Australia One of the Favoured Destinations in APAC for Cross-Border Investment in Commercial Real Estate

2 May 2025

Australia is one of the favoured destinations in Asia-Pacific for cross-border investment in commercial real estate, according to the latest research from Knight Frank.

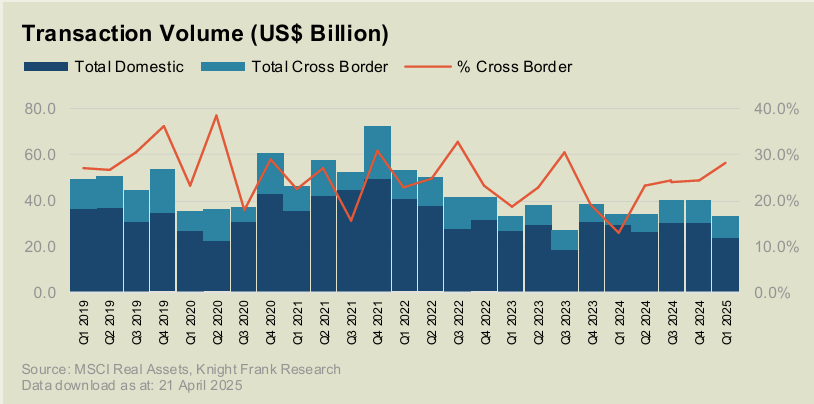

The firm’s Asia-Pacific Capital Markets Insights Q1 2025 found regional cross-border investment in commercial real estate more than doubled in Q1 2025, rising 116.7% year-on-year to US$9.5 billion.

This sharp increase stands out amid persistent global economic volatility and uncertainty around Trump’s tariff policies and reflects renewed investor confidence in the region’s real estate fundamentals, with Japan, Australia, and South Korea emerging as key destinations.

Overall transaction volumes in Asia-Pacific held steady at US$33.4 billion in Q1 2025, easing 0.8% from the same period last year. However, it showed a sharper 17.1% decline from the strong activity in Q4 2024. International investors remain active, with cross-border transactions accounting for 28.4% of all investment activity, the highest proportion since Q3 2023.

The highest cross-border transaction volumes for Q1 2025 were in Japan ($US4.135 billion), followed by Australia ($US2.462 billion) and South Korea ($US1.749 billion).

Craig Shute, CEO, Asia-Pacific, Knight Frank, said: “Asia-Pacific’s real estate market held up well in 2025, with cross-border investment activity reflecting sustained interest, particularly in Japan, Australia, and South Korea. Stabilising asset prices and the clear signal that interest rates have peaked encourage investors to support renewed capital deployment. As investors gravitate toward office, industrial, and retail assets that offer resilient income and long-term growth potential, improved financing conditions and clearer valuation floors are helping to restore confidence across key markets.”

Australia emerges as investor favourite, along with Japan and South Korea in attracting international capital

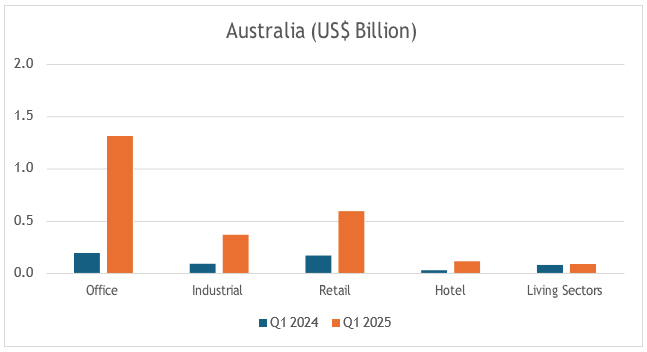

Over Q1 2025 Australia saw the highest cross-border investment in the office sector, at US$1.309 billion.

Retail assets experienced a rebound, with investment volumes nearly tripling year-on-year to US$592 million, while industrial assets attracted US$364 million in cross-border investment.

Knight Frank Australia’s Chief Economist Ben Burston said: “2025 has begun with stronger investor sentiment and improved liquidity in the Australian market, as evidenced by the substantial increase in cross-border acquisitions.

“Looking ahead, renewed uncertainty over the global economic outlook may knock the confidence of international investors in coming months, but the prospect of further interest rate cuts in the second half of the year will ultimately support the nascent recovery in Australian property markets.

“The recent volatility in equity markets also bolsters the case for allocating capital back to real estate as investors will be looking to mitigate further downside risks. In 2022-23, many investors opted against allocating to real estate, perceiving a better outlook elsewhere, but after significant repricing, the sector is back in favour.”

Early signs point to a continued momentum; tariff uncertainty creates both challenges and opportunities

With US$5.6 billion in deals already captured in the first weeks of Q2 2025, the market shows promising signs of continued growth. Central bank rate cuts have enhanced the attractiveness of debt- financed acquisitions, while stabilising asset prices have fuelled increased market activity.

Knight Frank’s Asia-Pacific Capital Markets Insights Q1 2025 report can be found here: Asia-Pacific Capital Market Insights Q1 2025 (2-pager).pdf