Value Opportunities Emerge in Melbourne Office Market as Investment Landscape Shifts | JLL

23 April 2025

The Melbourne office market is experiencing a significant shift in investment dynamics, with private investors, syndicators, and private equity firms emerging as dominant players. With the Melbourne CBD mid-point yield at its highest spread to Sydney in the past decade – currently sitting at 89 basis points – savvy investors are stepping up to capitalise on recalibrated asset pricing.

“We have now reached a value trough in Melbourne, and the office market in particular is presenting a compelling investment opportunity, with new players stepping up to capitalise on value plays,” said Josh Rutman, Executive Director, Head of Capital Markets Victoria.

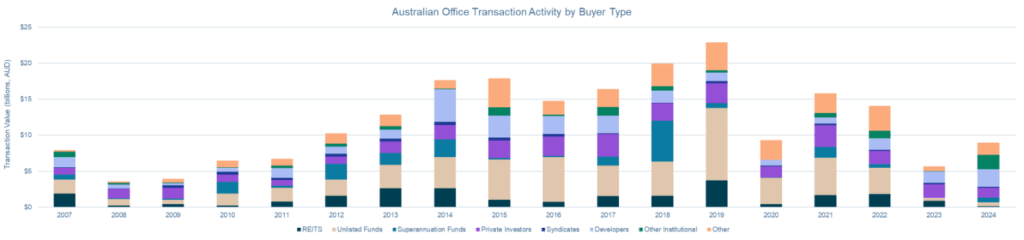

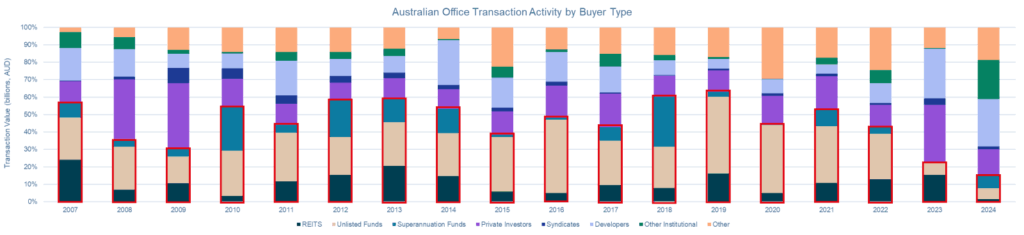

Traditional institutional investors (encompassing REITs, Unlisted Funds, and Superannuation funds) have on average, purchased 50.4% of office buildings (by value) in the 10 years from 2013-2022. However, both 2023 and 2024 were record lows for their participation in investment volumes (22.3% and 15.1% respectively), significantly below the previous lowest of 20.7% in 2009 during the depths of the GFC.

“Over the past two years, syndicators, private equity, and local family investors have accounted for a significant share of transactions, demonstrating a strong appetite for quality assets at recalibrated pricing. This shift mirrors historical cycles, where those willing to act decisively during market uncertainty often achieve outsized returns,” Rutman added.

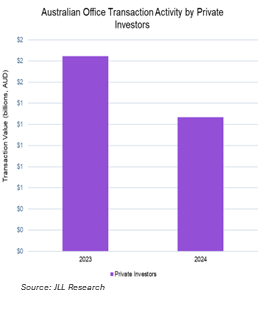

Private investors have deployed $3.1 billion into office assets across Australia, representing 21.2% of total investment volume over 2023 and 2024. This is a significant increase over the 5-year period from 2018-2022 where private investors only accounted for 7.6% of office investments by value. This is particularly evident in Melbourne where 37% of transactions over the previous two years can be attributed to these investors.

Recent transactions highlight this changing investment landscape. The sale of 655 Collins Street to Najee Imam for $111 million and the acquisition of 432 St Kilda Road by Marwood Property Group, traditionally an industrial development firm, illustrate the increasing interest from private capital and non-traditional office investors. Additionally, Bayley Stuart’s acquisition of 628 Bourke Street underscores the strong presence of syndicators backed by private wealth in Melbourne’s market.

“These investors have demonstrated an ability to capitalise on value opportunities, reminiscent of trends seen post-GFC. Their more active participation, particularly in Melbourne, signals a broader recalibration of capital markets, where those with agility and direct access to funds are driving transactional outcomes and asset pricing,” said Rutman.

With billions in dry powder available for investment and Australia maintaining its reputation as a safe destination for capital within the Asia-Pacific region, private investors and alternative institutional capital sources are well-positioned to benefit from the current market cycle. As traditional institutions remain constrained by sentiment and capital allocations, private capital is proving to be the driving force behind Melbourne’s office investment market resurgence.