”