Rising global uncertainty has failed to dent lender appetite for Australian investment opportunities, a new CBRE survey has shown.

CBRE Research tapped a mix of 34 local and international banks and non-bank lenders for its H1 2025 Lender Sentiment Survey, which was completed after the April cash rate decision.

The upshot? Appetite for new loans has remained relatively unchanged since the H2 2024 survey – despite global ructions – with 56% of lenders wanting to grow commercial real estate exposures and no surveyed lenders intending to decrease their books.

CBRE’s Managing Director of Debt & Structured Finance Andrew McCasker said, “The domestic banks sit on strong balance sheets and there has been a significant amount of capital raised in the private credit sector. This is underpinning competitive tension and strong appetite for lending to quality assets and sponsors.”

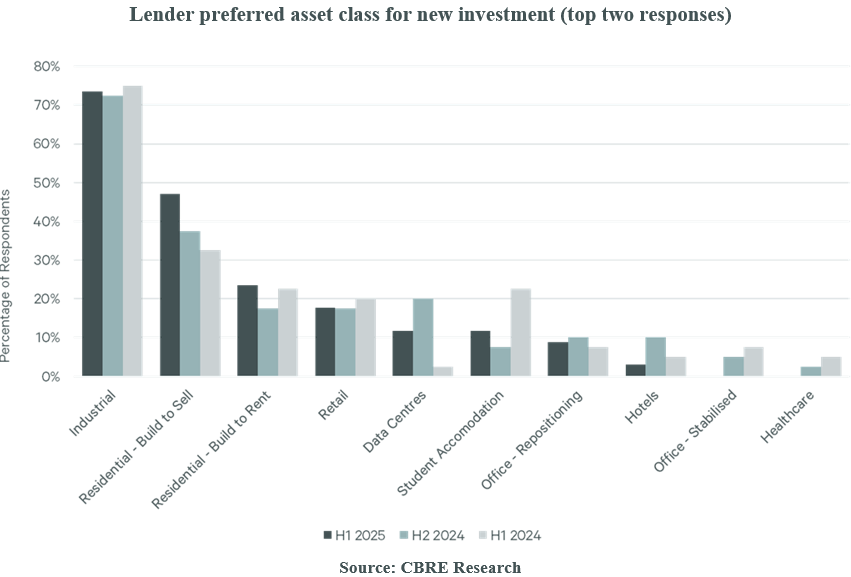

At a more micro level, the survey shows that lenders are also continuing to favour Australia’s industrial & logistics sector – by a considerable margin – despite weakening fundamentals in recent months.

The residential sector is also in favour, with interest in build-to-sell having grown for the fourth consecutive period to rank second on the list of preferred asset classes. Build-to-rent ranked third after experiencing a slight uptick in interest from H2 2024 levels.

Meanwhile the preference for data centres has declined from the highs seen in H2 2024 in the wake of Blackstone’s $24 billion AirTrunk acquisition, with the asset class slipping from third to fifth in the rankings.

There is also continued caution amongst local lenders when it comes to the office sector, with office repositioning opportunities outranking stabilised office assets.

The survey notes that asset type and location are among the top three factors impacting lender appetite for refinance, as commercial real estate bifurcation rises across the country for all sectors.

CBRE Debt & Structure Finance Director Will Edwards noted, “Amid caution in the office sector, we are seeing lenders take a considered approach to the sector reflective of flight to quality in the asset class. For Prime and A grade assets in core locations lenders will price aggressively for the exposure.”

While Australia’s cash rate cutting cycle is firmly underway, CBRE’s survey shows that local pundits and lenders are the most divided they’ve been in years as to what the terminal rate for this cycle will be.

More than half of the surveyed lenders expect two additional rate cuts over the remainder of 2025, however there is no majority viewpoint on the cash rate as of June 2026.

The upcoming RBA decision in May 2025 is expected to give more clarity to the trajectory of the rate cutting cycle.

Other survey takeaways include:

- Credit margins are facing upward pressure as they come off a cyclically low base, with a higher proportion (32%) of bank and non-bank lenders expecting margins to rise by at least 10bps over the next three months.

- Hedging requirements continue to decline, with more than two-thirds of surveyed lenders having an interest rate hedging requirement between 0-25%.