What’s Next for Rents, Land Values and Development in Australia’s Industrial Market?

9 September 2025

Australia’s industrial property market experienced substantial upheaval over the past five years, with a post-COVID surge seeing records breaking across demand, rents and supply. But what’s in store for the market now that vacancy rates have returned to normal levels?

Rents: Growth will remain divergent

Blended East Coast vacancy is currently 3.2%, which is still considered tight, but has lifted substantially since a low of 0.6% in the first quarter of 2023. Following a dramatic surge in East Coast Industrial leasing take up post COVID that fuelled record supply construction levels, tenant demand has since pulled back.

Effective rental growth in the industrial market is now expected to remain subdued on an aggregated basis in the short term, as vacancy stabilises, according to Knight Frank’s latest research report ‘From Surge to Stabilisation’.

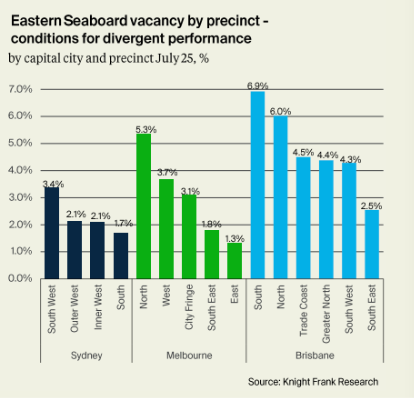

However, there will be significant divergence between cities and precincts as vacancy becomes concentrated in emerging areas with high development.

Areas such as Sydney’s South West and Outer South, Melbourne’s North, and Brisbane’s South and South West are exposed in the short term, and are less likely to see rental growth.

In contrast, established precincts with lower construction and vacancy such as Sydney’s Inner South, Melbourne’s South East and East, and Brisbane’s Trade Coast have far more robust rental growth expectations.

Knight Frank Partner, Research and Consulting, Queensland, Jennelle Wilson said that in areas where vacancy has lifted significantly, rents would not necessarily fall.

“It is expected that face rents will be defended with a corresponding increase in incentives to impact effective rents,” she said.

“Tenants on leases negotiated prior to 2021 will still face significant rental reversion on renegotiation or relocation, despite having greater choice in the market, to bring them into line with current market rents resulting from significant growth over the boom.

“Prime industrial rents grew by between 30% and 60% on the East Coast over the past three years as the market navigated a surge in tenant demand.”

Supply: Overhang will rebalance quickly

The report found supply in Australia’s industrial market would rebalance relatively quickly, with lower speculative development and pre-commitment delivery reducing new supply through the second half of 2025 and into 2026.

“The ongoing search for optimisation and efficiency across the supply chain will maintain baseline demand for new space where feasible, however some tenants may continue to defer relocation decisions,” Ms Wilson said.

“Development at more sustainable levels will emerge from 2026.

“Economic rents will remain high, with boosts to feasibility from expected yield contraction to be outweighed by the ongoing high land values and construction costs.”

Leasing: Pre-commitments to be the key driver of new supply

Ms Wilson said pre-commitments would be the key driver of new supply.

“Over time there will be a lift in pre-commitment activity as upgrading and unlocking operational efficiency remains key for large occupiers,” she said.

“A more conservative development environment will limit speculative supply in 2026, diverting demand back to pre-commitments to tenants seeking a technology and building fabric upgrade.

“The market will increasingly bifurcate into those seeking highly efficient premises and those who seek to mitigate rental cost at the expense of optimisation and technology adaptation.”

Land: Serviced land values to remain strong

The ‘From Surge to Stabilisation’ report found land values, particularly for serviced land, will continue to remain robust.

Over the past five years, East Coast land values have increased by 46% to 118% for small blocks and 46% to 131% for bigger lots of 1 to 5 hectares. Recently values have plateaued in Sydney and Melbourne but have held firm overall.

“In contrast to building construction timeframes, recent years have proven that the timeline for industrial land servicing and development is the most critical step in the development process,” said Ms Wilson.

“Lessons learnt across Western Sydney and to a lesser extent, Brisbane and Melbourne, particularly around water and power delivery, will insulate serviced land values even as immediate demand eases.”