Assembly Funds Management has re-opened its Australian Diversified Property Fund 1 (ADPF1) to raise $50m for its next series of investments.

The Group which was formed by Michael Gutman OBE former Director, President and COO of Westfield has the combined support of the Lowy family and Alceon.

ADPF1 is a diversified opportunistic real estate fund with a broad mandate to target investments to generate a 10-12% IRR for investors over the fund life. The fund can invest across most asset classes via equity or debt. At present Residential, Industrial, Large format retail and Alternative assets (such as childcare, pubs and service stations) are the key targets with the fund taking a more active role to generate higher returns.

The fund has already secured $207m of commitments at first and second close and has re-opened to secure additional capital to target $325m of capital within 18 months.

Target investments are around the $20 – 30m equity ticket size each which is a market slightly above private investors and below institutional radar.

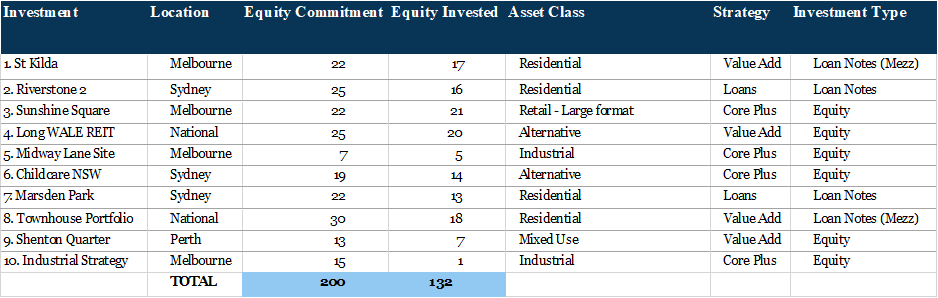

The fund has 10 existing investments including interests in six childcare assets in Sydney which were acquired in partnership with Harrington Property for $34m and an interest in a large format retail centre in Sunshine VIC acquired in partnership with Cadence for $39m.

The fund is forecast to pay an annual distribution of 5-6% pa from the 2022 financial year and its current investments are forecast to achieve a circa 17% gross IRR.

Search

Search

Home / General / Assembly Seeks a further $50m for Diversified Fund

Assembly Seeks a further $50m for Diversified Fund

16 June 2021

Assembly Funds Management has re-opened its Australian Diversified Property Fund 1 (ADPF1) to raise $50m for its next series of investments.

The Group which was formed by Michael Gutman OBE former Director, President and COO of Westfield has the combined support of the Lowy family and Alceon.

ADPF1 is a diversified opportunistic real estate fund with a broad mandate to target investments to generate a 10-12% IRR for investors over the fund life. The fund can invest across most asset classes via equity or debt. At present Residential, Industrial, Large format retail and Alternative assets (such as childcare, pubs and service stations) are the key targets with the fund taking a more active role to generate higher returns.

The fund has already secured $207m of commitments at first and second close and has re-opened to secure additional capital to target $325m of capital within 18 months.

Target investments are around the $20 – 30m equity ticket size each which is a market slightly above private investors and below institutional radar.

The fund has 10 existing investments including interests in six childcare assets in Sydney which were acquired in partnership with Harrington Property for $34m and an interest in a large format retail centre in Sunshine VIC acquired in partnership with Cadence for $39m.

The fund is forecast to pay an annual distribution of 5-6% pa from the 2022 financial year and its current investments are forecast to achieve a circa 17% gross IRR.

Fund Details

| Responsible Entity | AMAL Trustees |

| Fund Manager | AFM Trust |

| Current Fund Size | $207.0M |

| Fund Raising Target | $50.0M |

| Fund Open | 15 June 2021 |

| Fund Raising Close | Q3 2021 |

| Fund Term | 5 years from the latest end of the investment period. Plus options for i) a 1 year extension at managers discretion and ii) an additional 1 year extension at investors discretion. |

| Target Return | 10% to 12% IRR net to investors (with a distribution yield of approximately 5%- 6% pa with payments to begin in Q1 2022). |

| Gearing | Target 40% (50% maximum) |

| Liquidity | Illiquid – Redemption of securities of up to 10% per annum of total securities from 2 years from the latest end of the investment period. |

| Investor Type | Wholesale |

| Target Assets | Residential, Alternatives, Industrial and Large Format Retail |

Investment Strategy

The fund runs a diversified opportunistic strategy Assembly advise is important in achieving the target returns in a complex backdrop for investment. To date these investments have been made in the Residential, Alternatives, Industrial and Large Format Retail sectors.

Existing Assets

The fund has allocated $200m to 10 investments and deployed $132m of funds to date. The investment include;

Fund Fees

Assembly are entitled to receive fees in consideration for the management of the Fund including;

- 1.5% on committed capital during the investment term or 1.25% for capital commitments above $10m

- 1.5% on invest capital after the investment term

- Set Up Expenses capped at 1% Aggregate Capital Commitments

- A Performance Fee of 15% of the Fund’s performance above an IRR of 7% with a 50% catch up provision

The above fees are high in comparison to comparative offers in the market.

Recommendation

We support the Investment Strategy and target sectors for the Fund which align with our views of the current market. The Fund is recommended for further consideration by investors seeking an above average distribution yield. Capital growth from the assets in the fund are expected to be under pinned by increase rents and further compression in cap rates. An increase in interest rates could impact both of these elements and a such there is some risk to capital growth. Potential investors are advised to review the key risks in the product documentation and undertake a detailed assessment of the portfolio and investment cash flows.

Disclaimer: The information contained on this web site is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.