Growthpoint Properties Australia Delivers on Guidance and Executes on New Strategic Priorities

19 August 2025

Growthpoint Properties Australia (Growthpoint) is pleased to announce its financial results for the 12 months ended 30 June 2025 (FY25).

Growthpoint CEO and Managing Director, Ross Lees said, “This financial year, we created momentum in our funds management business, launching the first two funds under our Growthpoint banner, generating $328 million of new assets under management. We also delivered on earnings and distributions guidance.

“We launched our refreshed corporate strategy and delivered measurable progress across all strategic pillars. Throughout this period, we maintained the strong performance of our directly owned assets to deliver income-driven returns, with 94% occupancy and a 5.6 year weighted average lease expiry. Importantly, we achieved our 1 July 2025 Net Zero Target.”

Financial performance

- Funds from operations (FFO) of $176.0 million, 23.3 cents per security (cps)

- Statutory net loss of $124.6 million, largely driven by devaluations on investment properties (statutory net loss of $298.2 million for the 12 months ended 30 June 2024 (FY24))

- Ordinary distribution per security of 18.2 cps plus a one-off distribution of 2.1 cps; in line with guidance, and representing a payout ratio of 78.0% excluding the one-off distribution, within the target payout ratio range of 75-85% of FFO

- Net tangible assets (NTA) per security of $3.09

- Gearing reduced to 39.7% from 40.2% as at 30 June 2024, following capital recycling activity1

Key operational highlights

- Leasing execution has maintained robust direct portfolio occupancy of 94%, with consistent weighted average lease expiry (WALE) at 5.6 years

- Establishment of the $198.0 million Growthpoint Australia Logistics Partnership (GALP) with TPG Angelo Gordon, with follow-on acquisition of $40.0 million asset in Stapylton, Queensland

- Establishment of the Growthpoint Canberra Office Trust (GCOT) wholesale syndicate, which acquired a $90.1 million A-Grade office building in Canberra’s CBD

- Increased funds management revenue by 20.0%

- Raised $169.9 million in equity in the unlisted funds business2

- Significant expansion of the Perth Regional Distribution Centre and 10-year lease extension agreed with Woolworths, with works well underway and anticipated practical completion in November 2026

- Extended existing funds worth $253.9 million assets under management (AUM)

- Sale of non-core holding in Dexus Industria REIT for a total consideration of $131.7 million

- Achieved Growthpoint’s Net Zero Target on 1 July 20253

FY26 guidance

- FY26 FFO guidance of 22.8 – 23.6 cps and distribution guidance of 18.4 cps4

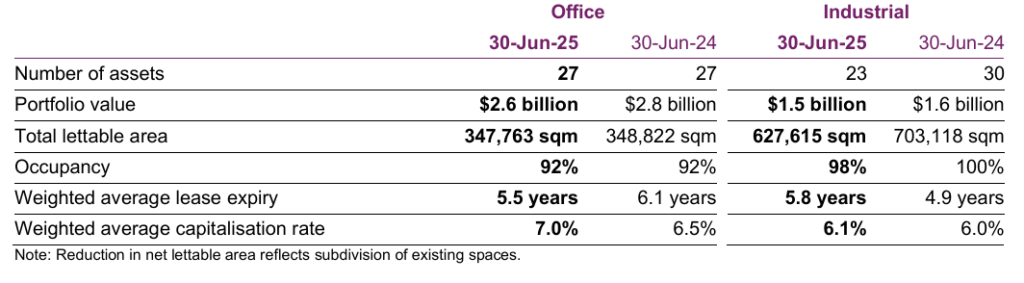

Direct office portfolio

In FY25, active management of Growthpoint’s directly held office portfolio delivered 2.0% like-for-like office property FFO growth5 through significant leasing execution. Growthpoint completed 23,087 square metres (sqm) of office leasing across 36 deals with an average lease term of 5.1 years, equivalent to 6.6% of office portfolio income.

