ESG credentials a key consideration for commercial property investors, according to Knight Frank survey

13 May 2025

ESG is a key consideration in investment decisions for commercial property investors in Australia, driven by the prospect of enhanced returns via increased values and rents, as well as net-zero requirements, according to the results of a new survey conducted by Knight Frank.

The firm’s global ESG Property Investor Survey 2025 found many commercial property investors in Australia are targeting the retrofit and refurbishment of existing assets to realise value and rental improvements.

The Knight Frank survey is a unique research survey providing valuable insight into how ESG trends are shaping property investment decisions.

It gathered the responses of 40 commercial property investors around the globe, including in Australia, representing assets under management totalling £300bn, between November and December 2024, to determine the role ESG was playing for property investors.

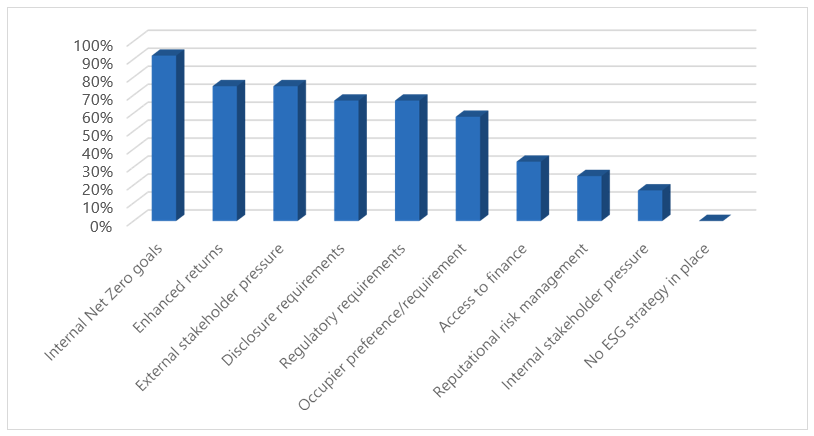

It found that the investment strategy of investors with assets in Australia was driven by internal net zero goals (91.7%), enhanced returns (75%) and external stakeholder pressure (75%), followed closely by disclosure and regulatory requirements (both 67%).

Australian responses: What is driving your ESG investment strategy and Due Diligence process? Please select all that apply

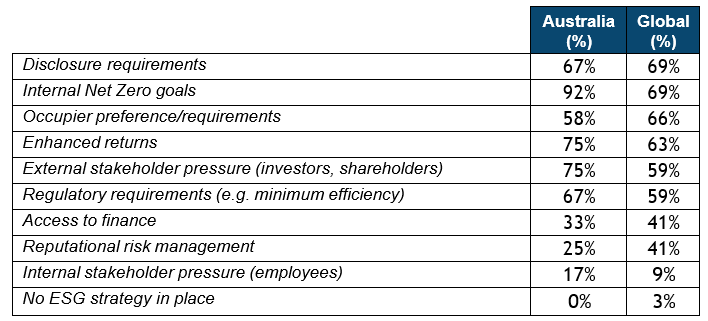

More than 83% of investors with assets in Australia indicated their ESG strategy for commercial property was to improve the quality of their existing portfolio through retrofitting or refurbishing assets. Meanwhile, 75% said their strategy was to acquire poor ESG-performing assets in order to retrofit or refurbish.

The motivating factors for retrofitting were indicated to be achieving a higher level of environmental certification (75%), followed by achieving a higher rental value (67%) and achieving a higher exit value (58%).

Australian responses: What is your ESG strategy in relation to property? Please select all that apply

Knight Frank Australia’s Head of ESG Jenine Cranston said ESG remained central to both investment and operational strategies for commercial property investors in Australia, with investors incentivised by potential value and rental gains, as well as net zero requirements.

“We are seeing demand developing from both investors and occupiers for properties with solid ESG credentials as all parties increase focus on their own sustainability targets, which is motivating owners to act,” she said.

“Properties that have solid ESG credentials will attract more buyers when owners want to sell, and this buyer competition will underpin the asset’s value.

“Buildings with better ESG credentials are also more in demand amongst occupiers, which will lead to higher occupancy rates and rents. According to Knight Frank’s latest (Y)OUR SPACE report, 67% of corporate respondents had a stated net zero carbon emissions target for their business, and the real estate they occupy forms a big part of this.

“On top of these drivers, there are also growing regulatory requirements in Australia which are encouraging investors to prioritise ESG, with mandatory sustainability reporting having come into effect from 1 January this year.

“These pressure points are all leading property investors in Australia – and globally – to have a greater focus on ESG.”

Knight Frank Head of Capital and Strategic Advisory Michel Kwok said: “Investor sentiment around ESG and associated capex spend in the Australian commercial property market is more defensive in nature to maintain value at this point in the cycle.

“Investors continue to show appetite for well-located assets with quality amenities, wellness features and strong ESG credentials.”