A DA-approved subdivision site in Austral has transacted through a joint venture between the vendor and a purchaser, a structure that continues to play a central role in how major projects are being capitalised and delivered across Sydney’s development corridors.

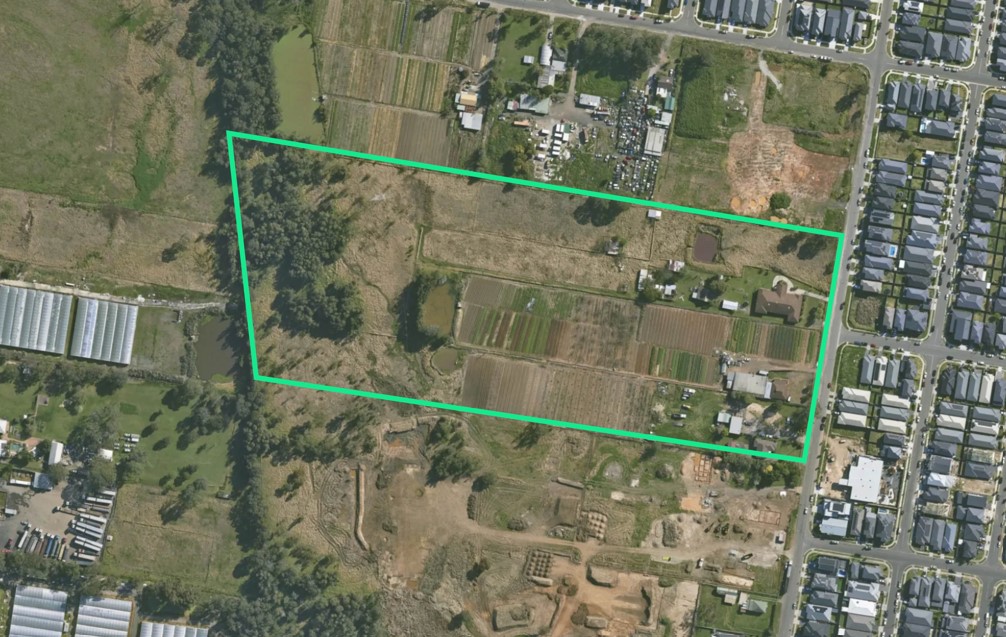

CBRE’s Ray Ahsan and Lord Darkoh represented the vendor in the transaction of 43–47 Kelly Street, a strategically positioned landholding approved for 119 residential lots. The project value is estimated to be worth over $100 million.

Mr Ahsan noted the transaction highlights the ongoing importance of partnership-led models in facilitating large-scale project delivery, particularly in today’s more complex funding environment.

“Joint ventures have long been part of the development market, but their relevance has become even more pronounced as developers and landowners look for smarter, more strategic ways to bring projects to life.

“These structures aren’t about reinventing the wheel; they’re about aligning capability, capital, and delivery strategy to ensure projects remain viable. This deal is a strong example of how experienced parties are working together to unlock sites of scale, reflecting both the depth of capital and the confidence that exists in Sydney’s Southwest,” Mr Ahsan said.

Mr Darkoh said joint venture structures continue to offer an effective pathway for both vendors and developers seeking to balance capital management and delivery outcomes.

“Partnership models like this allow counterparties to share expertise, stage capital deployment and manage delivery risk in a way that’s commercially sustainable. They remain one of the most reliable and pragmatic frameworks for executing complex development projects in the current market,” he said.

Collaboration between developers and landowners is now seen as a key driver of project momentum, Mr Darkoh added.

“There’s a growing recognition that success in today’s market often comes down to the strength of alignment between stakeholders. When capital, delivery capability and local knowledge come together early, it positions projects for much smoother execution — and that’s exactly what we’re seeing in Austral and similar precincts across Western Sydney,” Mr Darkoh said.

Mr Ahsan noted that Sydney’s Southwest remains one of New South Wales’ most closely watched growth corridors, underpinned by significant infrastructure investment and long-term housing demand.

“Developers are continuing to pursue DA-approved subdivision opportunities that align with Sydney’s long-term urban growth strategy,” he said.

“We are seeing an uptick in projects preparing to enter the market, signalling strong momentum for Q4 2025 and heading into Q1 2026.

“With development costs rising and pricing expectations remaining firm, joint venture structures are allowing projects to proceed with precision and strategic capital deployment. They continue to underpin market activity and form a critical part of how deals are being executed,” Mr Ahsan added.