Brisbane continues to lead the APAC region in annual office rental growth, despite signs of a stabilisation, according to the latest research from Knight Frank.

The firm’s Asia-Pacific Prime Office Rental Index for Q1 2025 found Brisbane recorded the highest rental growth of 14.2% over the 12 months until the end of March, with a 0.5% rise over Q1.

Signs of a stabilisation are emerging in Brisbane, however, with a moderation of rents following a period of sustained significant increases and elevated fitout costs, prompting many tenants to prioritise lease renewals over relocations.

However, the report found the limited pipeline of new office supply, combined with strong tenant demand, is expected to renew the phase of stronger rental growth beyond 2025.

Knight Frank Partner Research and Consulting Jennelle Wilson said rental growth had moderated in Brisbane’s CBD office market over 2025, but it was expected to pick up again by 2027.

“Prime gross face rents are forecast to grow by 2.2% in 2025 while the market takes a breath,” she said.

“The lack of supply post 2025 and the need to bridge to economic rents to trigger development will see rents accelerate again 2027 to 2029, with a five-year forecast effective annual growth rate of 6.5%.”

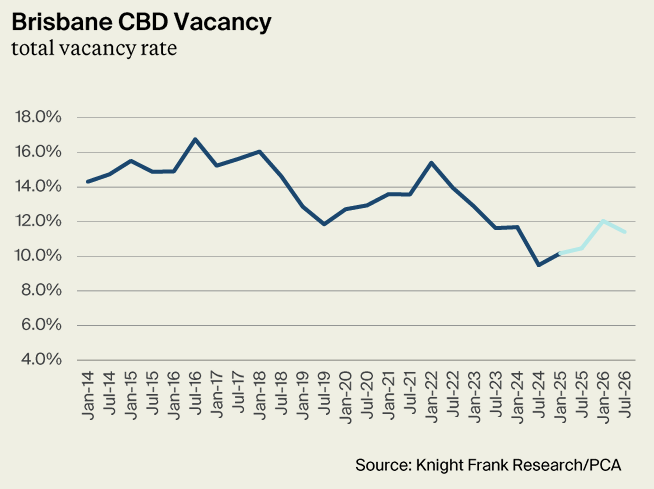

Knight Frank’s Brisbane CBD Office Market report found vacancy, in what is still the tightest CBD market in Australia, was expected to lift this year due to the first new supply being delivered to the market in three years, before falling again in mid-2028.

“The market started 2025 with tight prime vacancy of 8%, but this will rise as two new buildings totalling 90,000sq m are set to be delivered this year,” Ms Wilson said.

“Despite these new buildings being 87% committed, the addition of space is expected to see total vacancy in Brisbane’s CBD office market rise, rising from 10.2% to up to 12% by the end of 2025.

“However, the steady net absorption forecast over the medium term and the lack of any additional new supply from 2026 to 2028 will support falling vacancy to a low point of around 8.5% in mid-2028 before supply flows through the market once again from the second half of 2028.”

Knight Frank Head of Office Leasing Queensland Mark McCann said tenant sentiment towards relocations had eased from the middle of 2024 in favour of recommitments.

“The trend towards tenants renewing in their existing space has continued into 2025,” he said.

“This is partially due to delays in tenants obtaining internal approvals or commitments within the necessary timeframes, but also the ongoing challenge of accessing capital on both landlord and tenant sides to fund new fitouts.

“This has led to tenants increasingly resigning now and deferring potential relocation for a further lease cycle.

“For those relocating demand remains strong at the prime end of the market, with an uplift in the sophistication of tenant expectations.

“While the market has moderated in recent months, the future forecast is positive for Brisbane, with our city expected to lead other major CBD office markets on office workforce growth over the next five years.”

Investment activity lifting

Investor appetite for office assets in the Brisbane CBD is lifting, according to Knight Frank’s Brisbane CBD Office Market report.

It found stronger investment activity, particularly in Q4 2024 with $429.5 million, resulted in a total of $1.1 billion for sales greater than $10 million during 2024. This was an improvement on the $763 million recorded in 2023.

Knight Frank’s Head of Capital Markets Queensland Justin Bond said domestic investors had been the most active over the past few years, with investment from these buyers now higher than the long-term average of $860 million per year. In contrast, Sydney has seen international investors dominate the transactions over the past 12 months.

“Buyers and sellers now appear more closely aligned on pricing,” he said.

“While sometimes taking longer to complete, largely due to ongoing capital raising delays, most properties formally offered to the market are now selling.

“The range of buyers interested in the Brisbane market is broad, with the ongoing outperformance of the tenant market seeing the city move up the ranks as a potential investment location, with many investors now preferring Brisbane over Melbourne.

“We expect greater activity this year, with Knight Frank’s forecast that the market will enter recovery mode from mid-2025.”

The Knight Frank report found yields have now stabilised across the prime and secondary markets as cash rate reduction came to fruition in February, with prime yields averaging 7.25%.

Current yield levels are expected to be further confirmed by transactions and a broader buyer profile across the Brisbane CBD during 2025.

“Should trophy assets come to the market, the potential for major buyers – not yet in the Brisbane market – to compete, along with the anticipated reduced cost of debt, could provide the platform for yield compression later in the year,” said Mr Bond.