In FY25, Growthpoint repositioned approximately 33,000 sqm of office space including 5 Murray Rose Avenue, Sydney Olympic Park (New South Wales), 75 Dorcas Street, South Melbourne (Victoria), 100 and 104 Melbourne Street, and 52 Merivale Street, South Brisbane (Queensland). During the period, 45% of new office leases by area were executed for repositioned spaces.

The directly held office portfolio value declined 7.4% ($203.9 million) to $2.6 billion on a like-for-like basis in FY25. Most of the devaluation was recognised in the first half, with asset values across the portfolio – excluding those in Victoria – remaining broadly stable in the second half. Yield expansion was also less pronounced than in prior periods. Conditions are improving across most of the office markets in which Growthpoint invests, with positive net absorption, face and effective rent growth, and vacancy declining to 13.5% from 14.5% over the year.6

Direct industrial portfolio

Growthpoint’s customer-centred approach delivered leasing success, 6.0% like-for-like industrial property FFO growth5 and increased WALE from its directly held industrial portfolio. Over the period, Growthpoint completed 100,058 sqm of industrial leasing, equivalent to 18.2% of industrial portfolio income, with an average lease term of 10.9 years and positive leasing spreads of 25%.

The significant expansion of the Woolworths Regional Distribution Centre in Perth commenced during the year, with a lease extension of 10 years from practical completion of the works (anticipated in November 2026).

In Growthpoint’s directly held industrial portfolio of $1.5 billion, occupancy reduced slightly to 98% during FY25, due to a vacancy at 34-44 Raglan Street, Preston in Victoria. Industrial portfolio valuations increased by 4.0% on a like-for- like basis ($57.3 million) aided by stabilised yields, rent growth and the lease extension at the Woolworths Regional Distribution Centre in Perth. While the industrial market is normalising, it maintains strong fundamentals and sustained demand.

In October 2024, as part of the establishment of the Growthpoint Australia Logistics Partnership six directly held industrial assets were sold to the partnership, in line with 30 June 2024 book values, with Growthpoint retaining an approximately 20% interest. During the period, Growthpoint also sold 3 Millennium Court in Knoxfield, Victoria for $22.0 million, approximately 13% above 30 June 2024 book value and achieving an unlevered IRR of 14.0%.

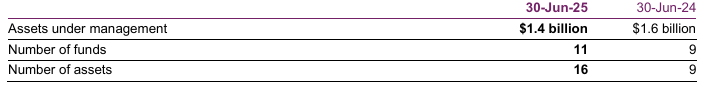

Funds management

Growthpoint created $328.1 million of new AUM in FY257, with over 45% from new investors to the Growthpoint platform8. Growthpoint raised $169.9 million in gross equity in the unlisted funds business9, and increased funds management revenue by 20.0% on FY24. The net decrease of $186.0 million AUM includes the impact of the low margin Mid-City Centre management contract expiry, which resulted in a $490.0 million decrease to AUM.

In FY25, Growthpoint partnered with TPG Angelo Gordon to establish GALP ($198.0 million AUM), in which they acquired an approximately 80% overall stake in six Growthpoint industrial assets. Growthpoint retained an approximately 20% interest and is the investment manager for the partnership. In May the portfolio was expanded, with the acquisition of a $40.0 million industrial and logistics property in Stapylton, Queensland agreed (settled in June).

Growthpoint also established GCOT to acquire a $90.1 million A-Grade office building in Canberra’s CBD. This high- yield, primarily government-leased asset is a countercyclical investment, managed by Growthpoint and is widely held amongst its private wealth investor network.

Sustainability

Growthpoint is proud to have achieved its Net Zero Target10 on 1 July 2025, a significant milestone.

Growthpoint’s sustainability credentials were further enhanced in FY25, increasing its GRESB score to 85, exceeding the peer average of 76, and ranking second in the peer group11. Growthpoint’s portfolio average NABERS ratings for Energy and Water remained stable at 5.2 stars and 4.9 stars respectively. The average portfolio NABERS Indoor Environment rating improved to 5.0 stars from 4.8 stars at 30 June 2024.

