Melbourne and Sydney in Top 5 Cities Globally for Luxury Residential Rental Growth over 2024

26 March 2025

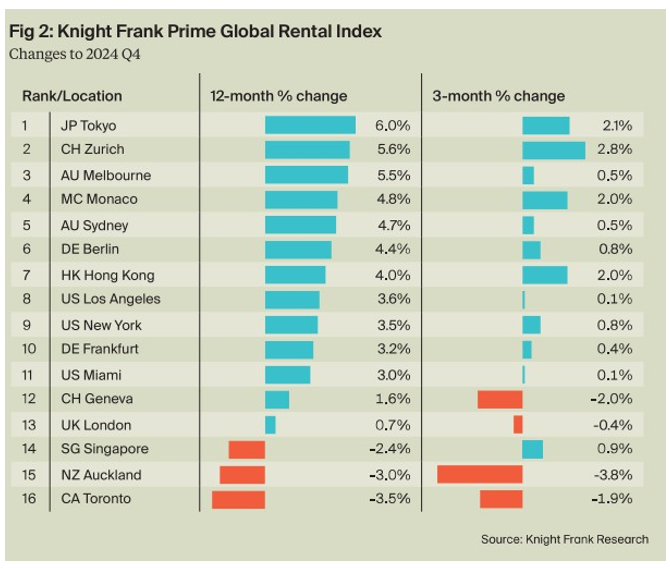

The firm’s Prime Global Rental Index Q4 2024, which provides a quarterly snapshot of trends in luxury lettings markets across 16 key world city markets, found prime rents increased by 5.5% in Melbourne and 4.7% in Sydney over 2024.

Tokyo recorded the largest luxury residential rental growth last year of 6%, while Zurich came in second at 5.6%. Monaco was also in the top five, sitting in 4th place just ahead of Sydney with growth of 4.8%.

The Knight Frank report found that prime rental growth across the basket of 16 cities slowed in the latter half of 2024. While 79% of markets saw a rise in rents over the final quarter of the year, the index grew by 0.3% overall, marginally up on the previous quarter’s growth of 0.1% but noticeably below the long-run average of 0.9%.

Luxury rents increased by 2.2% over the whole of 2024, which is the slowest rate in more than three years, since mid-2021, and below the long-run average of 3.7%. The rate of growth in luxury rents has steadily declined from a peak of 11.4% in Q1 2022.

Knight Frank’s Global Head of Research Liam Bailey said prime rental growth in Sydney and Melbourne slowed towards the end of last year with each city seeing just a 0.5% rise in rents over the final quarter of 2024.

“A post-COVID repricing saw prime city rents climb 28% from the end of 2020, with cities like London and New York experiencing growth of well over 50%,” he said.

“The upward repricing of prime global residential rents has now worked its way through the system in most major markets.

“With wage growth slowing and affordability stretched, we expect rental growth to remain positive, but to sit below trend this year.

“Over the longer term we are likely to see a return to stronger growth as demand requirements continue to outpace the supply response.”

Katherine Gaitanos, Head of Property Management at McGrath Estate Agents, Knight Frank’s partner in Australia* said: “Sydney’s luxury rental market is thriving, with high-end properties in prime locations experiencing strong demand despite tight supply.

“Barangaroo in particular has emerged as a standout destination for affluent renters, offering an unmatched blend of exclusivity, world-class amenities, and breathtaking waterfront views.

“Recent leasing activity highlights Barangaroo’s growing appeal, with premium apartments being swiftly secured by tenants seeking a sophisticated urban lifestyle. The area’s high-end developments, combined with its proximity to Sydney’s business hub and vibrant dining scene, continue to attract professionals and expatriates looking for a seamless blend of luxury and convenience.”

Definitions:

Knight Frank’s Prime Global Rental Index provides a quarterly snapshot of trends in luxury lettings markets across 16 key world city markets.

Prime Property – The most desirable and expensive property in a given location, generally defined as the top 5% of each market by value. Prime markets often have a significant international bias.

*Knight Frank, together with New Zealand-based Bayleys, has a partnership with Australian residential real estate group McGrath, following the acquisition of a controlling stake in the agency in June 2024.