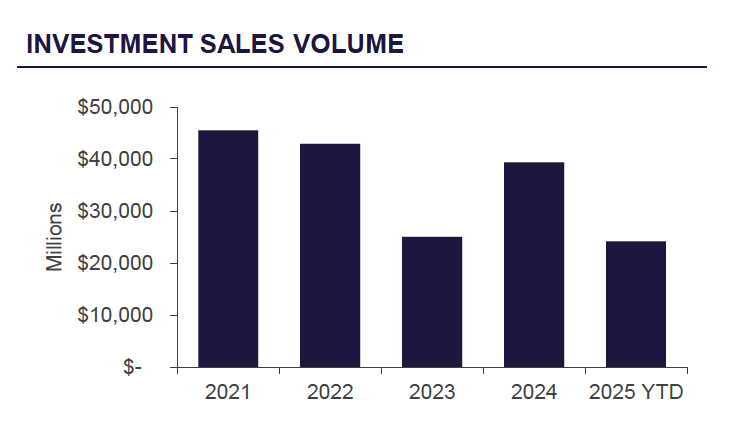

Australian commercial real estate (CRE) investment has recorded its strongest quarter since Q4 2021, with $16.6 billion in transactions in Q2 2025. This marks the sixth consecutive quarter of rolling annual investment growth, lifting the 12-month total to $48.1 billion, according to Cushman & Wakefield’s latest Capital Markets Marketbeat report.

The Alternatives sector led the charge in Q2 with its second-highest quarterly total on record, attracting $7.3 billion in investments. This was driven by significant cross-border capital across student accommodation and seniors housing, including the $3.85 billion sale of Aveo by Brookfield to Scape, marking the largest direct real estate transaction in Australian history.

The Logistics & Industrial sector followed with a recorded $4.3 billion, marking its third consecutive period of growth. The sector continues to outperform with strong rental, vacancy and absorption metrics and steady cross-border capital inflows.

The Retail sector has continued its cyclical pattern, rebounding strongly with $3.4 billion in Q2. The reemergence of listed groups, superannuation funds and offshore investors is building momentum in the sector, including UniSuper’s purchase of Macquarie Centre from Dexus for $830 million, marking the largest retail deal of the quarter.

Despite slightly subdued activity in the Office market, early signs of recovery are emerging with rental growth, stronger tenant absorption and a lift in business sentiment laying the groundwork for renewed investor and vendor confidence. Transactions totaled $1.7 billion for the quarter, with Sydney and Brisbane leading the way, suggesting selective investor interest in core markets.

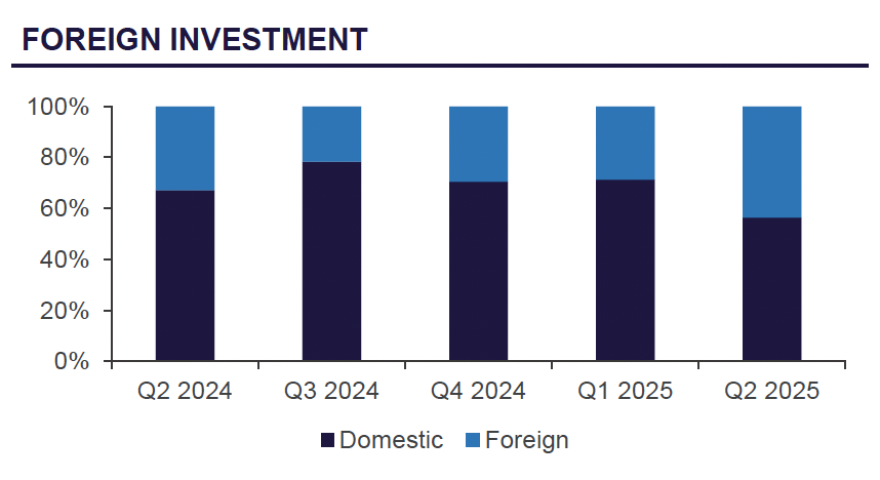

Global confidence in Australia’s commercial real estate market continues with foreign investment accounting for almost half (44%) of total investment activity in Q2, approximately $7.38 billion. Significant inflows were recorded by the UK and USA, contributing $3.85 billion and $2.18 billion respectively, followed by Canada, China and Japan.

Cushman & Wakefield’s Associate Director, National Research, Jake McKinnon said Q2’s performance was a clear indicator of the market’s renewed strength and accelerating recovery.

“Despite ongoing geopolitical uncertainty, Australia’s commercial real estate investment accelerating, with cross-border capital playing a key role in its resurgence.

“Investment volumes for the first half of 2025 have almost surpassed total 2023 levels and, as market sectors continue to recover, investment activity in 2025 is expected to strengthen further.

“Looking ahead, foreign capital is expected to contribute significantly to Alternatives and L&I investment volumes, while office pricing suggests the sector has bottomed out. Signs of rising transaction activity are emerging across cities and precincts as an increasing level of active office bidders come to market.”