Growthpoint installed 182kW of solar capacity across two assets, bringing the total capacity across eligible directly owned portfolio assets to 1,425kW (18 assets). Growthpoint achieved a margin discount, having met all its Sustainability Linked Loan (SLL) performance targets for the reporting period ending October 2024. Further, Growthpoint issued $320.0 million of SLLs during FY25, bringing the total to $1.3 billion, approximately 67.7% of Growthpoint’s loan book.

Growthpoint’s key focuses in sustainability for FY26 will be on progressing toward mandatory climate reporting in FY27, continuous improvement of NABERS ratings and refreshing our sustainability strategy.

FY26 strategic priorities and outlook

Ross Lees said, “Our operating environment is becoming more supportive – we are seeing inflation return to the RBA’s target band. We have already had three rate cuts this calendar year, and the market pricing further cuts through the balance of 2025.

“We expect this supportive backdrop should stabilise valuations across the market and our portfolio. We are already seeing metro office markets returning to growth. Further, while normalising, industrial markets continue to demonstrate sustained demand.

“Today we have reiterated our strategy to actively manage our portfolio of directly owned, high-quality real estate assets to deliver income-driven returns and generate growth through funds management.

“Following the achievement of our Net Zero Target, our focus in FY26 is on continuous improvement of NABERS ratings, progressing climate reporting and on post Net Zero Target initiatives.

“We will continue to pursue growth through funds management, focused on our core sectors of office, industrial, and retail, while actively managing near-term fund maturities. We will leverage our trusted customer relationships, strategic capital deployment, and the deep capability of our sector and discipline specialists to achieve our strategic objectives. Continued portfolio optimisation will support co-investment in new funds, ensuring alignment with our unlisted fund investors.

“Leasing remains a key focus in FY26, targeting current vacancies and key expiries across FY26 and FY27. Targeted capital expenditure will be directed toward minimising downtime, addressing near-term vacancies, and enhancing asset values. With terms agreed on 90,524 sqm of space in FY26 to date – representing 7.5% of portfolio income, we are making excellent progress.

“With the ongoing optimism from a stabilising rate environment and a renewed strategy, we look forward to carrying our positive momentum into FY26.”

FY26 guidance

Growthpoint provides FY26 FFO guidance of 22.8 – 23.6 cps and FY26 distribution guidance of 18.4 cps.13

1 Gearing calculation method has been revised to exclude impact of FX movements relating to USPP.

2 Excludes Growthpoint co-investment of $37.5 million.

3 Net zero emissions for all scope 1 and scope 2 emissions from our directly managed operationally controlled office assets and some scope 3 emissions from our corporate activities. Growthpoint has proactively purchased and retired carbon credits to offset the majority of our forecast FY26 greenhouse gas emissions that cannot be avoided or reduced. The remaining credits required to fully offset FY26 emissions will be purchased and retired upon finalisation of our FY26 accounts.

4 No acquisitions or disposals of direct investment properties are assumed in providing this guidance.

5 Excluding lease surrender payments and divestments.

6 JLL, Growthpoint research. Includes Canberra, Brisbane fringe, Melbourne fringe, Melbourne South Eastern Suburbs, Parramatta, St. Leonards, Sydney Olympic Park / Rhodes, West Perth. Vacancy and rental data refers to Prime office assets.

7 AUM at acquisition.

8 By number of investors.

9 Excludes Growthpoint co-investment of $37.5 million.

10 Net zero emissions for all scope 1 and scope 2 emissions from our directly managed operationally controlled office assets and some scope 3 emissions from our corporate activities. Growthpoint has proactively purchased and retired carbon credits to offset the majority of our forecast FY26 greenhouse gas emissions that cannot be avoided or reduced. The remaining credits required to fully offset FY26 emissions will be purchased and retired upon finalisation of our FY26 accounts.

11 Diversified – Office/Industrial.

Note: FY26 leasing includes signed leases and Heads of Agreement from 30 June 2025 to 1 August 2025.

13 No acquisitions or disposals of direct investment properties are assumed in providing this guidance.