Sydney Records Third Highest Growth Globally for Luxury Residential Rents over the past Five Years

21 August 2025

Sydney has had the third highest growth globally for luxury residential rents over the past five years, according to the latest research from Knight Frank.

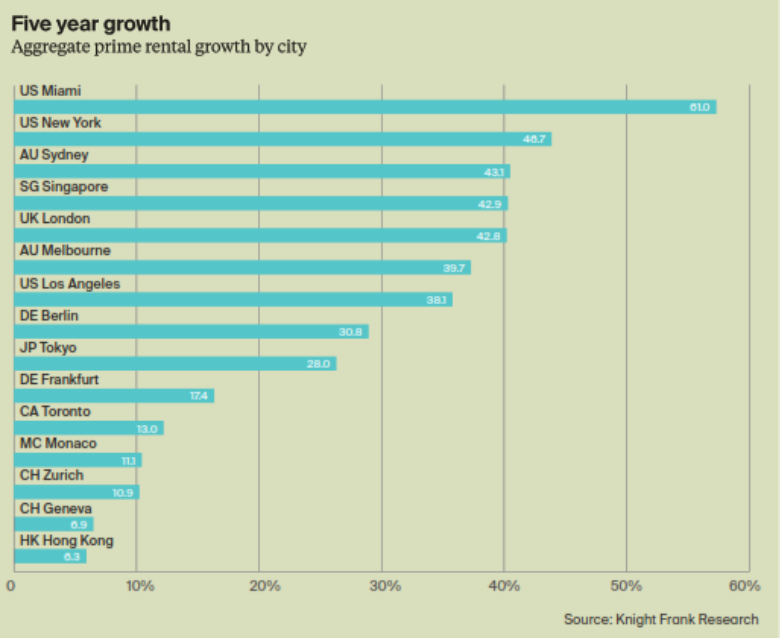

The firm’s Prime Global Rental Index Q2 2025, which provides a quarterly snapshot of trends in luxury lettings markets across 16 key world city markets, found prime rents in Sydney had risen by 43.1% over the five years to the middle of 2025, sitting behind Miami (61%) and New York (46.7%).

Melbourne was sixth for five-year growth in luxury rentals, recording a rise of 39.7%.

Over the past 12 months Melbourne has recorded luxury residential rental growth of 3.4%, while Sydney has seen growth of 2%, with the cities ranked 9th and 12th respectively against the 14 other global cities.

Hong Kong and Tokyo led luxury rental growth over the past 12 months, with annual gains of 8.6% and 8.3% respectively.

The Knight Frank report found the recovery in the global luxury rental market had firmed after last year’s slowdown. Rental growth ticked up again in Q2 2025, with annual growth averaging 3.5% across the 16-city index, up from 3% in Q1.

Knight Frank’s Global Head of Research Liam Bailey said luxury residential rental growth in Melbourne was currently moderate and Sydney was ticking along with around 2% growth.

“However, these cities have seen some of the strongest growth globally over the past five years, outperforming many other cities around the globe,” he said.

“Elevated interest rates and persistent inflation are tempering prime rental growth in major cities, as affordability constraints curb tenants’ ability to bid up rents.

“However, strong immigration underpins growth, and demand – set against limited new supply – will push rents towards long-term trend rates.

“New York and Miami are expected to sustain mid-single-digit gains, while Hong Kong and Tokyo face moderation amid regulatory headwinds.

“European hubs such as Berlin and London should see tight new supply delivery support low- to mid-single-digit growth.”

McGrath’s General Manager of Franchise Property Management Jess Alvial said, “Growth in Sydney and Melbourne’s luxury rental markets may have eased but with five-year gains above 40%, prestige demand remains very healthy and supply remains scarce.

“While demand at the ultra-premium end remains resilient, tight vacancy rates and renewed investor confidence are continuing to drive strength across the broader rental market,” she added.

“Sydney’s ultra-premium homes still command eye-watering rents up to $25,000 a week, reflecting enduring global demand despite moderating growth.”