The impact of higher office vacancies and working from home continues to impact values for major office towers, while values for major shopping centre appears to have stabilised. According to the annual reporting of Australia’s major listed property trusts, it seems shopping centre owners are factoring in the potential for residential development.

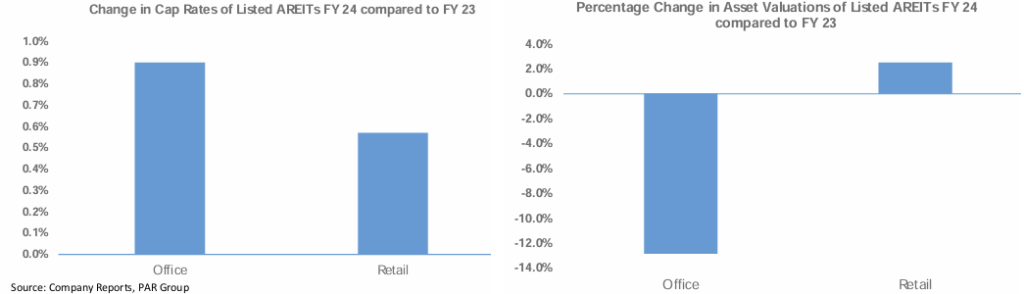

Since August 2023, the listed property trusts have posted only modest changes to capitalisation rates. Indeed, over the past 18 months, listed property owners have increased the cap rate of their office assets by an average of 0.9%, while cap rates for shopping centres have risen by an average of 0.27%. This has resulted in just under $1.4 billion being wiped off the book values of their office and retail portfolios.

However, there is a stark contrast between the performance of office and retail properties. Values for office assets have fallen by 12.8% since August 2023 while, in comparison, the value of shopping centre assets increased by 2.5%. These valuation changes are broadly in line with recent asset transactions, reflecting the narrowing gap in price expectation between buyers and sellers.

These results for the future direction of property values are part of a PAR Group analysis undertaken by Damian Stone of Y Research and Rob Ellis of The Data App. The analysis reviewed the book values and capitalisation rates across 11 listed Australia Real Estate Investment Trusts (AREITs) which reported during February 2025. The findings from February 2025 were compared to the corresponding outcomes from August 2023.

This study considered eleven listed AREIT office and shopping centre property portfolios. In total, 202 commercial (shopping centres and office) properties were reviewed. The key findings were:

- Owners have increased the capitalisation rate of their office properties by an average of 0.9%. As a result, the value of the 96 office assets reviewed fell by $2.8bn in the 18 months to February 2025.

- The most dramatic changes for office properties were in Victoria and New South Wales, where office values fell by 15% compared to August 2023. The revaluations reflect higher vacancy, in part a reflection of the impact of working from home in these markets.

- The AREITs increased the capitalisation rate of their shopping centre properties by an average of 0.27%. Despite the increased cap rate, the value of the 106 shopping centre assets reviewed increased by $1.43 billion in the 18 months to February 2025.

- The largest centres have a disproportional impact of shopping centre values. The 13 centres valued at more than a billion dollars collectively increased by $715 million dollars, while 92 centres worth less than a billion dollars increased by a net total of $167.8 million dollars. The change in asset value for major centres is linked to underlying land values and the ability to add residential in the years ahead.

Commentary

When we first reviewed the changes in office and retail property values for the listed Australian Real Estate Trusts back in 2023, we expected values (office and retail) could fall by up to $15 billion in the years ahead.

In spite the structural changes influenced by the pandemic; this valuation decline has not occurred. This is primarily due to the turnaround in retail property values, which increased by $1.43 billion in the 18 months to February 2025, partially offsetting the fall in office assets, which fell by $2.8 billion over the same time frame.

The narratives around each asset class are stark contrast. The increase in retail property values suggests these assets have experienced their correction. While a substantial proportion of improvement in retail asset values have been for the billion-dollar plus valued centres, there has been a broad improvement. In part this is tied to continued transactions reaffirming market pricing for assets, but also the pricing in a range of future non-retail uses at shopping centres.

Major centres such as Chadstone, Chermside and Carousel have significant infrastructure close by, as wand invariably land holdings. Their scale, at over 100,000 sqm, gives them an edge over smaller competing centres, akin to the Walmart/Costco strategy, of having everything under one roof. These centres offer consumers a level of choice, experience and entertainment not found online or at smaller physical centres.

The ability for retail centres to add residential properties to sites, not only adds to the primary catchment but also generates new revenue, which is being priced into values.

The increase in construction costs may also lead to reduced retail supply being added to existing (sub regional and above) shopping centres. The expectation of reduced retail supply, against a backdrop of continuing population growth, may also have been priced into retail asset values.

The ongoing decline in office values is primarily in New South Wales and Victoria; accounting for over 90% of lost value across office assets. As outlined, in both these states office values fell by 15% compared to August 2023. The revaluations reflect higher office vacancy rates in recent years, in part due to the impact of working from home. Conversely in WA, which has seen a stronger return to office, office values fell by just 1.8%.

Of office assets reviewed, 78.1% are Premium or A Grade properties which seems to have been the beneficiary of the flight to quality in office markets. It is likely secondary grade properties in NSW and Victoria have recorded a more significant decline in values, as the cost to convert secondary grade properties for alternative uses such as residential or accommodation (students or tourists) is currently uneconomical. Therefore, it is likely office

vacancy rates will remain elevated in 2025/26, even before factoring in potentially weaker global economic conditions.

Examining the listed office buildings, properties with Government or major companies have retained value since August 2023, potentially highlighting the value of major tenants as part of the broader valuation of the property.

The impasse faced by listed property owners 18 months ago, with a lack of assets transacting due to a price expectation gap between buyers and sellers, has now cleared. Assets are transacting, with greater acceptance of current valuations, in particular for retail assets. Land values appear to have set a price floor for retail (and industrial) property assets, despite leakages to e-commerce and the number of major shopping centre retailers recently going into administration.

The question for the commercial property sector – what sets a price floor for office? The results across states suggests that a return to office is a significant driver of valuations. As previously outlined by PAR Group, expect more pressure from employers, building owners and Government to encourage people back to the office.